How Uber could become a nightmarish monopoly

What if every time you took a taxi, you were charged the absolute maximum you could afford?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

What if every time you took a taxi, you were charged the absolute maximum you could afford?

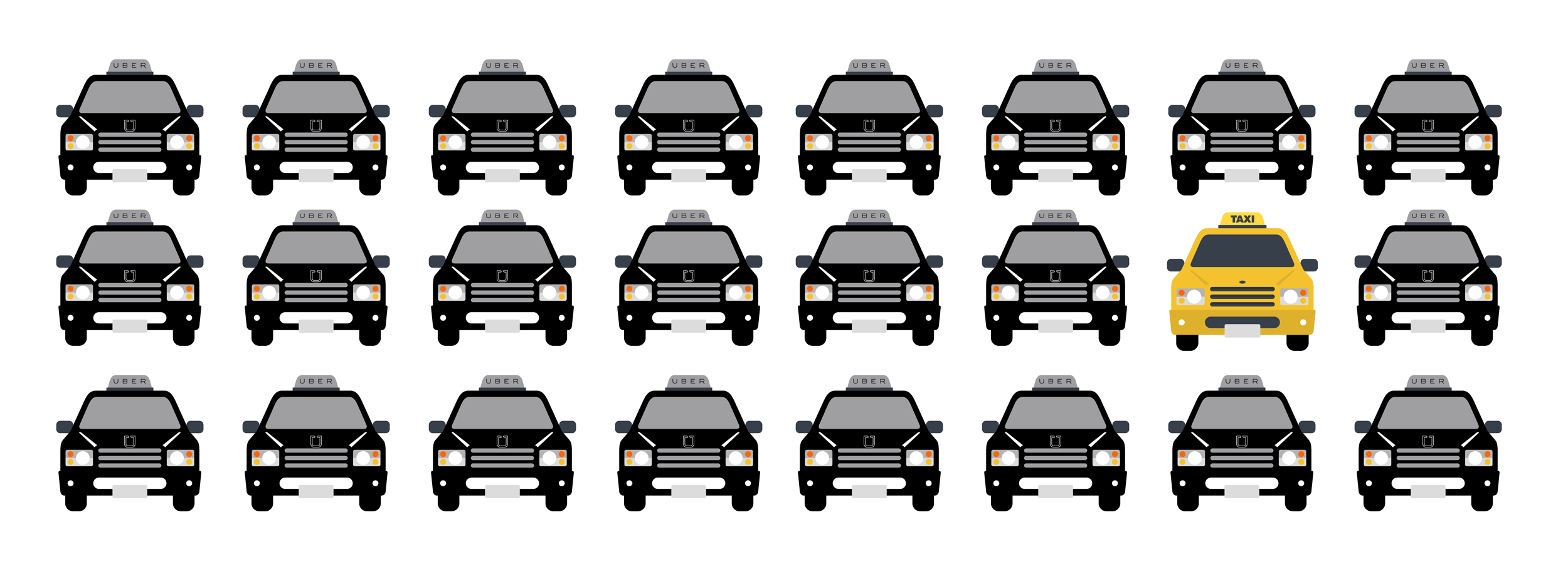

If you live in a city, chances are you've got a taxi app on your phone. Right now, there are a number of choices: Lyft, Sidecar, Uber, and a few others. But imagine a future where there is only one option — and all the traditional taxis have been driven out of business. A time when if you need a cab somewhere, it's Uber or bust. Imagine further that sophisticated pricing algorithms have enabled the company to determine exactly how much you'd be able to pay for a ride.

This might all sound implausible, when Uber and Lyft are locked in ferocious rate-cutting wars and trying to poach each other's drivers. But there could easily come a time when one finally defeats all its competitors. It could be any of them, but the smart money would be on Uber, a notoriously aggressive company, scornful of existing legal regimes or industry norms that has already captured much of the taxi business.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

With traditional cab companies collapsing and most cities reticent to tackle ride-sharing apps head on, Uber would have a chance to dominate the American taxi market to an unprecedented degree. And because any such nationwide taxi monopoly would also have powerful high-tech tools at its disposal, it could be the first company in history to be able to attempt perfect price discrimination — adjusting individual prices so that every taxi customer pays as much as she can afford.

A worst-case scenario would mean a technological arms race between Uber and consumers, abuse of lower-class people, and an erosion of the financial base of public transportation. Every time you take a ride across town, Uber would be leveraging surveillance data to soak you for every penny it possibly could — and either you'd eat the cost or engage in a lot of expensive and complicated counter-espionage.

Now, price discrimination itself is restricted at the federal level under the Robinson-Pateman Act of 1936, but the law's conditions only govern commodities, putting any taxi company outside its reach. And while Uber has never indicated it wants to adopt such a pricing strategy, plenty of online companies have — and they were never presented with as great a temptation. (Uber did not respond to our request for comment.)

The looming taxi monopoly

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Corporate consolidation is a background condition of the modern economy. Since the Reagan years, endless waves of mergers have swept across American business. From agriculture to banking, a few behemoth companies now control up to 80 percent of all sales (or even 90 percent, in the case of computer chips and Intel). As a result, corporate competition often takes the form of excluding rival products from marketplaces, rather than beating them on quality or price.

Some of America's monopolies, like Monsanto, might sound like throwbacks to the days of U.S. Steel. But others — like Facebook and Google — have a more modern sheen. And investors are betting that Uber will be one of the next digital behemoths to join their ranks.

Uber is notoriously secretive when it comes to its internal information, so it's hard to know exactly how big it is. Bloomberg got access to internal data in December (the most recent leak) showing revenues of $5.5 billion in 2016. Uber operates at least somewhere in every state except Alaska and in over 70 other countries. It officially employs roughly 6,700 people, although that figure does not include drivers (not classified as employees, in a bid to avoid labor regulations) of which there are many hundreds of thousands.

Uber's business strategy might best be described as "rulebreaking." In city after city, they have crashed in and undermined the existing taxi market with cheap fares and violation of existing regulations. Two years ago it fended off an attempt at regulation from New York City with a massive PR blitz, and it has threatened to leave Maryland if that state insists on toughening up its driver background checks. And that's not all — one Uber executive openly speculated about using their ride data to blackmail journalists (after a firestorm of criticism, he apologized).

It's pretty clear Uber is banking on total domination. The company has raked in at least $15 billion in outside investment — including a massive $3.5 billion in a single shot from Saudi Arabia. Some quick arithmetic done by an analyst at Naked Capitalism demonstrates that Uber's fares only cover about 40 percent of its costs — the rest being subsidized out of investor cash. That, plus the fact that the entire American taxi market has yearly revenues of only $11 billion, suggests one of two things. Either investors are fooling themselves, or they "are assuming this will be a monopoly service," says Frank Pasquale, law professor at the University of Maryland. The strategy would be to undercut competition with investor-subsidized fares, and then when everyone else is driven out of business, jack prices through the roof and collect monopoly profits. Indeed, the firm claims it already controls over 80 percent of the taxi app market.

Uber's big opportunity

Here's where it gets interesting. A monopoly in the age of the internet raises unusual economic questions, particularly that of price discrimination.

There are several ways to charge individuals differently for the same product, but let's focus on what's called "first-degree" price discrimination. This means perfectly individualized pricing, where each consumer is charged their absolute maximum willingness to pay. (In economics lingo, this is called an exact reservation price.)

For most of history, this was thought impossible. "The hard part in the old days was finding the reservation price," says William Black, professor of law and economics at the University of Missouri-Kansas City. Figuring it out for a single person means determining how much money she makes, what sort of things she wants or needs, how badly she craves it, and so forth. Thus, it not only involves a great deal of intrusive surveillance across the entire market, but also managing tremendous quantities of data.

But computers and the way the internet economy has developed have demolished these barriers to perfect price discrimination. The constant acceleration of computing power and data storage technology has made sorting millions of personal data portfolios quite straightforward. Ordinary web browsing and shopping now means history, purchases, relationships, and more are comprehensively tracked and assembled into dossiers, compiled and traded in a $156 billion industry (as of 2014).

Apps themselves also assist in personal surveillance. Installing a taxi app necessarily requires access to much of one's personal information, even aside from when and where you are going.

Assistant economics professor Benjamin Shiller of Brandeis University modeled the potential business benefits of price discrimination in a 2014 paper, given reasonable assumptions. He found that Netflix could have increased its profits by 0.8 percent using simple demographic data — but by 12.2 percent using the detailed information available from browser surveillance.

However, it's still risky. "Even if you can do it, it's unwise due to backlash," says Carl Shapiro, professor of economics at UC Berkeley. Some businesses have experimented with quasi-perfect discrimination and gotten caught at it, to their regret.

In September 2000, for instance, Amazon was discovered offering higher DVD prices to customers whose browsers identified them as regular Amazon shoppers. CEO Jeff Bezos apologized, swore his company wouldn't do it again, and offered refunds to people who had gotten the higher price.

But Uber might be different.

First, the company is already well-known for constantly fiddling with prices with its "surge pricing" function, which supposedly adjusts prices to fit demand — part of Uber's self-presentation as a mere marketplace. However, unlike a usual market, it controls pricing across its entire fleet, and its pricing mechanism is opaque. When you receive a surge price alert on the Uber app, you take the company at their word that everyone in the area is also getting it.

The opportunity for camouflaging price discrimination is obvious. Uber "could usher in price discrimination under the banner of dynamic pricing," says Lina Khan, a fellow at the New America Foundation's Open Markets Program.

Suppose you're a lawyer on the way back from a business trip. You make a fair bit of money, but you don't mind taking public transportation when you've got the time. But on returning from this particular trip, you learn your wife has gone into premature labor. And Uber, armed in this hypothetical with a granular analysis of your personal dossier — who you've been calling and texting, what things you've been buying, and so on — figures this out. You've simply got to take a taxi to the hospital from Dulles — except this time, it's going to cost you $750. There is no other option, so you grit your teeth and pay up. Meanwhile, a broke college student leaving the airport five minutes later is charged only $15.

Would price discrimination really be so bad?

If Uber were to go this route, it would have its defenders.

Some researchers argue that price discrimination could actually benefit the poor. "Given reasonable assumptions, there will be a redistributive effect," says Glen Weyl, a senior researcher for Microsoft Northeast. This is because while a single price will be higher than many poorer people would be willing to pay, it might still be profitable to sell to them at a lower price. For example, price discrimination allows poor nations access to prescription drugs that would be otherwise unaffordable.

Or consider internet content services, where the cost of one additional download is essentially zero. Perfect discrimination for Netflix might mean that the very poorest people get access for a pittance, while more expensive subscriptions from the rest of the income ladder would provide the bulk revenues necessary to keep it in business.

The theory checks out — but it's Panglossian in its optimism.

The progressive result depends critically on price discrimination happening across the entire market. If it is restricted to bottom- or middle-income tiers, regressive outcomes may be the result, possibly even with poor consumers paying absolutely more than wealthy ones.

This was the finding of a 2012 Wall Street Journal report on Staples.com pricing. They discovered that the website varied its prices based on the zip code of the search, giving somewhat higher prices to shoppers who were far from any competitor. Because poorer zip codes generally have fewer retail options, giving Staples greater market power, "areas that tended to see the discounted prices had a higher average income than areas that tended to see higher prices."

Such a market strategy could also be combined with use of Uber's tiered service levels. Surveillance could predict people who are on the verge of upgrading to a more expensive level (moving from UberX to Uber Black, for example). They could then be nudged into it with strategic price changes — surging on the cheaper service but not the more expensive one. This wouldn't be price discrimination, strictly speaking, but the overall effect would be largely similar.

The dystopian future of taxis

So let's imagine what might happen if Uber manages to achieve full market domination and attempt price discrimination. It wouldn't be pretty.

First, it's important to realize that there would still be certain barriers to implementing price discrimination across the entire market. The reservation price of people at the top of the income distribution, for instance, is likely to be very high. Obscuring the difference between $20 and $30 with opaque algorithms is one thing, but it would get harder and harder if the price, say, automatically rises into the thousands of dollars.

People also tend to react angrily to discovering that they pay higher prices simply based on identity alone. Just as with the Amazon experiment, the Staples discrimination experiment caused a storm of controversy and a quick reversal and apology. A dominant Uber would be different due to its monopoly and greater ability to camouflage, but anyone who is charged $25,000 for a trip from Manhattan to Brooklyn is going to raise a stink even if they're extraordinarily wealthy. Instances in which discrimination is accepted, such as need-based college tuition pricing or the progressive income tax, are explicitly framed as a morally praiseworthy subsidy of those with lesser means. Calmly accepting a price tens or hundreds of times greater than the next person, simply to juice the profits of a large corporation, is far less likely.

Therefore, "people will think, 'I'm going to try and hide my identity,'" says Shapiro. But wealthy people are far more likely to have the education and technological sophistication necessary to challenge corporate surveillance, or be able to hire someone to do it for them.

This would have the likely side effect of sparking an escalating battle between the monopolist attempting to discriminate, and those wealthy or savvy enough to foil the surveillance technology. Browsing "trackers" can be defeated by other browser plugins, use of no-tracking search engines like DuckDuckGo, encrypted email, and other strategies. Corporate counter-tactics, such as charging a great deal more to people who refuse to provide personal information, might be foiled by tech services providing a low-income identity presentation, and so on.

Finally, America's already-lousy public transportation would rot, as the taxi monopolist uses its political influence and market power to force people into using taxis wherever possible. A taxi app could be an excellent complement to public transport, helping people get to and from the bus stop or train station, but a taxi monopolist is certain to view those services as just another competitor to be stamped out. The resulting congestion — as trains and buses are capable of tremendously more throughput than cars — would be abysmal.

Given an Uber-style market setup, perfect price discrimination will become more and more feasible the further one goes down the income ladder. Wealthy people are likely to have the means and social influence to make perfect price discrimination more trouble than it's worth, while the poor will probably just accept it as just one more thing for which they have to pay an extraordinary premium. All the while, a good deal of economic product will be squandered in a zero-sum technological fight between the monopolist and their customers.

Businesses are built within legal structures created by the state. Uber, like every company, could not possibly exist without property law, securities law, and corporate law. There is every reason to use state power to prevent the U.S. taxi market from becoming a wasteful, nightmarish monopoly.

This is the first article in a two-part series on Uber. Stay tuned for the second installment.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy