Banks and the TARP payback

How easy should it be for big banks to pay back federal bailout funds?

Treasury Secretary Timothy Geithner is “sensibly laying out pretty strict criteria” for when banks can pay back their TARP bailout money, said Felix Salmon in Reuters. That’s good: It isn’t enough that an individual bank is healthy, when the broader financial system and credit flow are not. But the TARP legislation is “pretty unambiguous” that Geithner can’t stop banks from paying the Treasury back, so this will be a test of Geithner’s power.

You’d think Geithner would welcome some money flowing back into the TARP coffers, said Dwight Cass in BreakingViews.com (via Fortune), and the markets would certainly cheer banks able to survive on private capital. Besides, who can blame “relatively strong” banks such as Goldman Sachs and JPMorgan for wanting to “shuck off” the TARP “scarlet letter”?

The problem is that those banks are mostly strong on paper, said Andrew Ross Sorkin in The New York Times. In reality, each bank is busy pulling an accounting “bunny out of the hat” to wow investors with better-than-expected—and better-than-merited—earnings. So far, investors aren’t buying the “amateur hour” magic.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

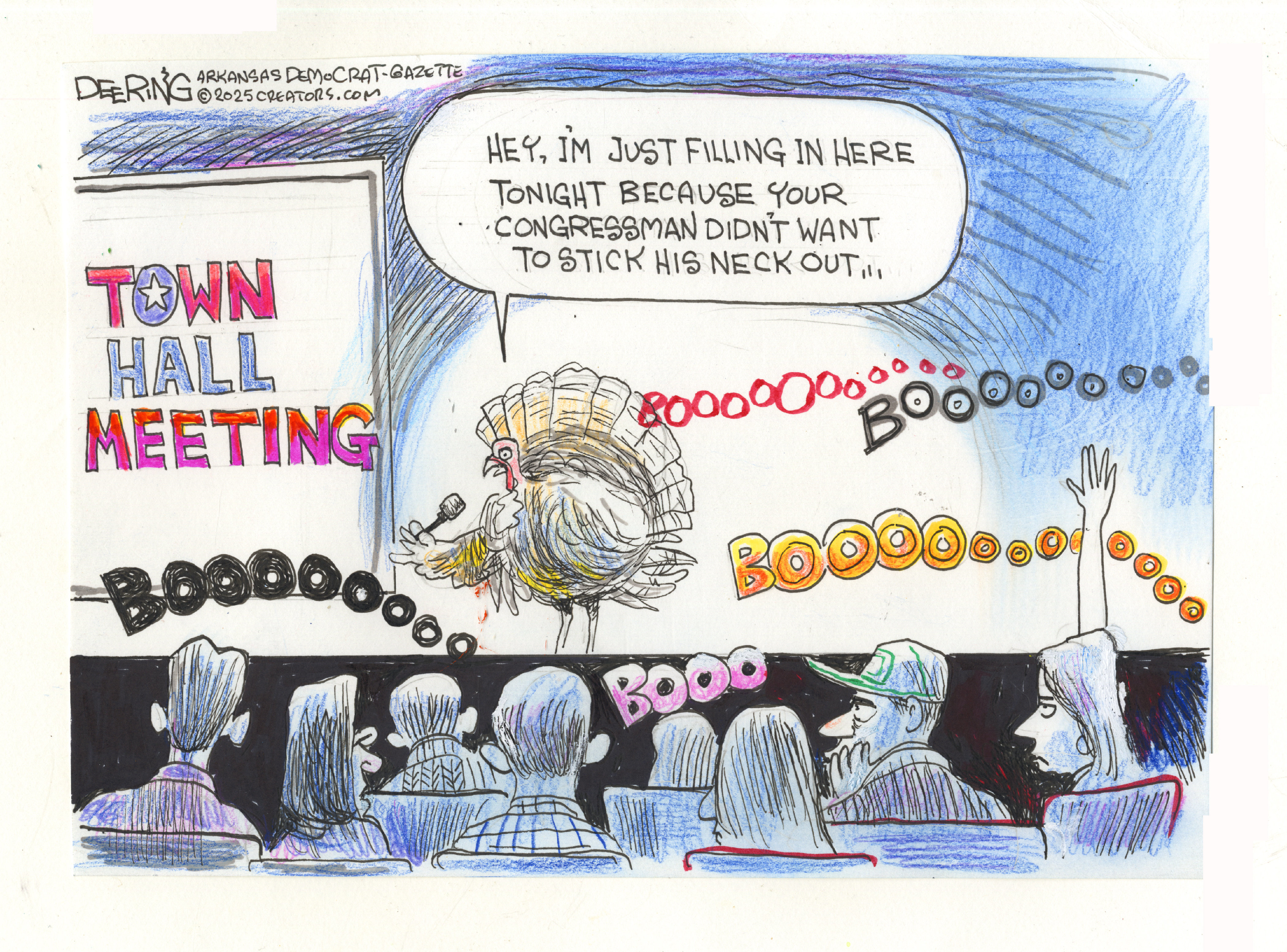

Political cartoons for November 15

Political cartoons for November 15Cartoons Saturday's political cartoons include cowardly congressmen, a Macy's parade monster, and more

-

Massacre in the favela: Rio’s police take on the gangs

Massacre in the favela: Rio’s police take on the gangsIn the Spotlight The ‘defence operation’ killed 132 suspected gang members, but could spark ‘more hatred and revenge’

-

The John Lewis ad: touching, or just weird?

The John Lewis ad: touching, or just weird?Talking Point This year’s festive offering is full of 1990s nostalgia – but are hedonistic raves really the spirit of Christmas?