A brief history of unicorns

The question of 'unicorns' – tech start-ups worth at least a billion dollars – is concentrating minds in the business world

In the second dispatch examining the human stories behind the business and financial trends shaping America, this article focuses on the new breed of tech giants currently commanding eye-watering valuations. Will it all end in tears again?

The Year of the Unicorn

According to a recent report in The Wall Street Journal, the must-have toy, game or accessory for American children right now is anything to do with unicorns. It’s strange how play reflects real life. The question of "unicorns" – the tag given to private tech start-ups worth at least a billion dollars – is currently concentrating minds in the business world.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Less than two years ago, when the moniker was coined, unicorns were thought so rare that they bore comparison with the mystical beast of legend. Now, they’re positively stampeding. At the start of the year, around 80 companies qualified for the tag. By June, 22 more had joined the ranks in the US, with new unicorns appearing at a rate of one a week, and numbers growing in Europe. Meanwhile, new mutations abound. There are now "decacorns" (those deemed to be worth $10 billion or more) and "super-unicorns" (potentially worth over $100 billion).

Unsurprisingly, this development is ringing alarm bells, particularly among those old enough to remember the dotcom burst of 2000. Indeed, as one critic notes, the "fantastical" nature of unicorn terminology is particularly apt given the rocketing valuations and the fact that the actual cashflow streams of many of these outfits "exists only in the imagination".

In March, Bill Gurley, the prominent investor behind Uber and Snapchat, observed that he was concerned by the "complete absence of fear" in Silicon Valley. More people are employed by money-losing companies in the Valley than ever before, he told Fortune. We should steel ourselves for "some dead unicorns this year".

This time it’s different…

More bullish commentators insist that "this time it’s different" – a phrase memorably summed up by the legendary financier, Sir John Templeton, as "the four most dangerous words in investing". Yet, there are certainly some important differences between the tech boom of the late 1990s and the conditions in play today. For one thing, many of the start-ups currently being backed so munificently have actual customers and revenues – two factors that were glaringly absent in the old dotcom days.

Moreover, unicorn poster companies, such as Uber and Airbnb, have demonstrated how effectively firms majoring on technological advance can disrupt existing markets. Groundbreaking technological developments – from the universal adoption of the smartphone, through the arrival of cloud computing, to the rapid fusion of tech and life sciences – have changed the game completely. While many dotcom business models were based on little more than theory and hope, the current crop of unicorns are riding an extraordinary wave of innovation across multiple sectors, creating services and applications that have either already taken off or are on the verge of doing so.

Where are the Moms and Pops?

The other vital difference lies in the way that today’s unicorns raise investment money. During the heady days of the dotcom era, the main vehicle for raising cash was a stock-market listing – the IPO became a sort of rite of passage. This time around, however, the action is all in the private domain, with venture capitalist firms jostling to secure their stakes in the most promising players. Hedge funds, private equity firms and sovereign wealth funds have also joined the rush. The fact that traditional money managers, such as Fidelity Investments, have been piling in too is seen by some as a major vote of confidence in the permanency of the unicorn phenomenon.

For ordinary investors, the famous "Moms and Pops" whose investments fuelled the dotcom boom, this might be a mixed blessing. On the one hand, the dearth of IPOs means that they’ve missed out on some of the extraordinary paper gains made in the past couple of years as valuations have shot higher. On the other, if we are indeed in a new tech bubble, they’ll be spared the painful fallout from any eventual crash.

The big risk, of course, is that when the private backers of fast-growing tech start-ups start cashing in their chips by taking companies public, ordinary punters will pile in en masse at the top of the market, with potentially ruinous consequences.

A cupful of blessings?

Early-stage investing is always high risk, and the older this investment cycle grows, the greater these risks become. The conditions that helped create the unicorn boom – notably the flood of cheap money springing from low interest rates – could swiftly reverse as central banks in the US and Britain start tightening monetary policy.

Indeed, we may already be seeing the first tremors. In late July, billions were wiped off the valuations of established tech stars, including Apple, due to growing concerns over the health of the Chinese economy – a key consumer market. It wouldn’t take much for falling confidence in the established tech sector to seep into the highly speculative domain of the unicorns. The collective noun for a group of unicorns is apparently a "blessing". Time will tell how true that turns out to be.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

‘Television and film can help model these safety measures’

‘Television and film can help model these safety measures’Instant Opinion Opinion, comment and editorials of the day

-

LS Lowry: The Unheard Tapes – a ‘fascinating’ portrait of an artist and his times

LS Lowry: The Unheard Tapes – a ‘fascinating’ portrait of an artist and his timesThe Week Recommends The programme stands as an ‘epitaph’ to the ‘vanished North’ of ‘industrial Manchester obliterated by the slum clearances’

-

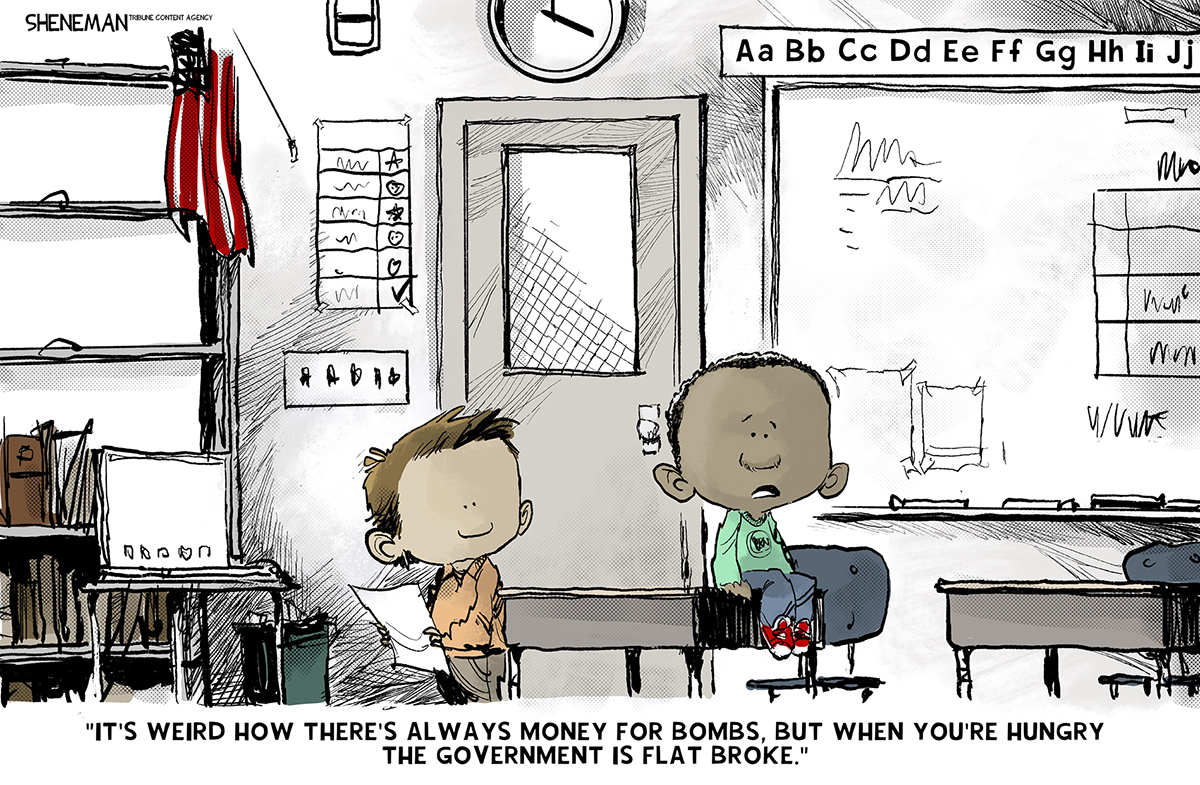

Political cartoons for March 5

Political cartoons for March 5Cartoons Thursday’s political cartoons include priorities, labyrinths, and more