The Federal Reserve's premature extraculation problem keeps getting worse

The central bank keeps winding down the stimulus — only for the recovery to flag yet again

Federal Reserve Chair Janet Yellen, like Ben Bernanke before her and all central bankers generally, projects an aura of unflappable seriousness. Listening to her speak on economic issues, one gets the feeling that were she to witness the second coming of Christ, her first thought would be the likely effect on inflation and employment.

This reputation, however, is belied by their behavior. While both Yellen and Bernanke are brilliant economists, the actions of the Federal Reserve since 2008 have betrayed a basic lack of substantive seriousness. Instead of a straightforward, honest, empirical consideration of how best to restore the economy to health, there has been unjustifiable hesitation and dithering, covered up by a lot of serious-sounding argle-bargle.

This failure was grimly illustrated yet again with the release of revised GDP numbers for the first quarter of 2015. Just like in 2014, the economy shrank during the beginning of the year, this time at an annualized rate of 0.7 percent. It's symptomatic of a Fed that is not only failing the American people, but setting itself up for its own worst nightmare in the future.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

In 2008, when the worst of the financial crisis struck, the Fed cut interest rates essentially to zero, and moved heaven and Earth to rescue America's crumbling banks. After the financial system was stabilized, but unemployment was still a gigantic emergency, the central bank tried a number of far more modest policies to restore employment and growth (in addition to President Obama's Recovery Act).

The Fed recently began to wind down that policy, called quantitative easing, after several halfhearted rounds. Economists disagree about the utility of this brand of monetary stimulus. Some, such as Paul Krugman, think it doesn't do much good, but is worth trying. A second group, including Scott Sumner, think it could have completely restored economic health if it had been tried with sufficient aggressiveness.

The upshot here is that there is no credible reason (no, not even financial stability) for the Fed not to try everything in its power to restore employment and growth. Even today, seven years after the financial crisis, unemployment is high, inflation is low, and growth has been weak at best. But instead of vigorously trying to put the nation back to work, the Fed has been extremely eager to withdraw stimulus, only to be forced back into it repeatedly when the recovery's strength flags.

I dubbed this pattern "premature extraculation," and it seems hopeless that the Fed will ever see sense. This despite the fact that we are about due for another recession, which is undoubtedly being cooked up in a grifting financial parasite, I mean, large bank right now. Postwar economic expansions have lasted an average of 58 months; this one is currently at 72 months and counting. Wall Street has largely returned to the size and profitability of the pre-crisis years. Another asset bubble is coming, sooner or later.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Given all that, the Fed ought to be conducting an all-out effort to restore the economy to capacity, after which interest rates can be raised without the fear that a weak economy will be knocked back into recession. The Fed could announce something like $50 billion in new monetary stimulus, to be doubled every month until inflation hits 3 percent or unemployment hits 4 percent.

The central bank also ought to bring down the value of the dollar, to reduce the trade deficit. As Ryan Avent has been saying for the past three straight years, "Try overshooting for once!"

The fact that Yellen genuinely seems to understand all the parts of this argument, yet rejects the conclusion, suggests that the Fed's reluctance is about political and institutional constraints rather than intellectual ones. Perhaps, as Simon Wren-Lewis argues, this militates towards granting the Fed the power to give newly created money directly to citizens, as a better recession-fighting policy tool.

But it's pretty clear policy-makers are not going to do that. They're also not going to try roided-up normal stimulus. They're going to sit on their hands, hem and haw, wring their handkerchiefs, and make reasonable-sounding noises. When the next crash comes, rest assured, their brows will be extremely furrowed.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

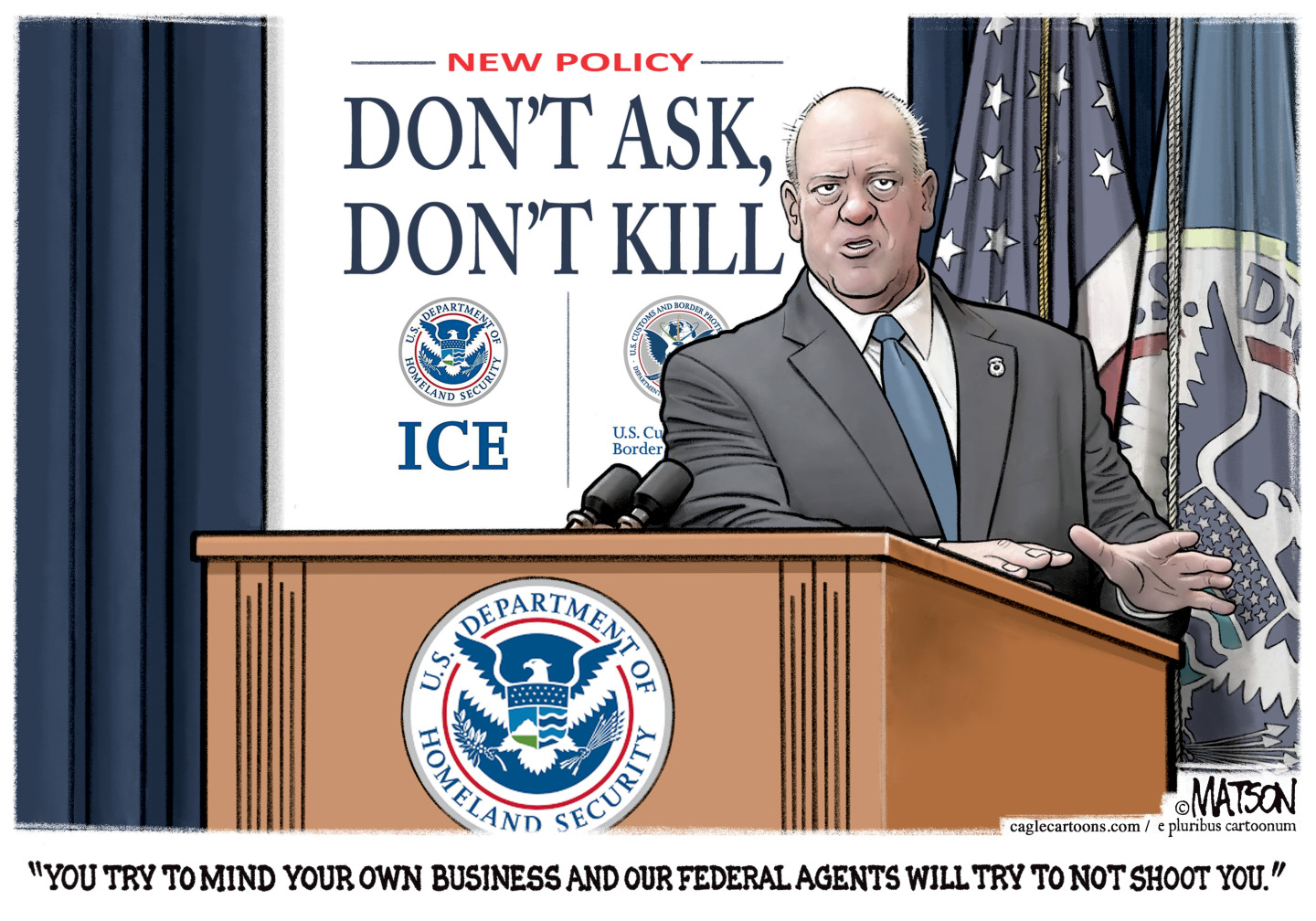

Political cartoons for February 1

Political cartoons for February 1Cartoons Sunday's political cartoons include Tom Homan's offer, the Fox News filter, and more

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

Reforming the House of Lords

Reforming the House of LordsThe Explainer Keir Starmer’s government regards reform of the House of Lords as ‘long overdue and essential’