Old £10 notes: £2bn must be spent before March deadline

New polymer £10 will consign paper note to history at the end of the month

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

More than £2bn in old £10 notes is still to be spent or exchanged before they cease to be legal tender at the end of the month, the Bank of England has warned.

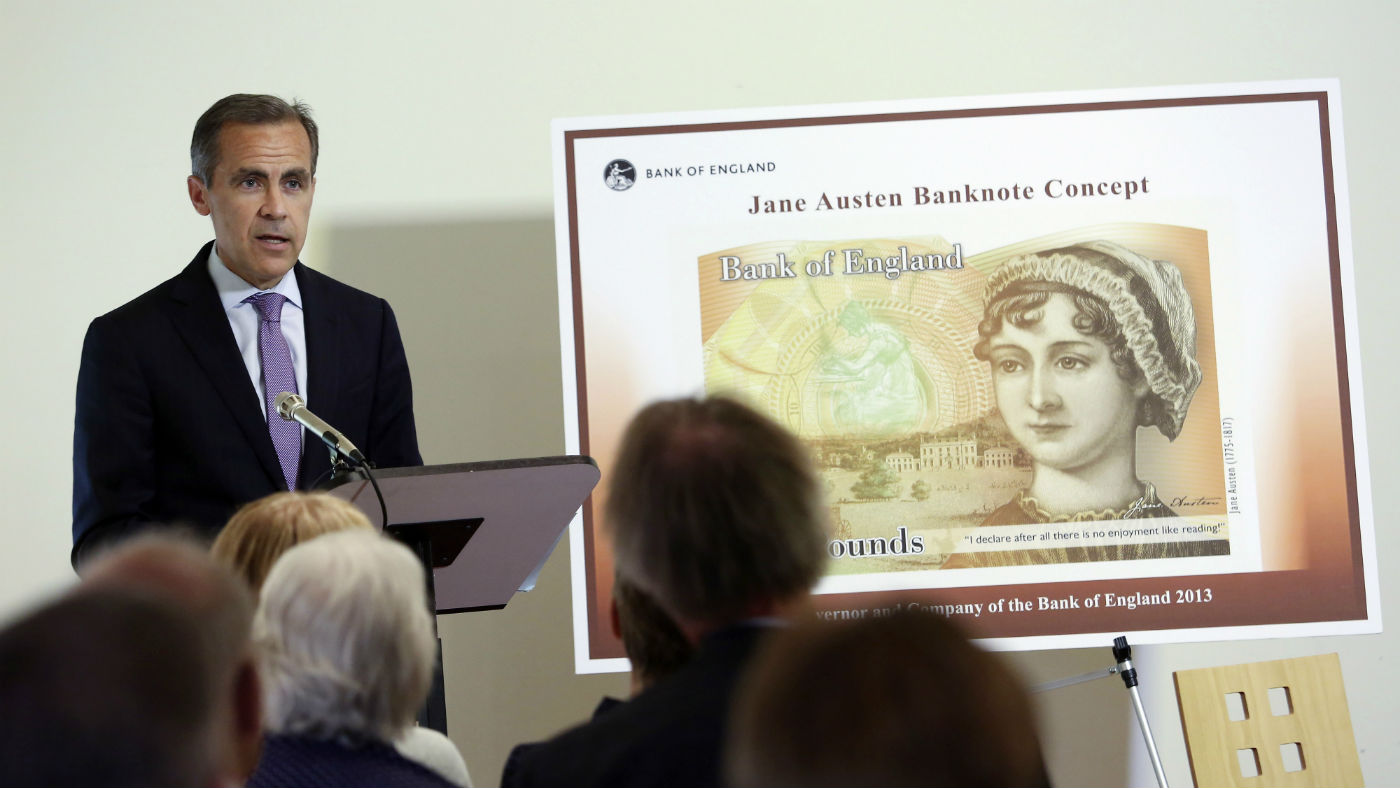

The Bank has been phasing out the old £10 note, featuring Charles Darwin, in favour of new polymer ones depicting Jane Austen.

The old notes cease to be legal tender on 1 March, leading to concern that people could be scrambling to spend or exchange them in time. The Bank says paper £10 notes have been exchanged at a rate of £85m a week.

Article continues belowThe Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

“The Bank does not expect all old £10 notes to be returned, because some will have been destroyed, gone overseas or kept as memorabilia,” says the BBC.

The new £10 is the second polymer note to enter circulation after the £5 note featuring Winston Churchill was introduced last year. It was not without controversy: the notes contained traces of animal fat, angering some vegans and religious groups.

The new notes are expected to last up to twice as long as the old ones, and to be harder to counterfeit.

According to research conducted by the Bank of England last year, old tenners were the least popular note with forgers, with just 0.0054% of all ten pound notes in circulation found to be fake.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com