How the oil crash could turn into a much bigger economic shock

This could be a huge problem for the entire economy

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

"Good for the consumer, gasoline prices coming down!" President Trump blared this morning on Twitter. "Coming down" is a pretty wild understatement: Major oil indexes crashed anywhere from one-fifth to one-third as trading opened Monday morning and the economic shocks from the coronavirus set off a full-blown oil price war between Saudi Arabia and Russia.

Unfortunately for the president, this could also turn into a very concrete lesson in how, given the world's interlinking financial markets and economic webs, a price drop like this can never be written off as simply "good for the consumer." In fact, the economic impact from the coronavirus leading to an oil price war between Saudi Arabia and Russia is exactly the sort of out-of-left-field chain of events that could cause the unexploded bomb of U.S. corporate debt to finally go off.

These days, the global oil market is probably best understood as a three-way standoff between Saudi Arabian, Russian, and American producers. The first two are state-run oil industries, in which central planners decide how much oil to produce based on political and geostrategic considerations. American oil producers, by contrast, are a scattered and decentralized bunch of market-based actors, who primarily make their decisions based on profits and shareholder payouts. That means there's no one on the U.S. side that Saudi Arabia and Russia can "talk to" and cooperate with on production plans.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The other thing to understand is the colossal amount of debt U.S. producers had to take on to become big global players. The boom in American oil production over the last decade was astounding, but it came along with tons of borrowing to finance the capital-intensive task of shale drilling. U.S. oil and gas producers owe roughly $86 billion, all of which is coming due over the next four years, and plenty of which is due in 2020. A lot of that debt is also very low-quality: American corporations have a significant overleverage problem — companies that already owe a lot of debt taking on even more, making their overall financial position even more precarious — and American oil producers are among the worst offenders. At this point, energy sector debt accounts for 11 percent of America's most popular junk bond trading.

This is where coronavirus, Saudi Arabia, and Russia enter the picture. The COVID-19 outbreaks around the world, and the resulting shutdowns of economic activity and supply chains, have already put a major dent in oil demand. Saudi Arabia wanted to work with Russia to cut production and make sure prices didn't collapse from supply outpacing demand, but Russia didn't want to cooperate, because protecting oil prices would benefit U.S. producers, who couldn't be relied upon to restrain their own production. "Russia has been dropping hints that the real target is the U.S. shale oil producers, because it is fed up with cutting output and just leaving them with space," the energy consulting firm FGE wrote to clients on Sunday.

Oil prices dropped 10 percent on Friday, when talks between Russia, Saudi Arabia, and the rest of the OPEC nations that work with Saudi Arabia ended without an agreement. But then Saudi Arabia really threw down the gauntlet over the weekend: With Russia insisting that every country should just do what it thinks is best, Saudi Arabia reversed course and jacked its oil production up, while cutting its selling prices. The country currently rolls out 9.7 million barrels of oil per day, it's reportedly aiming for 10 million, and it has the ability to go as high as 12.5 million.

Basically, Saudi Arabia called Russia's bluff. "This has turned into a scorched Earth approach by Saudi Arabia, in particular, to deal with the problem of chronic overproduction," Again Capital's John Kilduff told CNBC. Since "the Saudis are the lowest cost producer by far," they can presumably survive a price drop longer than the Russians or the U.S. producers.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

More to the point, a price collapse will make it very hard for American producers to repay their debt. And if a lot of them start going bankrupt at once, they could start dragging down the banks that made the loans, widening the shocks throughout the financial markets and seizing up the credit that's available to the rest of the economy as well, including the other overleveraged sectors. One market measure of corporate debt risk saw its biggest jump in almost a decade.

The question now is how low oil prices go, and how long they stay there. The U.S. oil industry has survived major price crashes before, in 2008 and 2014. But it also wasn't facing down a pile of debt like this. West Texas crude just saw its worst single-day drop since the start of the 1991 Iraq War, and its second worst day since trading began in 1983. As of now, its price was still in the low $30s, and analysts seem to think it would have to fall into the $20s for in-the-ground reserves to no longer be valuable enough to serve as collateral for bank loans.

As mentioned, Russia may well knuckle under the cost pressures pretty quickly and return to the bargaining table to hike prices. And even Saudi Arabia itself can only sustain ultra-low prices for so long, as the government's finances and much of the national economy depend on oil revenue. Finally, interest rate cuts by the Fed will allow oil producers and other indebted sectors to refinance at least some of their old debt obligations with newer and cheaper credit. But the Fed's target rate is already pretty close to zero: It only has so much breathing room it can offer, and there's no guarantee it will be enough.

Ultimately, there's just no way of knowing how long either Russia or Saudi Arabia can continue their oil spat, or how much of a revenue collapse the U.S. oil sector can endure, or how much of a fall off in debt payments the larger U.S. financial system can take, or how much additional damage the coronavirus itself will pile onto the whole system. It might be enough to pitch the American economy over the brink, it might not.

We'll find out soon.

Want more essential commentary and analysis like this delivered straight to your inbox? Sign up for The Week's "Today's best articles" newsletter here.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

Crisis in Cuba: a ‘golden opportunity’ for Washington?

Crisis in Cuba: a ‘golden opportunity’ for Washington?Talking Point The Trump administration is applying the pressure, and with Latin America swinging to the right, Havana is becoming more ‘politically isolated’

-

5 thoroughly redacted cartoons about Pam Bondi protecting predators

5 thoroughly redacted cartoons about Pam Bondi protecting predatorsCartoons Artists take on the real victim, types of protection, and more

-

Palestine Action and the trouble with defining terrorism

Palestine Action and the trouble with defining terrorismIn the Spotlight The issues with proscribing the group ‘became apparent as soon as the police began putting it into practice’

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

-

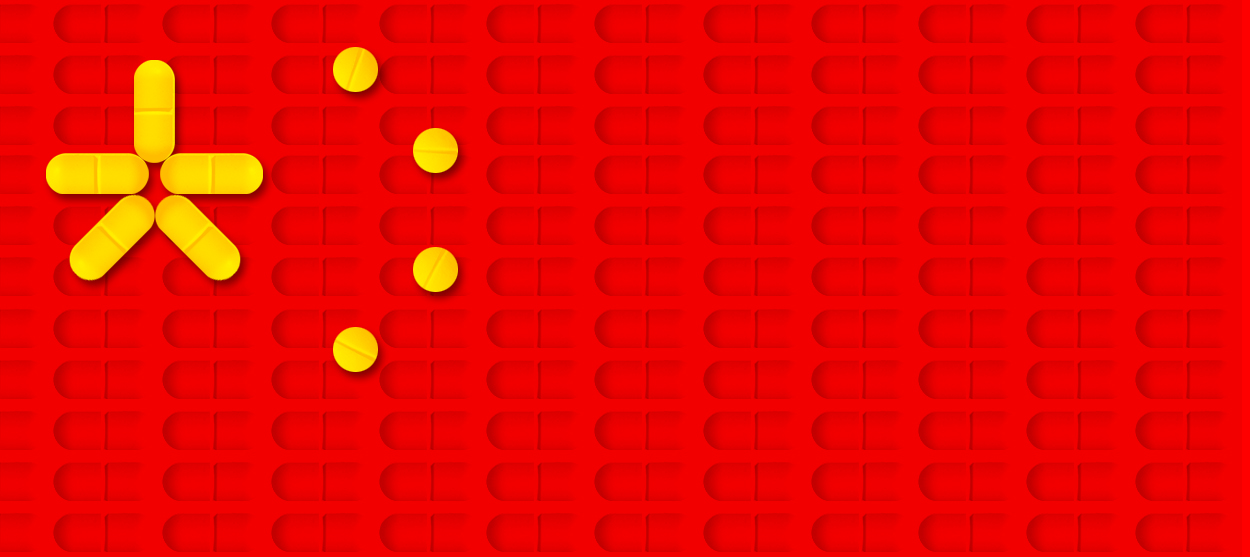

America could run low on medicine at the worst possible time

America could run low on medicine at the worst possible timeThe Explainer Another coronavirus lesson: Don't offshore all your basic drug manufacturing