Madoff’s crumbled pyramid

How a respected money manager bilked his clients of $50 billion

“Respected financier” Bernard Madoff stands accused of “operating an elaborate Ponzi scheme,” said Ben Levisohn in BusinessWeek online, using new investment cash to pay older investors, “to the tune of $50 billion.” The sums are unprecedented, but sadly, “Madoff’s alleged scam is not unique.” Such schemes happen every time there’s an asset bubble, dating back to 1720 at the latest. And they’re always exposed when the bubble pops.

Still, we should call it a “Madoff scheme,” not a Ponzi get-rich fraud, said Peter Henning in The New York Times online. Charles Ponzi bilked greedy investors out of millions by promising “outsized returns,” but Madoff catered to “the very rich” who liked his “stay-rich-for-a-long-time” scheme because he promised safe, steady, 10-percent annual returns. But both men profited from gullibility.

Really? If you were a Madoff investor, what would you have done? said David Weidner in MarketWatch. Performed due diligence on a Wall Street “icon” of “sterling reputation who already was servicing pension funds, endowments, and the super-rich?” The “complicit” parties in this are the federal regulators and accountants. How did the SEC miss this massive a fraud?

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A scheme like Madoff’s only works in a “high-trust” business culture like the U.S. has, or had, said Anne Applebaum in Slate. Madoff’s fraud will shutter charities and hurt major global banks, the rich, and the famous, but the biggest victim could be “American capitalism.” Along with “subprime lenders, Wall Street investment banks, and Enron fraudsters,” Madoff’s sins will make U.S. business “slower, more cautious, less productive, and less entrepreneurial.”

So how can you avoid investing with a Madoff? said Brett Arends in The Wall Street Journal. Here are some “red flags”—be wary of an investment manger who wants “complete control of your money,” or checks made out to him or his firm. Also, beware a “guaranteed” return, or one that’s “too steady over the long term.” If it looks too good, it probably is.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Create an account with the same email registered to your subscription to unlock access.

-

'Horror stories of women having to carry nonviable fetuses'

'Horror stories of women having to carry nonviable fetuses'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

Haiti interim council, prime minister sworn in

Haiti interim council, prime minister sworn inSpeed Read Prime Minister Ariel Henry resigns amid surging gang violence

By Peter Weber, The Week US Published

-

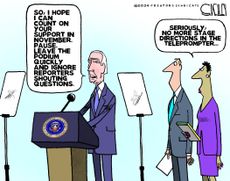

Today's political cartoons - April 26, 2024

Today's political cartoons - April 26, 2024Cartoons Friday's cartoons - teleprompter troubles, presidential immunity, and more

By The Week US Published