FTSE 100 chiefs take a £1m pay cut

Investor revolts and public outcry brings average executive salary down to £4.5m

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Top bosses at Britain's largest listed companies saw their pay packets fall by nearly £1m last year, "following fierce pressure from investors and politicians", says the Financial Times.

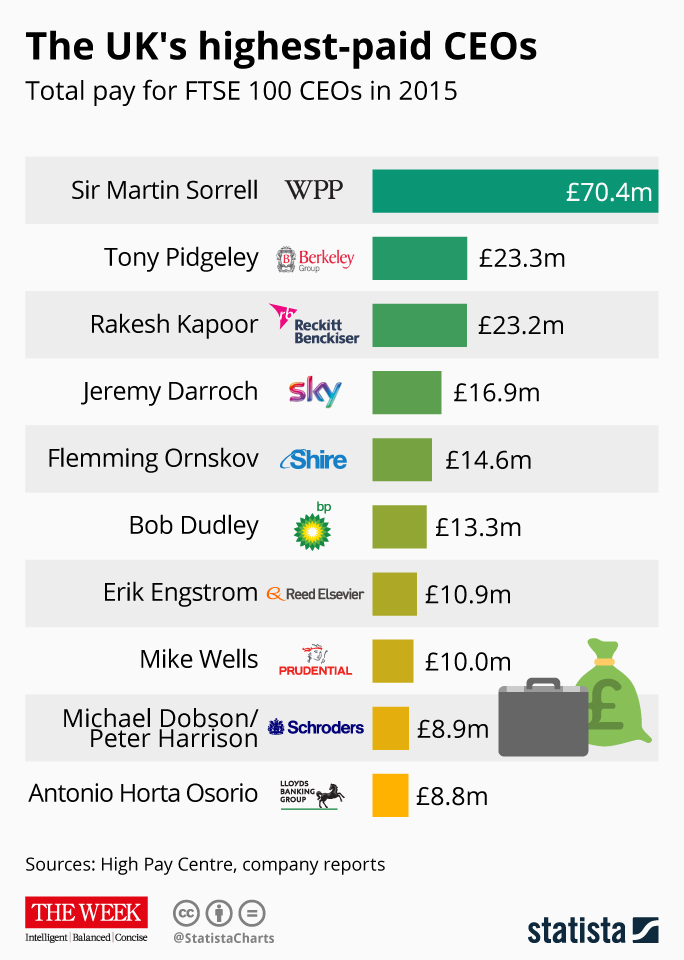

A series of investor revolts together with threats of political intervention and a public outcry has resulted in reductions in awards to a number of top bosses, including Sir Martin Sorrell, chief executive of advertising giant WPP, and Bod Dudley, his counterpart at oil major BP.

As a result, FTSE 100 chief executives were paid an average £4.5m in 2016, including variable remuneration in both cash and shares, according to the Chartered Institute of Personnel and Development and the High Pay Centre. That's a drop of 17 per cent from 2015, when they received £5.4m.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

However, Stefan Stern, of the High Pay Centre, warned the change was "so far a one-off" and a "limited and very late" response to hostile public opinion.

In May, fund manager Royal London said big public companies had been doing “the bare minimum to gain shareholder approval", although it "singled out BP for praise", says the FT.

Some of the fall is accounted for by big drops at individual companies: at Sky, Jeremy Darroch's pay went from £17m to £4.7m "because the company's long-term incentive plans... only vest in alternate years".

Union leaders at the GMB union said the figures "really bring home the scandalous gulf between rich and the rest", adding that the average UK worker on £28,213 would need to work for 159 years to earn the same as the average FTSE 100 boss does in 12 months.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Added to that, there is a yawning gender divide: Sorrell, the top paid male executive, had a salary of £48m last year, the same as the total pay for the five female chief executives in the FTSE 100 combined.

The government is expected to "publish its proposed responsible business reforms" next month, which could include measures to try to give shareholders more control over executive pay.

IoD demands investors get more say on executive pay

10 May

The Institute of Directors (IoD) has called for shareholders to have more power to reject long-term pay deals, calling for a change in the rules to force a rethink if three in ten investors reject a pay review, says the BBC.

At the moment, investors have a binding shareholder vote on listed companies' overall remuneration strategy every three years. If 51 per cent reject the policy, the company has to go back to the drawing board.

Retrospective votes against actual amounts paid do not have to be acted on immediately, although the overall plan must be brought back for vote the following year.

Under the IoD plans, companies would have to take action if 30 per cent of investors vote against the three-year pay deals. This will help bolster the power of independent shareholders in those firms that remain majority-controlled by their founders.

Executive pay has become a touchstone topic in recent years and sizeable rebellions have become a regular feature of annual general meetings.

The government has also promised to act to tackle excesses, although Theresa May stepped back from an earlier suggestion of forcing firms to have workers' represented on the boards.

MPs call for ban on long-term executive pay packages

05 April

Long-term shares-based pay packages for senior executives should be banned "as soon as possible", recommends the parliamentary business select committee.

Publishing a wide-ranging report aimed at modernising corporate governance rules, MPs warned that "recent scandals and the issue of executive pay have undermined public trust in corporate culture", says The Guardian.

"A worrying lack of trust in business by the general public has been fuelled by recent high-profile examples of bad practice, as well as pay levels being ratcheted up to levels so high it is impossible to see a credible link between remuneration and performance," the report says.

MPs highlighted the cases of Sports Direct, where conditions at its Shirebrook warehouse were compared to a "Victorian workhouse" and workers were routinely paid less than the minimum wage, and the collapse of BHS, which was blamed in large part on the hundreds of millions of pounds withdrawn from the business by directors including billionaire Sir Philip Green.

The committee also suggested that the government's threatened clampdown on corporate pay could include a ban on complex pay deals worth millions each year.

Other proposals to curb excessive pay could see worker representation on remuneration committees and the heads of these groups resigning if less than 75 per cent of shareholders back pay deals.

The report also recommended private companies be forced to sign up to a voluntary code similar to the one that applies to listed companies, an idea also put forward by the parliamentary pension committee.

Beyond pay, the MPs also make a series of suggestions to tackle under representation of women and ethnic minorities on boards, says the Financial Times.

Among these is a proposal for women to fill half of all executive appointments by 2020.

Executive pay has become a touchstone issue in recent months and a series of shareholder revolts have seen pay deals curbed for the likes of Bob Dudley, chief executive of BP, and his counterparts at Thomas Cook and tobacco company Imperial.

BlackRock hits out at executive pay

16 January

The world's largest fund manager is warning companies to stop giving bumper pay packets to their top executives.

BlackRock, "a major shareholder in almost every company listed on the FTSE 100 and FTSE 250", according to the BBC, said it will only approve wage increases for directors if workers' wages also rise.

It also threatened to vote against re-electing executives if its advice is ignored.

"Where we determine that executive pay is not aligned with the best long-term interests of shareholders, we will also consider this in our voting decision for remuneration committee members' re-election," it said in a letter to the bosses of more than 300 UK companies.

"Given the increasing political attention on the issue," says the BBC, some companies may heed BlackRock's call.

Prime Minister Theresa May signalled a clampdown on executive pay when she took office last summer, including hints that she would give shareholders greater power to reject executive pay deals with binding annual votes.

Since then, however, she appears to have scaled back on this and other suggestions, such as putting workers' representatives on boards.

Labour leader Jeremy Corbyn has also outlined plans to cap executive pay at a set level, or at a multiple of median employee earnings.

Chief executives of FTSE 100 firms now have a median pay package of £4.3m, 140 times that of the average worker, according to the High Pay Centre.

MPs launch inquiry into soaring executive pay

16 September

An influential panel of MPs has launched a wide-ranging inquiry into corporate governance that will focus on soaring executive pay.

The Business Innovation and Skills Committee will consider a number of issues relating to apparent corporate excess, including why the remuneration of top company bosses has soared over the past three decades.

It will also examine whether the government should establish formal powers to directly step in to control or curb executive pay awards.

Among its many tasks, the committee will scrutinise the appointment, role and oversight of company directors, as well as whether or not the same rigorous rules for public companies should be applied to their private counterparts.

Such issues are being examined as a result of the collapse of BHS and the poor working practices at Sports Direct. The committee will consider submissions until 26 October and could go on to call witnesses to appear in person.

The MPs' scrutiny comes in the wake of a letter that was sent to the chairs of all FTSE 350 companies by Legal and General Investment Management (LGIM), a major shareholder that is pushing for changes to executive pay policies.

Among a number of demands, Sky News notes that LGIM is calling for anyone who chairs a company's remuneration committee to have served at least one year on the board as a director. It is also calling for all listed firms to publish a ratio comparing the total pay of its chief executive to the median employee.

Companies are on the defensive over high pay awards – FTSE chief remuneration rose 10 per cent last year – after a string of investor revolts at firms like BP.

Businesses must also contend with a new Prime Minister who has set out a tough approach to corporate pay. Proposals will follow this autumn and are expected to include a demand for workers' representatives on boards.

Mike Fox, head of Sustainable Investments at Royal London Asset Management, welcomes the renewed focus on executive pay, but cautioned that there is a danger of delivering the "wrong answer to the right question".

"The recommendation of a 'pay ratio' is a crude measure that risks tarring well governed firms with the same brush as those with a flagrant disregard for what is acceptable," he says.

FTSE 100 bosses earn 144 times more than average UK worker

8 August

Theresa May's pledge to clamp down on excessive executive pay has been thrown into the spotlight by new figures showing FTSE 100 bosses' pay surged ten per cent last year.

According to figures published by campaign group the High Pay Centre, the chief executives of the top UK-listed companies took home an average of £5.5m in 2015.

The median salary of blue chip bosses was £4m - 144 times the £27,600 wage of the average UK worker, the BBC reports. Within these firms, it is 129 times the average employee's earnings.

May spoke out against the "irrational, unhealthy and growing gap" between the salaries of top bosses and average workers in her campaign to be Tory leader and prime minister last month.

She has set out a number of policy responses, including two particularly welcomed by High Pay Centre director Stefan Stern: appointing employee representatives on boards and forcing all large firms to publish data comparing the pay of bosses and workers.

Offering a contrasting view on Forbes, Tim Worstall criticises the "absurd, quite simply ridiculous" comparison between the pay of FTSE 100 chiefs and ordinary UK workers.

These companies, he says, are actually large multinationals merely listed in Britain and so "comparing anything about [their executive's pay] to the British economy or the pay within it is simply nonsensical".

He adds that shareholders "own these companies and what they pay their employees is rightly and properly a matter for them" – and them alone.

Perhaps, then, Worstall might be more in favour of May's policy suggestions that shareholders' votes on executive remuneration should be made legally binding.

This would have added real weight to the shareholder rebellion at BP this spring, where investors rejected a £14m pay deal for its chief Bob Dudley.

Similar revolts have been seen at the likes of Weir, Reckitt Benckiser, Shire and Standard Chartered, which has led the Executive Remuneration Working Group, which includes some of Britain's most high-profile bosses, to declare executive pay in the UK is "not fit for purpose".

Infographic by www.statista.com for TheWeek.co.uk.

Investment giant backs PM's executive pay clampdown

20 July

Prime Minister Theresa May's proposal to clamp down on executive pay has secured the backing of one of the City's biggest investors.

Dominic Rossi, the chief investment officer at Fidelity International, which manages £185bn on behalf of clients, will say today that outline plans to introduce an annual binding vote on pay would boost efforts to "align... rewards with shareholder interests".

Announcing her prospective programme for government last week before being unexpectedly installed in the top job without a leadership race, May said "big business needs to change" and that she wanted to foster an economy that works "for everyone".

Among the policies she sketched out were plans to give shareholders and workers a greater voice in large corporates, including having employee representatives on management boards and a binding annual shareholder vote on pay.

Under plans introduced by then business secretary Vince Cable in 2013, listed companies must already put their remuneration policy to a binding shareholder vote every three years.

Firms must also include an "implementation report" in their annual accounts setting out how actual pay relates to the approved policy, on which a shareholder vote is advisory. If it is lost, bosses can press on but must submit the wider policy to a new binding vote the following year.

Since these rules came into force, Fidelity has pushed for businesses to ensure long-term incentives within their remuneration policies last for at least five years. It has secured the backing of 48 of the top 100 listed companies.

Rossi will say today that while he is "delighted with the progress that has been made… there is still work to do" and that the new proposals will "add significant momentum", Sky News reports.

His is not the only major voice to support the plans. A group set up by lobbyists Investment Association could back an annual vote on pay in a report to be published next week.

The Financial Reporting Council watchdog has also said that excessive executive pay has eroded public confidence in big business, says The Guardian.

“Unfortunately, the continuing inconsistent alignment between executive remuneration and company performance, and between the remuneration of senior executives and employees, has led to a lack of public confidence," it states.

Business must address 'toxic' attitudes to executive pay

15 July

Businesses must do more to address "toxic" attitudes towards executive pay or face a government crackdown, according to a report by consultancy group PricewaterhouseCoopers.

Two-thirds of Britons polled said they believed executive pay was too high, with nearly three-quarters saying it made them angry if a chief executive was paid a lot while their company was doing badly.

PwC partner and report author Tom Gosling said increased regulation in this area "is best avoided" and that in order to avoid government intervention, "there needs to be a sea-change in attitudes and behaviour" within corporate culture.

On Tuesday, the Institute of Directors told the London Evening Standard the UK's biggest firms had been "asking for it" for years by ignoring public outrage over "grotesque" levels of corporate pay.

Discontent among large swaths of the working class population over inequality and related issues is seen as one of the key reasons for the vote for Brexit last month.

On Monday, Theresa May set out proposals to tackle boardroom excess, including "adding employee and consumer representatives to company boards and making shareholder votes on executive pay legally binding", says The Guardian.

"It is not anti-business to suggest that big business needs to change," May said during her speech setting out her campaign to lead the Tory Party. Just two days later she had the job - and that of prime minister.

May took the first bold action on business yesterday, by disbanding the current business and energy departments to create a new Department for Business, Energy and Industrial Strategy.

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

Bad Bunny’s Super Bowl: A win for unity

Bad Bunny’s Super Bowl: A win for unityFeature The global superstar's halftime show was a celebration for everyone to enjoy

-

Labour shortages: the ‘most urgent problem’ facing the UK economy right now

Labour shortages: the ‘most urgent problem’ facing the UK economy right nowSpeed Read Britain is currently in the grip of an ‘employment crisis’

-

Will the energy war hurt Europe more than Russia?

Will the energy war hurt Europe more than Russia?Speed Read European Commission proposes a total ban on Russian oil

-

Will Elon Musk manage to take over Twitter?

Will Elon Musk manage to take over Twitter?Speed Read The world’s richest man has launched a hostile takeover bid worth $43bn

-

Shoppers urged not to buy into dodgy Black Friday deals

Shoppers urged not to buy into dodgy Black Friday dealsSpeed Read Consumer watchdog says better prices can be had on most of the so-called bargain offers

-

Ryanair: readying for departure from London

Ryanair: readying for departure from LondonSpeed Read Plans to delist Ryanair from the London Stock Exchange could spell ‘another blow’ to the ‘dwindling’ London market

-

Out of fashion: Asos ‘curse’ has struck again

Out of fashion: Asos ‘curse’ has struck againSpeed Read Share price tumbles following the departure of CEO Nick Beighton

-

Universal Music’s blockbuster listing: don’t stop me now…

Universal Music’s blockbuster listing: don’t stop me now…Speed Read Investors are betting heavily that the ‘boom in music streaming’, which has transformed Universal’s fortunes, ‘still has a long way to go’

-

EasyJet/Wizz: battle for air supremacy

EasyJet/Wizz: battle for air supremacySpeed Read ‘Wizz’s cheeky takeover bid will have come as a blow to the corporate ego’