The Fed’s $1 trillion bet

The rationale, and risks, of the Federal Reserve decision to 'print money' to revive the economy

Federal Reserve Chairman Ben Bernanke has done what he “promised/threatened” to do, said Megan McArdle in The Atlantic. On Wednesday, Bernanke said the Fed would buy $1.15 trillion in long-term U.S. Treasury bonds and mortgage-backed securities, in a flood of “quantitative easing”—or “doing its damnedest to print money”—to revive the economy. In theory, it should work. But in reality? I don’t know, “and I bet Bernanke doesn’t either.”

By going “all in,” Bernanke is clearly showing he “does not want deflation or Depression on his résumé,” said The Wall Street Journal in an editorial. But now we all have to worry about inflation. The Fed can get away with pumping out dollars when the economy is ailing, but we’d all better hope Bernanke can turn off the spigot before we get hyperinflation—or “another asset bubble.”

At least the “grown-ups” at the Fed are worrying about fixing the economy, said Rex Nutting in MarketWatch, rather than getting distracted by the AIG bonus “circus.” The economic outlook has worsened, and Bernanke’s right that this is no time for “half measures.” If we’re lucky, the economy will “start breathing on its own again.” If not, at least loans will get more favorable for most borrowers.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

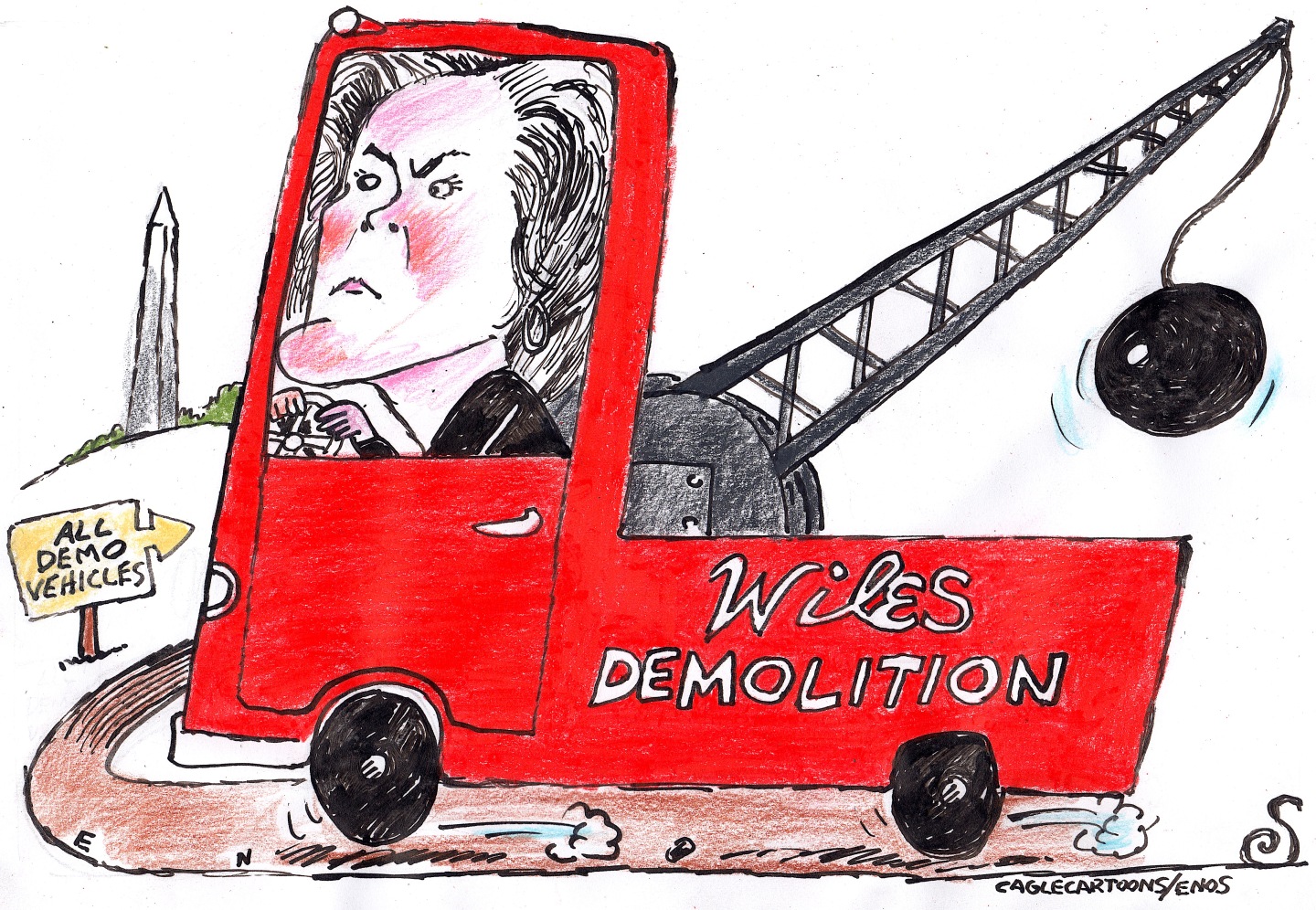

5 fairly vain cartoons about Vanity Fair’s interviews with Susie Wiles

5 fairly vain cartoons about Vanity Fair’s interviews with Susie WilesCartoon Artists take on demolition derby, alcoholic personality, and more

-

Joanna Trollope: novelist who had a No. 1 bestseller with The Rector’s Wife

Joanna Trollope: novelist who had a No. 1 bestseller with The Rector’s WifeIn the Spotlight Trollope found fame with intelligent novels about the dramas and dilemmas of modern women

-

Codeword: December 20, 2025

Codeword: December 20, 2025The daily codeword puzzle from The Week