Yahoo! Alone, Sprint Together

Yahoo! and Microsoft each face challenges after the end of their strained courtship. Deutsche Telekom is mulling a bid for Sprint. And Chinese outsourcing just isn

NEWS AT A GLANCE

Microsoft drops Yahoo! takeover

Microsoft walked away from its bid for Yahoo! after Yahoo! said it wouldn’t accept Microsoft’s sweetened offer of $33 a share, which valued Yahoo! at $47.5 billion. The failed deal means Microsoft has to find another way to bolster its money-losing Internet unit and take on the search-ad dominance of Google. (Bloomberg) It also puts pressure on Yahoo! CEO Jerry Yang to come up with a way to prove to shareholders that the company is worth more than $47.5 billion. (AP in Yahoo! Finance) How Yahoo! shares react to the news “is going to tell everyone just how credible Yahoo’s long-term targets are,” said TCW Group analyst Anthony Valencia. (Los Angeles Times, free registration)

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Deutsche Telekom weighs Sprint bid

Deutsche Telekom, the parent of T-Mobile, is reportedly considering a bid for No. 3 U.S. wireless carrier Sprint Nextel. T-Mobile is currently a distant fourth in the U.S. market, but acquiring Sprint would propel it to No. 1, past AT&T and Verizon Wireless. The U.S. has been Deutsche Telekom’s biggest growth region. (The Wall Street Journal) Deutsche Telekom shares slipped in Frankfurt early today on the news. Sprint’s weak share price and the strong euro could make the acquisition a bargain, German magazine Der Spiegel said. But while it could make sense, said Dexia analyst Rob Goyens, “we are bound to take this morning’s news with a grain of salt.” (Bloomberg)

Buffett sees pain, but no panic

Billionaire investor Warren Buffett, speaking at the end of his annual investors’ conference, said he thinks the worst of the turmoil from the credit crunch has passed, but that the bank losses “aren’t over by a long shot.” About 31,000 investors came to the Berkshire Hathaway conference. (The Wall Street Journal) Buffett said he has been looking abroad for new acquisitions, was “probably close” to a purchase in the U.K., and was looking at bidding on the insurance unit of Royal Bank of Scotland. (MarketWatch) Separately, ex-Fed Chairman Alan Greenspan said he thinks the U.S. is in an “awfully pale recession,” likely until year’s end. (Bloomberg)

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The new Chinese outsourcing

With the weak U.S. dollar and the spreading fallout from the credit and mortgage meltdowns, cash-flush Chinese businessmen are increasingly moving their factories to the U.S. Land and electricity now cost less in some parts of the U.S., and state and local governments are offering incentives to counter the higher cost of labor. Many Chinese entrepreneurs are wary of U.S. visa restrictions or upset about a perceived pro-Tibet bias in the run-up to the Olympics, but those concerns rarely trump business. “They don’t want to miss this opportunity to bottom-fish in the U.S.,” said economist Mei Xinyu at China’s Commerce Ministry. (Los Angeles Times, free registration)

-

Ultimate pasta alla Norma

Ultimate pasta alla NormaThe Week Recommends White miso and eggplant enrich the flavour of this classic pasta dish

-

Death in Minneapolis: a shooting dividing the US

Death in Minneapolis: a shooting dividing the USIn the Spotlight Federal response to Renee Good’s shooting suggest priority is ‘vilifying Trump’s perceived enemies rather than informing the public’

-

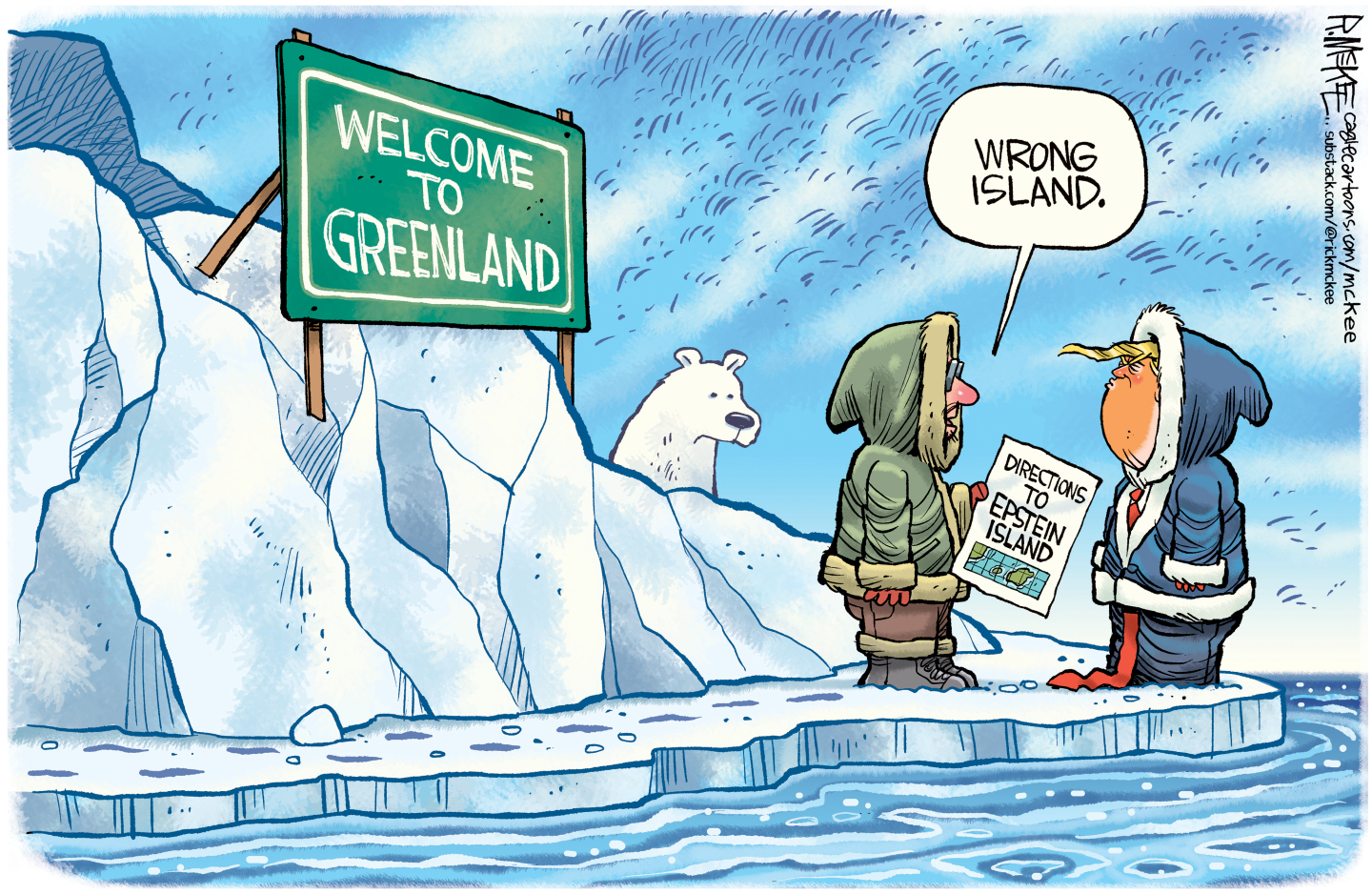

5 hilariously chilling cartoons about Trump’s plan to invade Greenland

5 hilariously chilling cartoons about Trump’s plan to invade GreenlandCartoons Artists take on misdirection, the need for Greenland, and more