Scotch whisky heads east

Asian markets are thirsty for collectable whiskies

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

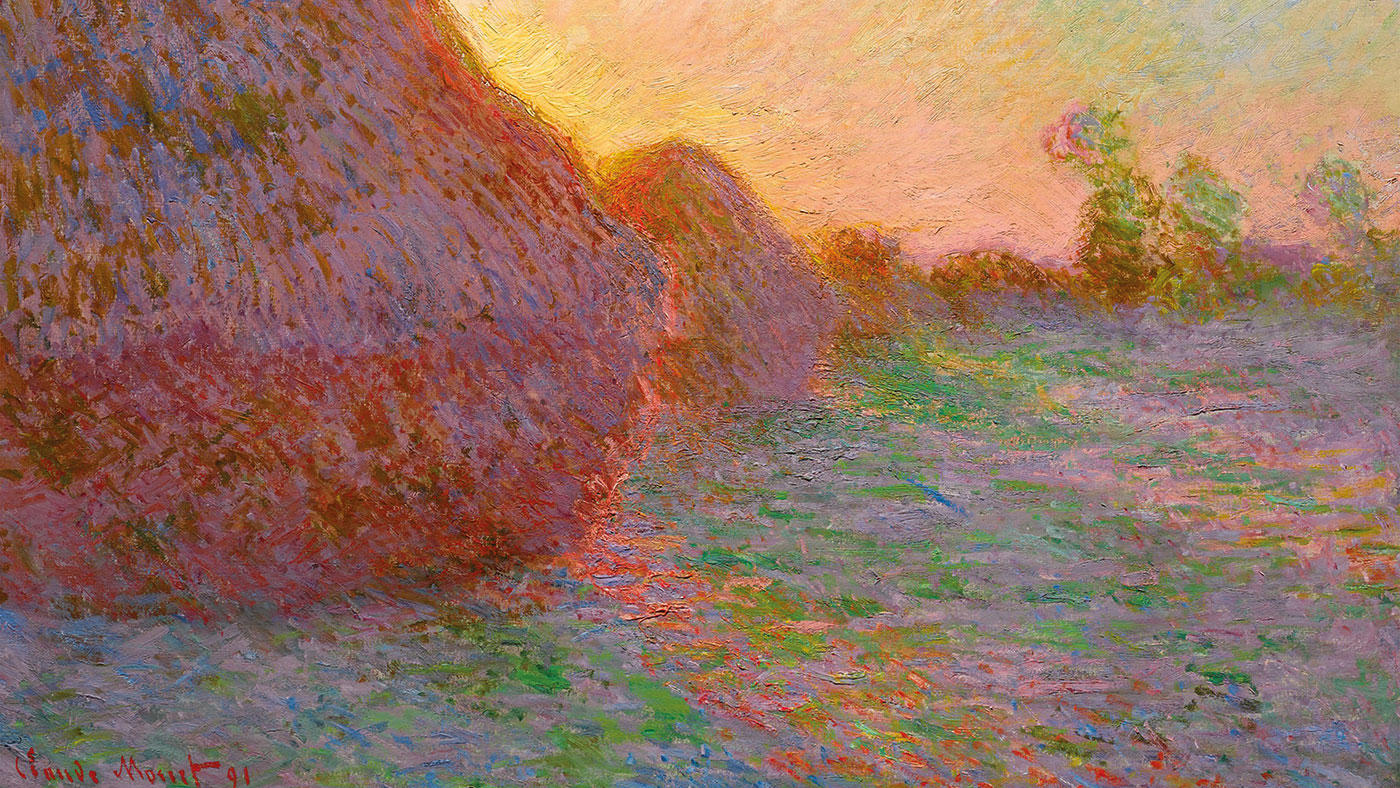

It’s been another good year overall for collectables, or “objects of desire” as Knight Frank rather theatrically terms them. The estate agency’s Luxury Investment Index (KFLII) rose by 9% in 2018, and by 161% over the last ten years. Broken down by type of collectable, coins did well over the last 12 months, rising by 12%; wine and art were both up by 9%; and watches added 5% to their overall value. Classic cars gained just 2%, which is perhaps a sign that the market is cooling off, given its strong performance over the past decade, having risen by 258%. Still, most car marques continued to rise in value.

The biggest faller, however, was Porsche, which lost 6.5% in 2018, as measured by the Hagi Index of 50 models from 19 marques. Among the other categories of collectables tracked in Knight Frank’s The Wealth Report, furniture, coloured diamonds and stamps either rose slightly or were flat. Jewellery fell by 5%, despite a diamond and pearl pendant that belonged to Marie Antoinette selling for 36.4m Swiss francs (£28m) in Geneva last November.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

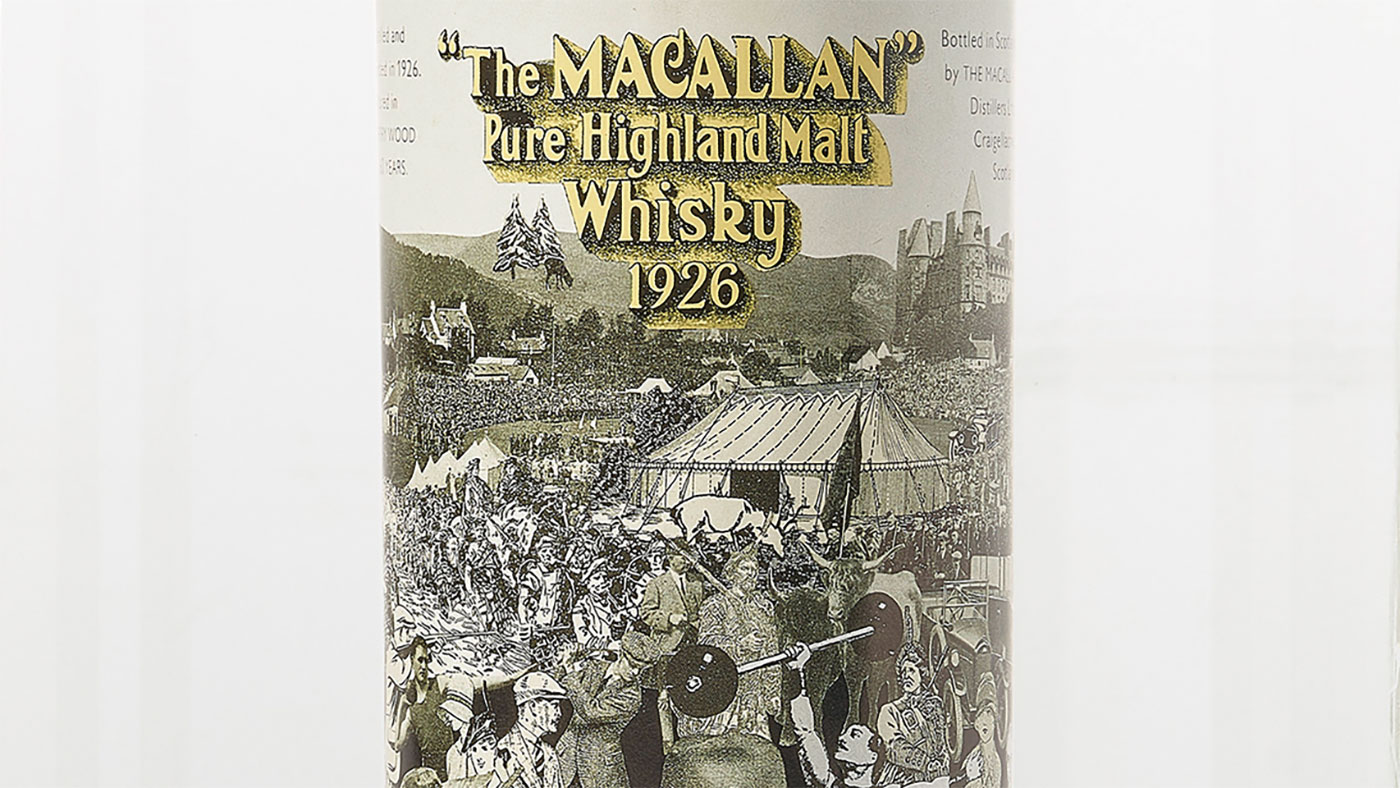

At the other end of the spectrum, the biggest riser in 2018 by far was rare Scotch whisky. Considering that the Knight Frank Rare Whisky 100 Index, compiled by consultancy Rare Whisky 101, puts whisky’s rise over the last ten years at 582%, it’s a little surprising that it’s taken until now for the annual report to include it. Then again, the rare whisky market never ceases to amaze. When a Dubai-airport retailer sold two bottles of rare 1926 Macallan whisky for $600,000 each last April, it made headlines. It wasn’t, after all, your typical carry-on duty free.

Then the stakes were raised again the following month. Two bottles of the same whisky breached the million-dollar mark – a first for any whisky – at Bonhams in Hong Kong. The bottles with different labels by artists Peter Blake and Valerio Adami had each been given estimates of around half that figure. Yet earlier this month in Edinburgh, Bonhams sold another Peter Blake 1926 Macallan (pictured, above) for a still impressive £615,063 ($808,721).

The point is that, as with any collectable, prices will always be volatile, and whisky is no different. Collectables are rare or unique – that’s what makes them collectable. But it also means sellers can be at the mercy of the whim of the market on any given day.

That high-water mark for a bottle of whisky set last year in Hong Kong – HK$8.6m ($1.1m) – also tells us something else: if you want to fetch the highest price for your whisky, head to Asia. Sales of Scotch whisky to India, China and Singapore rose by 44%, 35% and 24% in the first half of 2018, according to the Scotch Whisky Association.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Increasingly, that market is going straight to the source, notes The Wealth Report. Whisky tourism was apparently one of the main drivers behind the launch of a new non-stop flight from Edinburgh to Beijing last year.

Tips for how to bid at auction

Auctions can be a great place to snap up bargains. But for the uninitiated, it’s easy to be intimidated. There’s no reason to be, Luke Macdonald, a director at Cheffins auction house in Cambridge, tells Victoria Brzezinski in The Times. “Many people imagine that auctions are full of oil paintings with enormous reserves and are solely the mainstay of serious collectors or dealers. This is definitely not the case.”

And if you’re worried about accidentally buying something, because you scratched your nose, that’s a myth. “As auctioneers we are looking for your bidding number and someone who is really bidding,” says Macdonald. Besides, attending an auction is a fun thing to do on a weekend, and the events themselves are broadening their appeal, says Benedict Winter, a Christie’s specialist.

Items often appear on auction house websites at least two weeks before a sale, allowing you to peruse lots, and Barnebys is a useful online auction aggregator. Specialists are also on hand to answer questions.

“We often find ourselves caught up in the romance of picking an engagement ring or a present for a loved one,” says auctioneer Alexandra Whittaker of Fellows. “The specialists can even advise how to repair and remodel, if necessary, as they have seen it all before.” Lastly, decide on your budget before you start bidding, and don’t forget to factor in the buyers’ premium, which varies, and VAT.

This article was originally published in MoneyWeek

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

The rise of the lost luggage auction

The rise of the lost luggage auctionIn the Spotlight Lost luggage hauls are attracting millions of views online

-

Most US adults ‘have been visited by dead relative’

Most US adults ‘have been visited by dead relative’feature And other stories from the stranger side of life

-

Collectables: the market in Tintin artwork takes off

Collectables: the market in Tintin artwork takes offThe Week Recommends Tintin, the Belgian boy-reporter cum adventurer, is in demand once again

-

The art world goes online with virtual auctions

The art world goes online with virtual auctionsSpeed Read The pandemic has presented new challenges for auction houses

-

The art market endures after a jittery 2019

The art market endures after a jittery 2019Speed Read Wealthy Americans step up to help calm the art market’s jitters

-

Auctions: what you should know before you go

Auctions: what you should know before you goIn Depth Auctions showcase items ranging from classic cars and comic books to jewellery and toys.

-

The world’s most beautiful book set for $8m sale

The world’s most beautiful book set for $8m saleSpeed Read John James Audubon’s stunning The Birds of America is up for auction.

-

Auction news: a booming trade in Asian art

Auction news: a booming trade in Asian artIn Depth Japanese porcelain, Indian diamonds and a 16th century portrait with an intriguing history