Facebook's first year as a public company: By the numbers

A look at how the social giant has fared on Wall Street

On May 18, 2012, Mark Zuckerberg, wearing one of his signature black hoodies, rang the opening bell on the Nasdaq stock market, kicking off trading for Facebook — one of the most highly anticipated IPOs in history.

Immediately, the market went bonkers: Nasdaq's systems couldn’t handle the tsunami of trading volume, and broke down. As Facebook lawyers later suggested in a legal filing, the nail-biting half-hour spooked investors and drove down share prices. After years of buildup, shares of Facebook closed almost flat on the first day of trading.

It turned out to be a fitting omen. Facebook's share price has declined markedly as it struggles to explain how it will earn the kind of revenue its giant IPO promised. Here are some of the numbers behind Facebook’s first year as a publicly traded company:

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

$104 billion

The total value of Facebook's IPO

$63.2 billion

Facebook's current market cap

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

100

Number of times the company’s earnings were multiplied to reach its original valuation

25

Percentage increase in shares Facebook released for sale just before the IPO, due to heavy investor demand

30

Minutes Facebook trading was delayed on the first day, due to technical glitches

$38

Original stock price

$43

The high Facebook shares reached on the first day

$38.23

Closing stock price on the first day

$26

Facebook's current share price (give or take)

$10 billion

Facebook revenue from its initial public offering

30

Percent Facebook's share price has dropped since opening day

$1.06 billion

Revenue from the first quarter of 2012, before it was public

$1.46 billion

Revenue from Facebook's most recent quarter

85

Percent of revenue Facebook made from right-column desktop ads before the IPO

30

Percent of revenue Facebook now makes from mobile advertising

1.11 billion

Active Facebook users as of March

1.06 billion

Active users in December 2012

$5.32

Average revenue Facebook earned per user in 2012

Sources: The Los Angeles Times, The Wall Street Journal, TIME

Create an account with the same email registered to your subscription to unlock access.

Carmel Lobello is the business editor at TheWeek.com. Previously, she was an editor at DeathandTaxesMag.com.

-

'Republicans want to silence Israel's opponents'

'Republicans want to silence Israel's opponents'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

Poland, Germany nab alleged anti-Ukraine spies

Poland, Germany nab alleged anti-Ukraine spiesSpeed Read A man was arrested over a supposed Russian plot to kill Ukrainian President Zelenskyy

By Peter Weber, The Week US Published

-

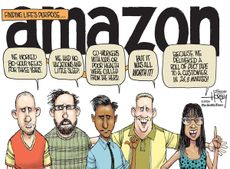

Today's political cartoons - April 19, 2024

Today's political cartoons - April 19, 2024Cartoons Friday's cartoons - priority delivery, USPS on fire, and more

By The Week US Published