The Fed absolutely should embrace a 4 percent inflation target

A new target would give the central bank more room to fight recessions

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Federal Reserve officials are meeting this week to consider the course of U.S. monetary policy. And according to The New York Times, questions are being raised about what until now has been one of the Fed’s sacred cows: the 2 percent inflation target. The chatter from a few more ambitious corners is that a 4 percent inflation target might be better.

This is a very good idea, one that has major ramifications for the U.S. economy.

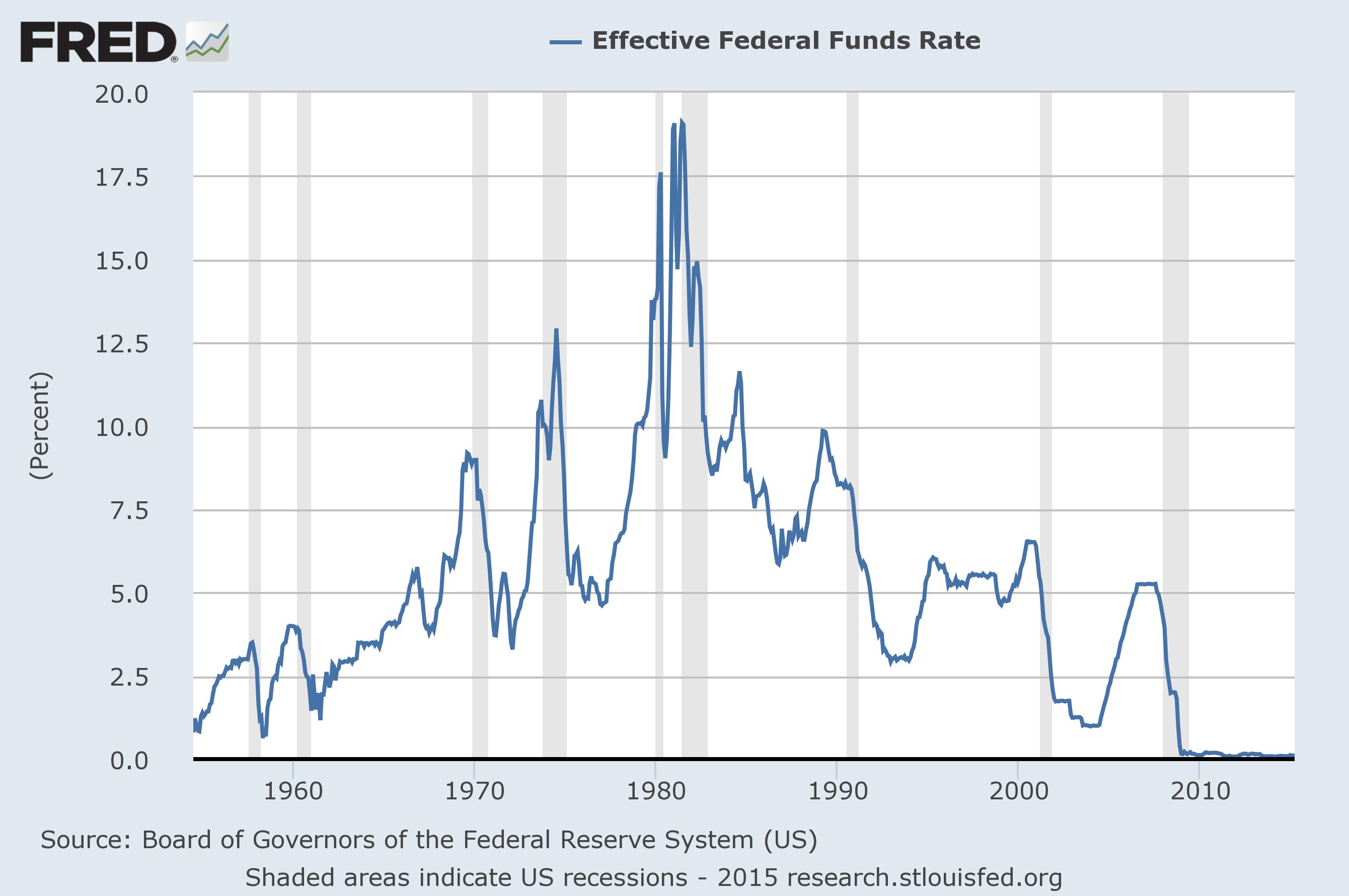

After the big run-up in inflation during the 1970s, the Fed massively hiked interest rates, driving the economy into a severe recession. But it also broke the inflation trend, which fell back to around 4 percent during the 1980s, and then ratcheted down further to 2 percent by the 2000s.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

By that point the Fed was also keeping the federal funds rate — its primary tool for controlling interest rates — at a historically modest level of around 5 percent or lower. As Binyamin Appelbaum reports at the Times, that experience has made a 2 percent target something close to gospel, both at the Federal Reserve and the central banks of other western countries.

But a big problem has emerged. The Fed uses the federal funds rate to keep the economy from running too hot or too cold. When growth is high and jobs are plentiful, inflation can also rise, so the Fed will hike the federal funds rate to push interest rates up and slow the economy down a bit. Conversely, when a recession happens, the Fed will cut the federal funds rate to power the economy out of the ditch.

Now, the institutions in the economy factor in the inflation rate when deciding what interest rate to charge borrowers. When inflation is higher, so are the interest rates. That means the same cut in the federal funds rate will translate into a bigger reduction in interest rates — and thus a bigger jolt to the economy — when inflation is higher than when it's lower. It's a question of getting the biggest bang for the buck.

That brings us to the problem. A 2 percent inflation rate is pretty low, historically speaking, and doesn't give the Fed a lot of room to maneuver. After the 2001 recession, it cut the federal funds rate all the way down to 1 percent to fight the drop.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

With the massive 2008 slump, the Fed ran out of room entirely. It cut the federal funds rate to near zero in 2009, and it’s stayed there ever since. Suddenly, the Fed has gone from trying to keep inflation down to 2 percent to not even being able to push it back up to 2 percent. And what we’ve gotten in exchange has been a grinding and poisonously slow emergence from one of the worst economic catastrophes in U.S. history.

"Most developed countries' central banks have experienced difficulty in providing sufficient monetary stimulus to spur a robust recovery in their economies," said Eric Rosengren, the president of the Federal Reserve Bank of Boston, in a massive understatement. "This may imply that inflation targets have been set too low."

The problem also arguably extends far beyond the 2008 mess.

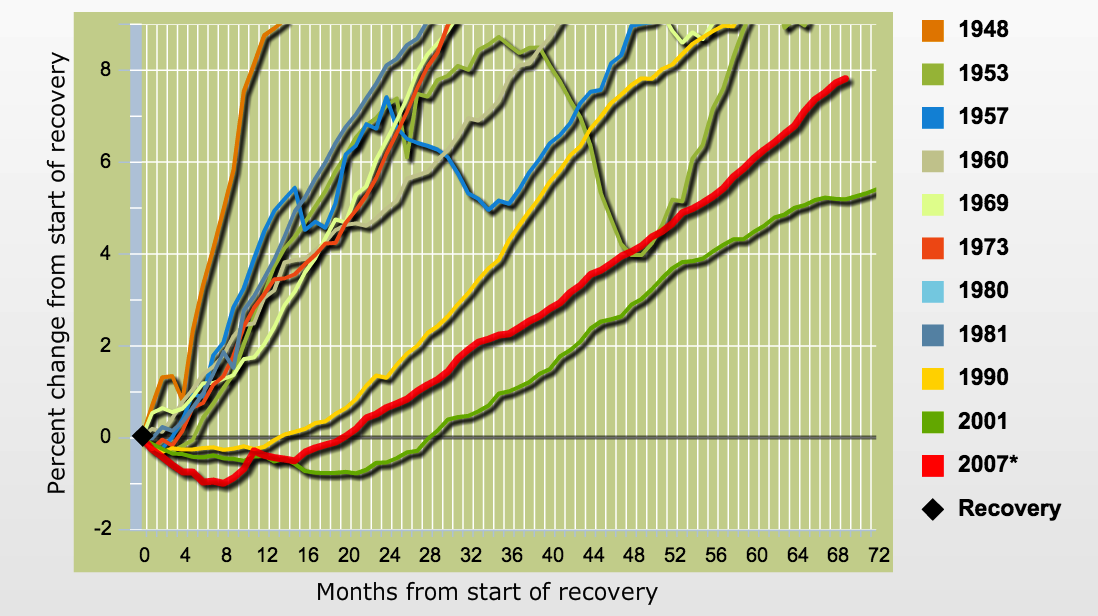

As Paul Krugman once observed, there's been a fundamental change in the nature of U.S. recessions. Up through 1981, recessions happened when the Fed decided the economy was running too hot and hiked interest rates, and recoveries were swift. But the recessions in 1990, 2001, and 2008 have been like the Great Depression — caused by a bursting credit bubble or a financial crisis or something else going fundamentally wrong in the economy. After these latter recessions, employment has recovered at a shockingly slower pace.

(Note: this graph excludes the 1980 recession, since the 1981 recession cut it short.)

You can also see the post-1980 shift in the unemployment rate, which has been a noticeable tick higher since, and the involuntary part-time employment rate, which has been considerably higher.

But the Great Recession has been worst of all. Even Krugman, who recognized the severity of the problem, originally anticipated it would be over by 2010. But it's 2015, and the economy only recently got above the raw number of jobs it had just before the 2008 dive. And it probably won't get back to the number of jobs we need, given the growth in our labor force, until sometime in 2017.

For everyday Americans this kind of economic grind causes all sorts of damage. When people spend prolonged periods out of work or grappling with low incomes, their social networks and their skill sets deteriorate, setting them back economically as individuals and the economy as a collective, possibly permanently. Marriages are stressed out and break up; the educational, emotional, and physical development of children in hard-hit families can be permanently affected.

For the poorest 10 percent of Americans, whose incomes are primarily determined by how many hours of work they can get, the new form of recession has been especially brutal — effectively wiping out the economic gains they made in each previous recovery. And the data showing that ends in 2007, before the 2008 implosion.

As Matthew O'Brien once put it, the Federal Reserve’s strategy for guiding the economy has implicitly shifted. Up through the early 1980s, the Fed tolerated higher inflation and maintained a higher federal funds rate, but that also gave us regular periods of robust growth. Since then, the Fed has been ratcheting down the federal funds rate, but at the price of less room to boost the economy, while relying on much slower and more punishing recoveries to keep inflation in check.

That's fine for the financial and business elite who form the socioeconomic circles around the Fed; they have various economic interests in keeping inflation as low as possible, and they're the last people who will be touched by the job loss during a slump.

But to get back to a monetary policy that prioritizes the economic well-being of the most vulnerable American workers, the Fed needs to shift again. As Appelbaum notes, economist Lawrence Ball has calculated that a 4 percent inflation target would give the Fed much more elbow room to boost the economy back out of its occasional slumps. And we handled a decade of 4 percent inflation just fine in the 1980s.

You could imagine much more involved and radical reforms: moving the Federal Reserve to nominal GDP level targeting for instance, or completely reworking how it disperses the money it prints.

But for the moment the Fed has the policy toolkit it has, and its current dual mandate to keep inflation low and employment up. A 4 percent inflation target would be a good first step to ensuring it takes the "keep employment up" part of that equation seriously.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

Film reviews: ‘Send Help’ and ‘Private Life’

Film reviews: ‘Send Help’ and ‘Private Life’Feature An office doormat is stranded alone with her awful boss and a frazzled therapist turns amateur murder investigator

-

Movies to watch in February

Movies to watch in Februarythe week recommends Time travelers, multiverse hoppers and an Iraqi parable highlight this month’s offerings during the depths of winter

-

ICE’s facial scanning is the tip of the surveillance iceberg

ICE’s facial scanning is the tip of the surveillance icebergIN THE SPOTLIGHT Federal troops are increasingly turning to high-tech tracking tools that push the boundaries of personal privacy