Fed jolts markets

Federal Reserve policymakers slashed interest rates more sharply than expected and sent the major stock indexes shooting higher Tuesday. There goes Fed Chairman Ben Bernanke's reputation as an inflation fighter, said Andrew Leonard on Salon.com. Well, sai

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The Federal Reserve slashed short-term lending rates by a half percent, which was deeper than expected, sending the major U.S. stock indexes climbing by more than 2 percent Tuesday afternoon. The Fed said in its closely watched statement that the sharp cut was needed to keep the housing slump and credit crunch—which have roiled financial markets recently—from damaging the broader economy.

The Fed made its usual noise about the threat of inflation, said David Bogoslaw in BusinessWeek Online. But it’s clear that “the magnitude of the credit crisis assumed centerstage in the Fed's deliberations.” This cut will send rates on adjustable-rate mortgages down, and that will be a source of relief. The decision was unanimous, even though most observers thought the majority of the members of the Federal Open Market Committee favored just a quarter-point rate cut.

So much for Fed Chairman Ben Bernanke’s “carefully nurtured reputation as an exceedingly cautious inflation fighter,” said Andrew Leonard on Salon.com. Whether he likes it or not, Bernanke has just established himself as someone who, “in the glorious tradition of his predecessor Alan Greenspan,” is willing to “jump in and save the financial markets from their own excesses.”

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

It’s true that it’s not the Fed’s job to rescue investors who took on too much risk, said Douglas Roberts on BloggingStocks. But dealing with “the moral hazard issue”—here, fiddling with the markets to save people who made bad bets on bundled risky mortgages—will have to wait. For now, “forestalling a recession” is the bigger priority, and this rate cut will come in handy in that fight.

Actually, this super-sized rate cut “could make matters worse,” said Chris Isidore on CNNMoney.com. Most economists still don't even think we’re heading for a recession, and even if we were “the Fed can do little at this point to address many of the factors threatening continued economic growth.” But a steep rate cut can discourage foreign investors from buying U.S. Treasurys, for example, and we need their money to “keep long-term interest rates low.”

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

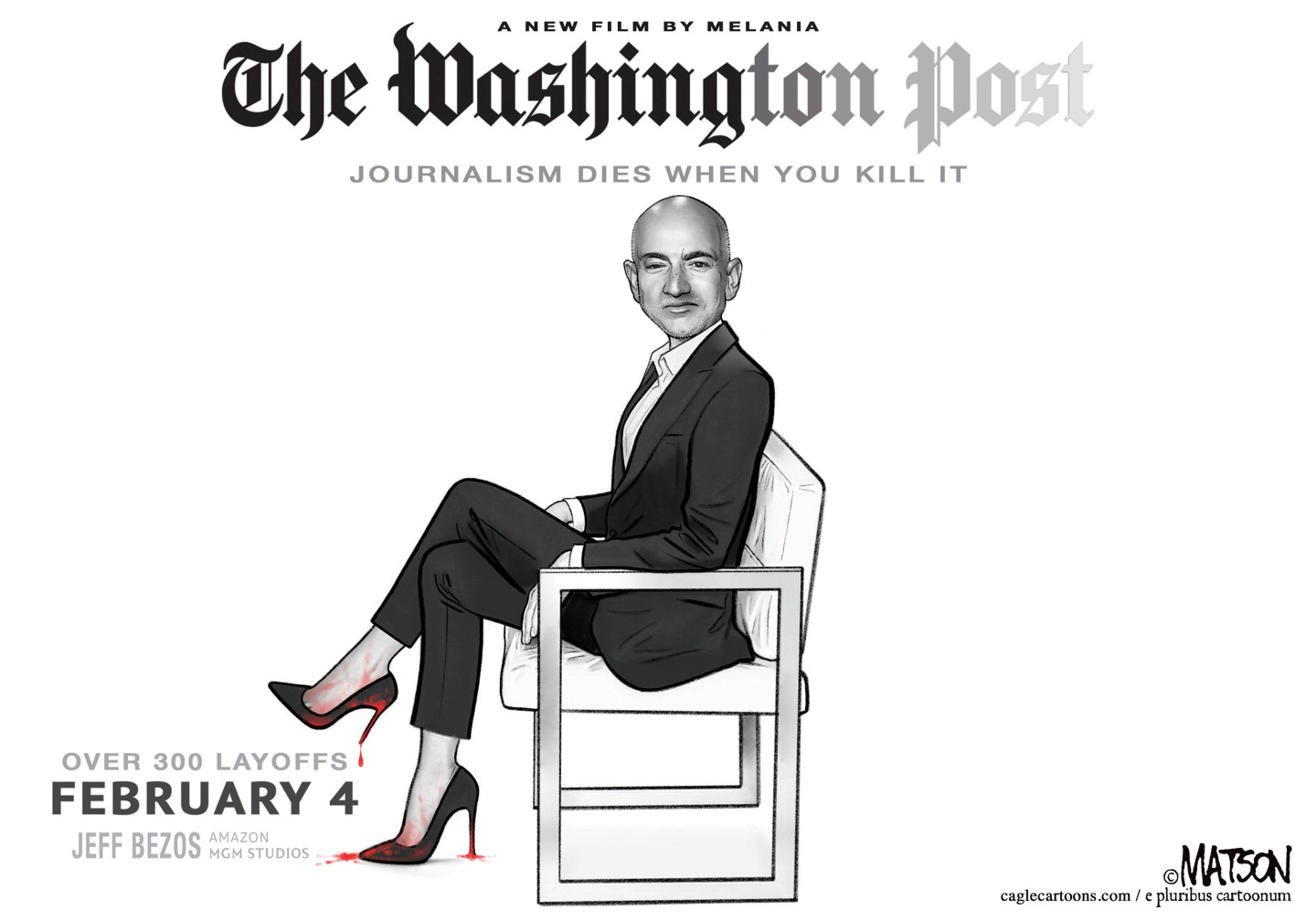

5 cinematic cartoons about Bezos betting big on 'Melania'

5 cinematic cartoons about Bezos betting big on 'Melania'Cartoons Artists take on a girlboss, a fetching newspaper, and more

-

The fall of the generals: China’s military purge

The fall of the generals: China’s military purgeIn the Spotlight Xi Jinping’s extraordinary removal of senior general proves that no-one is safe from anti-corruption drive that has investigated millions

-

Why the Gorton and Denton by-election is a ‘Frankenstein’s monster’

Why the Gorton and Denton by-election is a ‘Frankenstein’s monster’Talking Point Reform and the Greens have the Labour seat in their sights, but the constituency’s complex demographics make messaging tricky