Did TARP 'save' America?

Everybody seems happy to badmouth the bank bailout, says Steven Rattner in the Financial Times. But without it, we'd be living in a much poorer country

"America's Troubled Asset Relief Program — better known as TARP — died on Sunday, at the age of 2," says Steven Rattner in the Financial Times. "The causes of death were bitter politics and financial illiteracy." The program was born in "the post-Lehman bankruptcy panic," and it allowed then-President George W. Bush, and later Obama, to "bypass laborious Congressional approval and deploy $700 billion to rescue a collapsing financial system." Then partisan bickering turned it into "the program that everyone loved to hate" — Republicans vilified it as the epitome of "the meddling nature of a bailout nation," and liberals complained it only helped the same Wall Street financiers who ruined the economy in the first place. So everyone is glad to see TARP go. But instead we should be "eulogizing" it as the one piece of legislation that has done more to "save" America's financial system — and therefore its economy — "than any passed since the 1930s." Read an excerpt:

No one can doubt that without TARP financing sources would have fled in terror from the banking system. Almost immediately institutions that dwarfed Lehman in size — potentially, AIG, Citigroup, and Bank of America — would certainly have collapsed. Runs on other banks would have followed, causing credit to evaporate in the economy. A depression-era landscape of shuttered banks is easily imagined.

Without TARP, General Motors and Chrysler would also have been at the mercy of Congress, whose dithering ways would have resulted in at least one of them running out of money, shutting down and liquidating. If Congress then failed to act quickly the other carmaker would have immediately followed suit. That would have brought down the vast majority of the sector’s many suppliers, already teetering on the edge of bankruptcy.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Read the full article in the Financial Times (registration required).

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Political cartoons for January 4

Political cartoons for January 4Cartoons Sunday's political cartoons include a resolution to learn a new language, and new names in Hades and on battleships

-

The ultimate films of 2025 by genre

The ultimate films of 2025 by genreThe Week Recommends From comedies to thrillers, documentaries to animations, 2025 featured some unforgettable film moments

-

Political cartoons for January 3

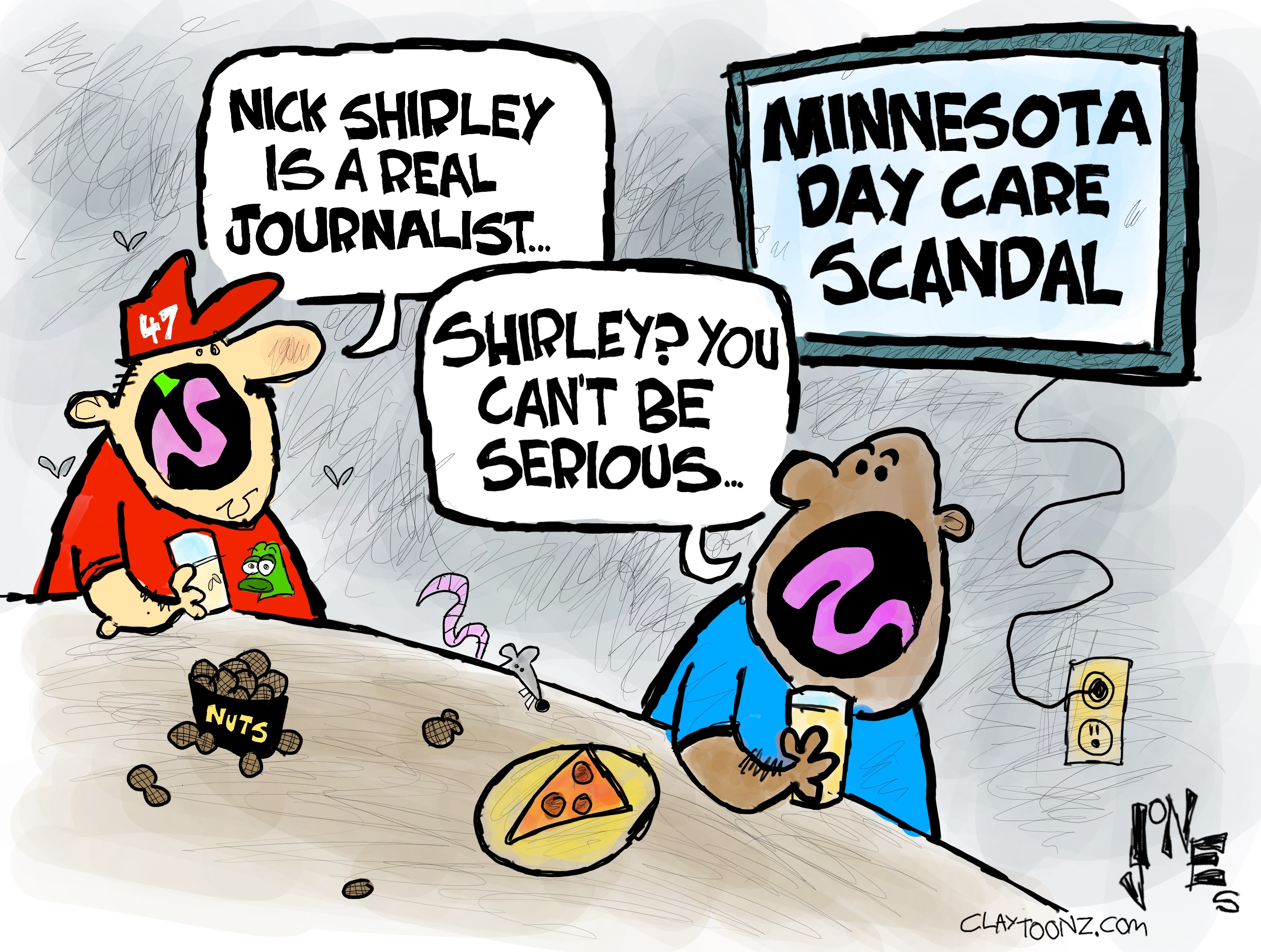

Political cartoons for January 3Cartoons Saturday's political cartoons include citizen journalists, self-reflective AI, and Donald Trump's transparency