Why Gravity Payments could be setting a business model for the future

The Seattle-based company shows that better pay doesn't destroy the bottom line

Depending on whom you ask, Dan Price is either a saint or a sap.

This week, the 30-year-old CEO announced he would raise the yearly wages of all 120 of his employees to a minimum of $70,000. That company — the Seattle-based Gravity Payments, which processes credit-card transactions — currently pays an average salary of $48,000. One hundred of its employees will see a pay increase, and 30 of those will see their pay double.

Needless to say, the news made quite a splash. The City of Seattle recently passed an ordinance hiking its minimum wage to $15, making it a premiere battleground in the ongoing national dispute over what to do about stagnating wages and rampant inequality.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Price has attracted a few critics as well. A good example is this bit of concern-trolling by Joe Carter, which rests on two points. One, by setting its minimum wage so high, Gravity Payments has created a floor beneath which its revenues cannot drop, which will put it at a disadvantage vis-a-vis other competitors. Two, the employees who just got raises are actually now being paid more than their productivity is worth, and will be the first to get cut from the payroll should Gravity ever need to underbid a competitor.

But here's the thing: Gravity didn't raise those wages by upping its prices. All it did was reshuffle the money that was already flowing through the firm. Price massively cut his own $1 million salary down to $70,000, and diverted about 80 percent of the company's profits for 2015.

That point is important to keep in mind, because Gravity's prices and the quality of its service are what will determine its competitiveness. Neither of those variables have been altered. And as it stands, Gravity is doing quite well against its competitors: The company's anticipated profits for 2015 were $2.2 million before it used most of that for the wage hike, and Price appears confident Gravity can get back to that profit level even with the new wage scale.

In fact, Gravity will still have at least $440,000 in profits in 2015, which means it could drop its prices a bit more, keep the new wage structure, and still remain in the black.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

It's certainly possible that another competitor could come along with some fundamentally new technology or approach to the credit-card transaction business, and that would force Gravity to cut prices to stay competitive. But that's the eternal danger any company with any pay scale confronts in any sector in a free market economy. It also simply means its overall flow of revenue would come down. And it would have lots of options for determining how to distribute that reduced flow: it could cut everyone's pay, it could let some people go, it could accept a few years of no profits until it retooled, it could expect a few years of losses and possibly take on debt, etc.

In other words, Price has taken a look at the overall market for his business, and concluded that it will support a business model that pays employees $70,000 annually. And he appears to be correct.

Then there's Carter's second argument: that Gravity is paying some of its employees more than they're worth. This is a pretty easy one to dispense with. Imagine if, by some miracle, our policymakers decided to get serious about getting the economy back to full employment, by, say, passing another trillion dollar stimulus. Labor force participation shoots back up, unemployment drops below 4 percent, and workers become a lot harder to hold onto because jobs are plentiful.

What happens? Well, wages are gonna rise — at Gravity and everywhere else. But they didn't rise because workers suddenly all magically became more productive at once. They rose because workers gained bargaining power against their employers, and their employers realized they'd have to hike pay to keep their businesses going.

Every company is a tiny society of human beings. That mix of people could be workers and the owner in a small business, or workers and investors or shareholders in bigger private or public companies, all depending on how the firm is legally structured. And negotiations between those human beings are what set pay.

The "cost of labor" is not a purely economic consideration, like the cost of bolts or scissors, as Carter implies. It's also an irreducibly social decision, which means what firms pay isn't just a matter of cold-eyed economic calculus. Human pride and greed and the desire for status can introduce a great deal of irrationality into how firms make these decisions. Price's change of heart is admirable, but it also highlights that he was paying his employees less because he could get away with it.

This is why policies like the minimum wage are important: They increase workers' bargaining power in the tiny societies of their firms, giving them a legal tool to demand a greater cut of the revenue flow. Laws to strengthen unions or to bulk up the social safety net can help, too. But with those approaches going nowhere in the United States, it's understandable that worker movements are turning to the minimum wage as an alternative.

Price deserves all the accolades he'll get for this experiment. But we probably shouldn't be relying on crises of conscience among CEOs to make sure workers get their fair cut of the great wealth they help produce.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

High Court action over Cape Verde tourist deaths

High Court action over Cape Verde tourist deathsThe Explainer Holidaymakers sue TUI after gastric illness outbreaks linked to six British deaths

-

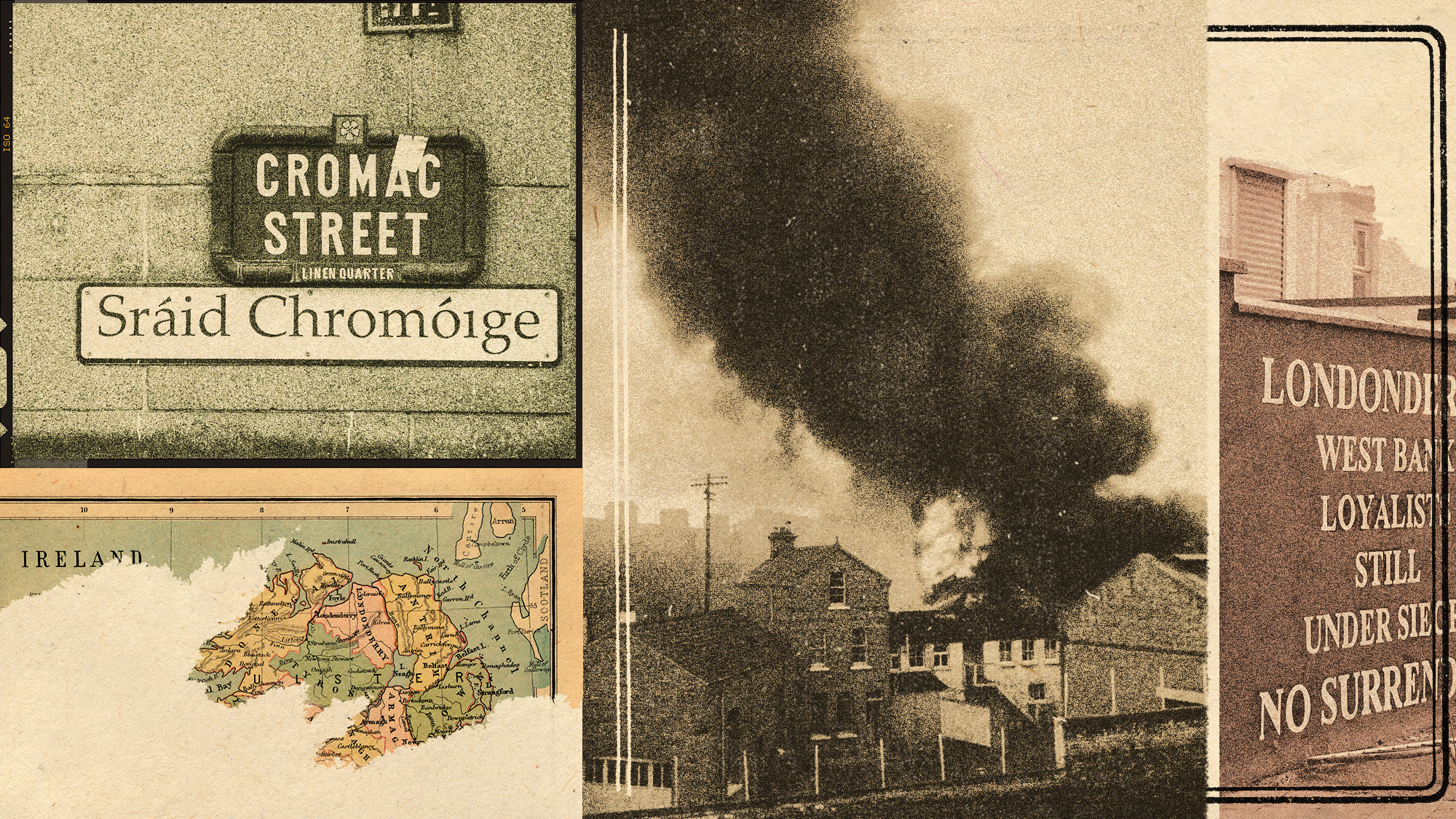

The battle over the Irish language in Northern Ireland

The battle over the Irish language in Northern IrelandUnder the Radar Popularity is soaring across Northern Ireland, but dual-language sign policies agitate division as unionists accuse nationalists of cultural erosion

-

Villa Treville Positano: a glamorous sanctuary on the Amalfi Coast

Villa Treville Positano: a glamorous sanctuary on the Amalfi CoastThe Week Recommends Franco Zeffirelli’s former private estate is now one of Italy’s most exclusive hotels