Trump's dangerous economic gambles

How the CEO president became bad for business

President Nixon famously observed that the U.S. economy was so strong "it would take a genius" to wreck it. But maybe that's not quite right. Maybe it only takes an American president who thinks he's a genius — or to be more specific, "a very stable genius." At the very least, it might take only a reckless American president who is willing to take tremendous risks with little potential upside based on either misinformation or raw emotion.

And that seems to be what America has right now with Donald Trump. The president could be spending 2018 building on his 2017 tax cuts and his deregulation efforts. Investors seemed to really like all that traditional Republican "pro-growth" stuff. Stocks rose 20 percent last year, and it's reasonable to assume enthusiasm for Trumponomics 1.0 played some role.

But now we're getting the more populist Trumponomics 2.0, and it's no upgrade. Trump has decided to launch a clumsy trade war with China and start a Twitter fight with Amazon, one of America's most successful and popular companies. Investors haven't liked this version of Trumponomics at all. Stocks are off about 7 percent since Trump in late January announced steep tariffs on imported washing machines and solar panels. And the Amazon attacks have fed into a declining tech sector where investors were already spooked by Facebook's recent troubles over data privacy.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

It is hard to fully explain the level of self-sabotage happening right now in Washington thanks to Trump, all of which is being reflected in the market's current woes. Let's start with trade. Although Trump might think "trade wars are good, and easy to win," the historical evidence strongly suggests they are not. There's a reason why all the economists in a recent survey agreed that Trump's February plan for sweeping steel and aluminum tariffs would make most Americans worse off.

Now the U.S. and China are involved in a back-and-forth conflict that is playing out just as trade economists predicted. Just hours after the Trump administration on Tuesday proposed a 25 percent tax on a variety of Chinese goods from the aerospace, machinery and medical industries, China retaliated with tariffs on U.S. products such as aircraft, automobiles, and soybeans. If fully implemented, noted Capital Economics, the effect would "be a tax on U.S. consumers, offsetting some of the boost to real disposable incomes from the income tax cuts." The market reacted by plummeting almost 2 percent at Wednesday's opening bell, before recovering on the assumption that the White House might not follow through on its threats.

But it really could get worse. Trump is fixated on slashing the U.S. trade deficit with China, which is highly unlikely to happen. If Trump doesn't back down, and his tweets give no indication that he will, the conflict will escalate. Remember, all this is happening because Trump can't or won't understand that America's chronic trade deficits stem from America's macroeconomic decisions not to save much of our money, not from dumb trade deals. Better if the administration kept its focus and actions narrowly targeted on more legitimate trade issues, such as Chinese theft of American intellectual property and the companies that benefit from it.

But focus isn't a Trump strong point, which is why the president has again started attacking online retailing giant Amazon for supposedly ripping off the U.S. Postal Service, which delivers some Amazon packages. Of course no one believes Trump has suddenly transformed into America's biggest postal service advocate since Ben Franklin. Trump is attacking Amazon because Amazon boss Jeff Bezos owns The Washington Post, which Trump views as anti-Trump.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

So because of his personal animus toward Bezos, the American president is attacking one of America's great tech firms — one with 500,00 employees and plus-60 percent approval rating — and one of America's great entrepreneurs. This is cronyist, third-world stuff where business needs to curry favor with authoritarian politicians or face the punitive consequences. And given that a growing share of Republicans see left-leaning Silicon Valley as a culture war enemy, it's not hard to imagine Trump eventually turning his Twitter account against Apple or Facebook or Google. But Trump's vendetta-based politics isn't bad just for U.S. business, it also undermines one of the central pillars of America's democratic capitalist system: rule of law.

The stock market isn't the economy. But politicians ignore it at their own peril. When stocks went nowhere in the 1970s, it was a powerful vote of no confidence in American economic policy and the volatile, stagflationary economy. Likewise, soaring stocks in the 1980s and 1990s symbolized a resurgent America. Trump probably grasps all that at some level. Since becoming president, he has argued that the ever-rising Dow was telling the truth about Trumponomics — even if the Fake News mainstream media refused to.

But what truth has Mr. Market been telling us in recent months? Maybe it's that Trumponomics has veered wildly off course. Maybe Trump should start listening.

James Pethokoukis is the DeWitt Wallace Fellow at the American Enterprise Institute where he runs the AEIdeas blog. He has also written for The New York Times, National Review, Commentary, The Weekly Standard, and other places.

-

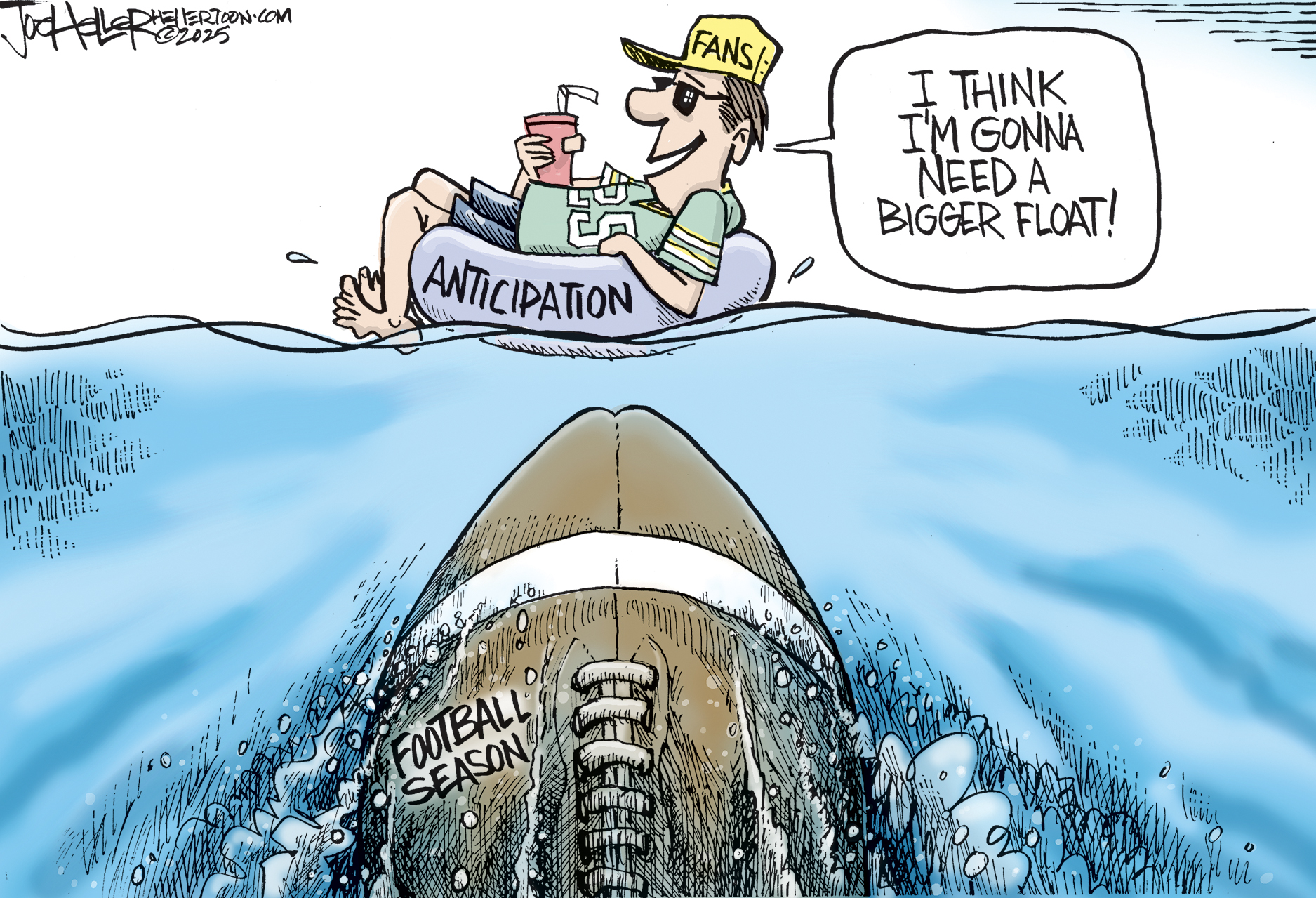

August 16 editorial cartoons

August 16 editorial cartoonsCartoons Saturday’s political cartoons include football season anticipation, and Donald Trump angling for Putin's autograph

-

5 hilariously cold cartoons about the Alaska summit

5 hilariously cold cartoons about the Alaska summitCartoons Artists take on the Alaskan totem pole, a peace flag, and more

-

Sudoku medium: August 16, 2025

Sudoku medium: August 16, 2025The Week's daily medium sudoku puzzle