How David Bowie changed the financial world

'Bowie bonds' were the first asset-backed security underpinned by intellectual property

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

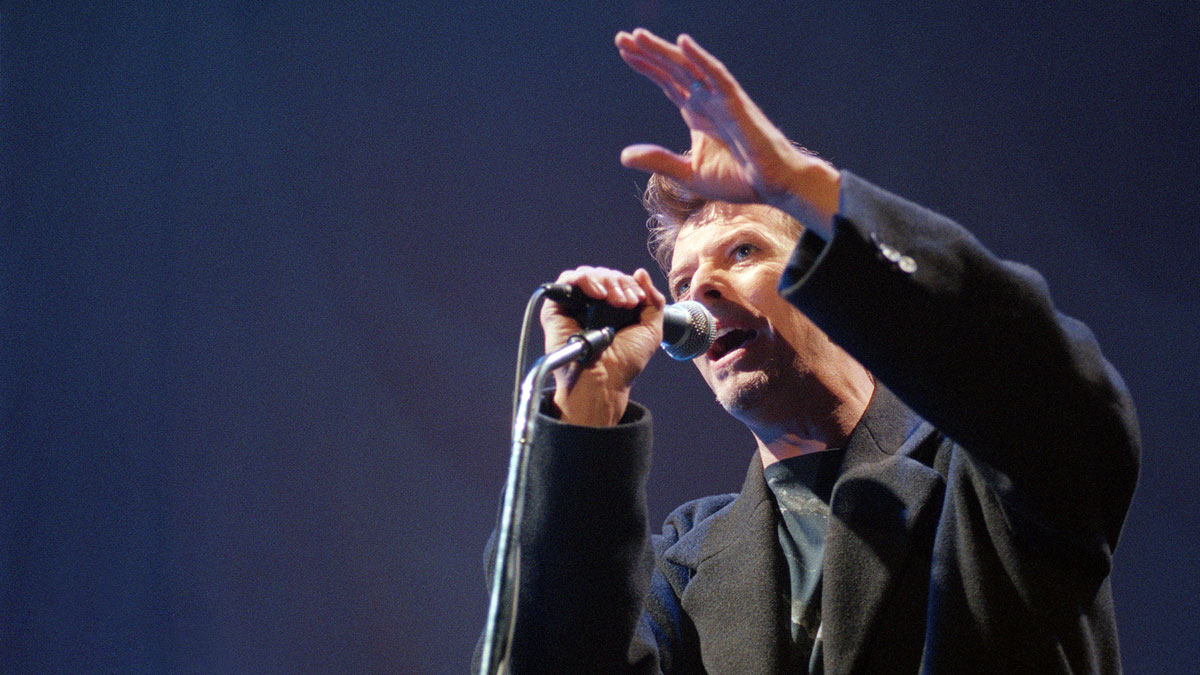

Much has been written about the wide-ranging influence of music legend David Bowie following the shock news of his death yesterday.

But alongside the artists telling how they were inspired by his musical, artistic and aesthetic innovations, the business pages also paid tribute to his legacy – the "Bowie bond".

Launched in 1997, the bond was a pioneering asset-backed security and the first to be backed by entertainment intellectual property.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

In simple terms, Bowie sold the rights to future revenues from the 25 studio albums he had recorded before 1990. Financial institution Prudential Financial paid $55m to secure the bonds, which paid a fixed return of 7.9 per cent each year, backed by royalties from the singer's back catalogue.

Some questioned why Bowie would want to sell the rights to sales of albums including The Rise and Fall of Ziggy Stardust and the Spiders from Mars, Aladdin Sane, Scary Monsters (and Super Creeps) and Let’s Dance.

"Rather than getting steady income from the revenues of his back catalogue... the bonds allowed Bowie to borrow more money up front," the Financial Times notes.

Alongside the cash boost, the BBC cites claims from music writer Paul Trynka that the singer used around half the proceeds to buy the 50 per cent of the rights to his legacy collection that he did not already own from his former manager, Tony DeFries.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The pioneering bonds opened the door to a whole new world of possibilities in the nascent asset-backed securities sector. David Pullman, the banker behind the deal, went on to similarly securitise the music rights to work by James Brown, Marvin Gaye and The Isley Brothers.

While the bonds are deemed to have performed well, they did eventually run out of steam in the early 2000s as the launch of online platforms offering music-streaming and downloads undermined album sales. In 2004, ratings agency Moody's downgraded the bonds to one notch above "junk" status.

Bowie himself predicted the huge shake-up the internet would bring to the business model for music artists and labels.

"The absolute transformation of everything that we ever thought about music will take place within ten years and nothing is going to be able to stop it," he told the New York Times in 2002. "I'm fully confident that copyright, for instance, will no longer exist in ten years and authorship and intellectual property is in for such a bashing."