ISIS's nutty economic policy shows it's not a serious security threat

In this world, winners don't use gold coins

What do ISIS and Ron Paul have in common? A love for gold, apparently.

Reports have circulated for months about ISIS's desire to use a gold monetary standard. And now the group has apparently finished minting its first gold coins, according to a video report from its propaganda wing. The coins will break "the capitalist financial system of enslavement, underpinned by a piece of paper called the Federal Reserve dollar note," the video claims.

Many goldbugs, like the crowd at Zero Hedge, are upset that this will discredit the gold standard and Austrian economics by associating them with jihadist terrorism. But in reality, the discrediting runs in the other direction. This sort of goofy economic policy only reveals what a minor threat ISIS really is, at least to the world outside Syria and Iraq.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Consider for a moment how a nation becomes militarily powerful. America, for example, has a large population, a skilled workforce, reasonably high-quality governance and infrastructure, and vast supplies of raw materials. Combined with a deep division of labor, this all serves to create a very large economic output.

A small fraction of that output is harnessed to produce high-tech weaponry and logistical support, and to train soldiers in that arsenal's proper use. The U.S. military is probably the most powerful in world history — though it's not omnipotent, of course. When using the military to solve political problems — propping up the regime in South Vietnam, or reconstructing the entire Iraqi state, for example — it tends to fail. But in open combat, the U.S. is nearly unchallengeable.

The upshot here is that military power depends very much on economic organization. Leadership and tactics do matter, of course, but particularly these days, when much "fighting" is conducted by remote-controlled robots and missile strikes, economic might is by far the most important factor in projecting force.

America's economic power is underpinned by the dollar and U.S. government debt, the trustworthiness of which stems from the credibility of the American state over 240 years. Even a gold standard (which would be a disastrous idea for any modern state) ultimately boils down to a promise to carry out some kind of currency policy, a promise that can be broken — but the U.S. has been extremely consistent about maintaining its currency and paying its debts in a reasonable fashion.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Compare that to ISIS's situation. Its members have partially consolidated control over a tiny piece of desert, a bit of oil, some ground troops, a hodgepodge of artillery and heavy weapons, and some light armor and tanks. They have no real air force, no navy at all, and no long-range missiles. They don't have the heavy industry necessary to manufacture their own weapons, so must rely on shipments or theft.

Put simply, ISIS's position is absolutely terrible. In open combat, the group would be crushed by a couple divisions of any halfway competent regular army. Their militants are more successful as guerrillas, but only when state collapse has left a huge power vacuum. And historically speaking, violently repressive dictatorships don't tend to last very long.

As such, any fiat currency ISIS tries to issue will be all but worthless. Borrowing in bond markets? Please.

Indeed, ISIS's desperate weakness may be why gold coins are a good idea, as Matt Yglesias argues. As a fractious group of maniacs ruling with nothing but naked force, beset on all sides by both regional powers and the world's military hegemon, ISIS is highly likely to not exist in a few years. Though one would have to worry about clipping and sweating, and the wildly gyrating price on commodities markets, gold is at least widely recognized as a precious metal. (Contrary to ISIS's ranting about the Federal Reserve's system of "enslavement," the group could also just piggyback off the U.S.'s credibility and use U.S. dollars for currency like Zimbabwe does, though it would obviously be ideologically problematic.)

It's unclear whether or not any coins have actually been issued yet. ISIS has apparently been trying to make this work for quite some time, and it would not be surprising if its gold standard never pans out. But the fact that ISIS is even trying this reveals either extreme weakness or nutty economic policy. The group is simply not a big threat.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

House GOP revolt forces vote on ACA subsidies

House GOP revolt forces vote on ACA subsidiesSpeed Read The new health care bill would lower some costs but not extend expiring Affordable Care Act subsidies

-

‘Kast’s victory is a political and ethical earthquake’

‘Kast’s victory is a political and ethical earthquake’Instant Opinion Opinion, comment and editorials of the day

-

Turner Prize 2025: ‘artistic excellence’ or ‘cultural nonsense’?

Turner Prize 2025: ‘artistic excellence’ or ‘cultural nonsense’?Talking Point Work by the four artists nominated for this year’s award is on display at Bradford’s Cartwright Hall

-

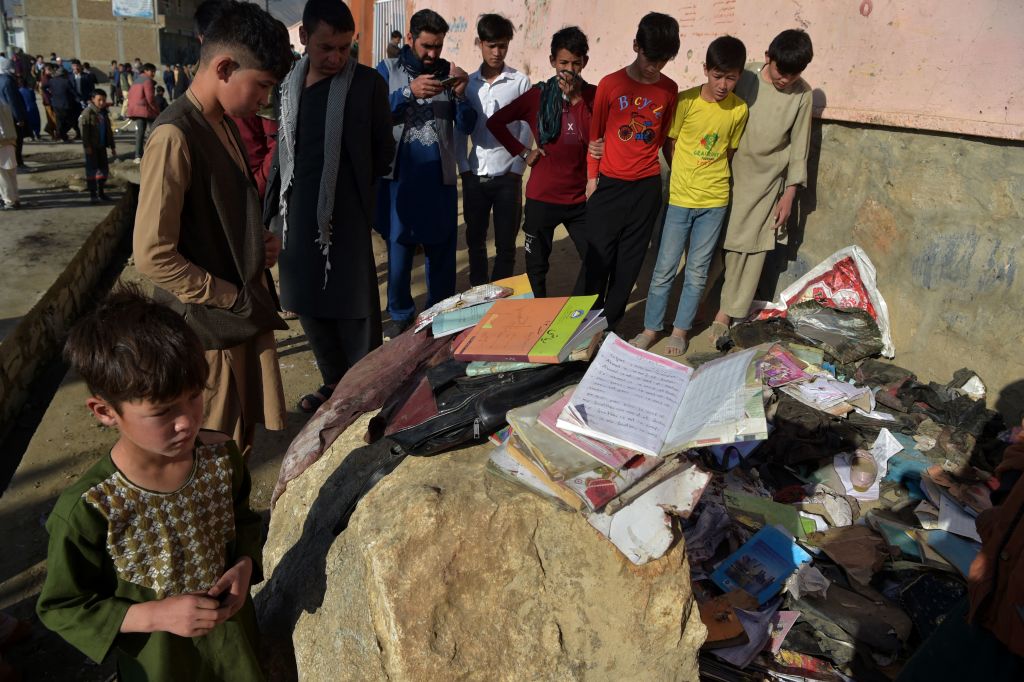

Bombing at girls' school in Kabul kills at least 50, including students

Bombing at girls' school in Kabul kills at least 50, including studentsSpeed Read

-

Garland says DOJ is 'pouring its resources' into stopping domestic terrorists 'before they can attack'

Garland says DOJ is 'pouring its resources' into stopping domestic terrorists 'before they can attack'Speed Read

-

Suspected Israeli cyberattack on Iranian nuclear site complicates U.S.-Iran nuclear deal talks

Suspected Israeli cyberattack on Iranian nuclear site complicates U.S.-Iran nuclear deal talksSpeed Read

-

North Korea fires 2 ballistic missiles into sea

North Korea fires 2 ballistic missiles into seaSpeed Read

-

U.S. airstrikes target Iranian-backed militia facilities in Syria

U.S. airstrikes target Iranian-backed militia facilities in SyriaSpeed Read

-

Rochester police who killed Daniel Prude during mental health crisis won't face charges

Rochester police who killed Daniel Prude during mental health crisis won't face chargesSpeed Read

-

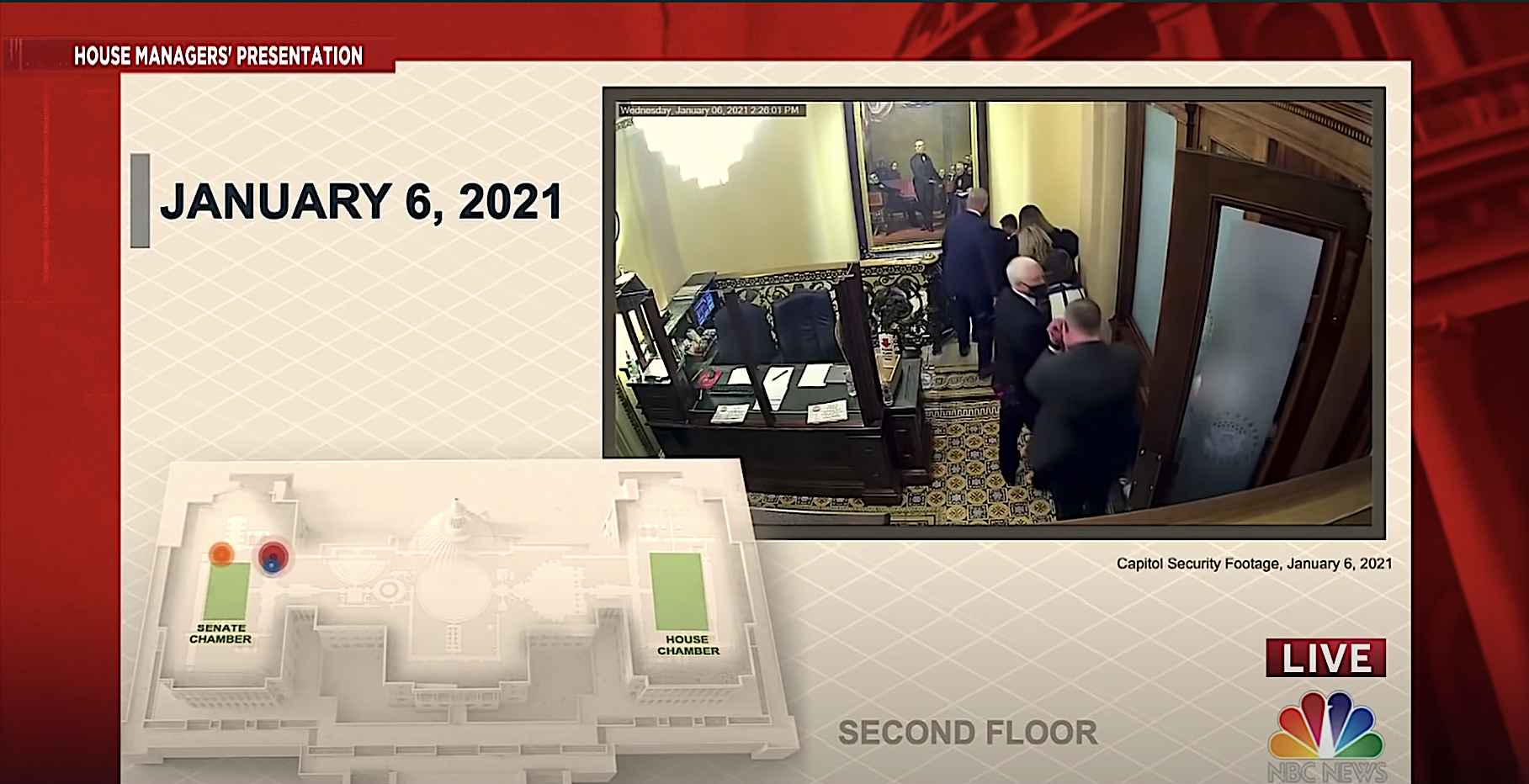

Mike Pence's 'nuclear football' was also apparently at risk during the Capitol siege

Mike Pence's 'nuclear football' was also apparently at risk during the Capitol siegeSpeed Read

-

Trump publicly attacked Pence during the Capitol riot knowing Pence was in trouble, GOP senator suggests

Trump publicly attacked Pence during the Capitol riot knowing Pence was in trouble, GOP senator suggestsSpeed Read