Investing in the digital age: the rise of the machine-enhanced investor

As automation advances, new investment services are merging mind and machine in previously impossible ways

In 1997, IBM computer Deep Blue beat chess grandmaster Garry Kasparov. In 2016, Google’s artificial intelligence programme AlphaGo beat one of the world’s top players of Go, an ancient Chinese game of even more complexity than chess. Computers are now working on beating us at poker, arguably one of the most ‘human’ of all games.

Are we obsolete? It might feel like it. It’s small wonder that the papers are full of stories about how machines are going to replace us and take our jobs. In 2013, an influential study from University of Oxford warned that more than a third of all jobs in the UK were at high risk of automation within 20 years. And last year, the McKinsey Global Institute has argued that up to 20% of the global workforce will lose their jobs to robotic automation by 2030. Silicon Valley experts and others are lining up to warn us to prepare for mass unemployment and the social ills it could bring.

But what if this is an overly pessimistic view of the future? More recent work by University of Bonn researchers has found that, on balance, increased investment in automation led to employment rising, rather than falling. And a recent study by the OECD argues that the risks from automation are overblown - although aspects of our jobs can be automated, there are plenty that can’t. Instead, advances in automation will enable employees to focus on what humans are naturally suited to – social interaction, planning, and the like – while using machines to perform the tasks they can excel at.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Indeed, a similar process is happening in financial markets right now. Human beings are working with advanced algorithms to analyse and act on market data on an unprecedented scale and offset our own error-prone, emotional minds.

In the wake of his defeat in 1997, Kasparov coined the term “centaur”, to describe a human being teaming up with a supercomputer to play chess against a similarly equipped opponent. This, perhaps, more accurately describes the future - a world where machines and human beings co-operate to explore new territory and exploit new opportunities - just as has happened with huge technological advances in the past. This can be seen in the world of financial technology too, where companies such as Exo Investing are bringing together the best of human and machine to make the process of investing less effortful and give the investor more control.

One of the biggest challenges facing any investor is grappling with their own emotional selves. Again and again, despite continuous warnings, investors buy high when a share is doing well and panic-sell when it’s doing badly, thus crystallising their losses. This is one place where machines have an edge: they can analyse immense datasets, test countless scenarios, and make unbiased, unemotional decisions based on information alone.

Financial institutions have been using computers to help make decisions in this way for 30 years, but the technology has not been available to the individual private investor - until now. Exo Investing, a new entrant to the financial technology world, aims to make the sophisticated analytical tools used by institutional investors available to the wider investing public.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

When you sign up with Exo Investing, you’ll get a personalised risk profile, taking into consideration your financial ambitions and limits - in other words, what you aim to achieve and what you can afford to lose. Then, Exo’s algorithms will determine the optimal mix of assets each day according to your personal profile: your capacity for loss, your tolerance for volatility, and your long-term financial objectives. In other words, you're in control – you set up your portfolio to meet your own unique needs, and then Exo manages it in the most effective way.

The result is a responsive individual portfolio tailored to your specific needs and wants, watched over every day by a complex monitoring system that will, for example, start to shift you out of risky assets if markets become too volatile. This helps to ensure you have the optimal portfolio for your personal objectives at any point in time.

With a minimum investment of £10,000, Exo hopes to break down the barriers of bespoke wealth management, bringing individualised investing to the public.

And like Kasparov’s centaur, Exo is a marriage of human and machine. As the investor, you’ll still have a deciding hand in the construction of your portfolio. Not only will you be able to tell Exo what your goals are and how much risk you’re willing to take, but you can specify which business sectors, geographical regions and asset classes you want to prioritise. You can change your strategy at any time, at no extra trading cost - a significant perk, given how trading costs can add up on other more mainstream investment sites.

Automation has its benefits - namely it gives you more time to do the things you enjoy while taking the worry and unconscious bias out of trying to pick shares or funds yourself. In places such as personal investing where the customer still plays a defining role, machines have not yet replaced humans. Instead, as with Exo Investing, man's best friend is now a machine. A machine that empowers you to start your own revolution and invest like you've never done before.

When investing, your capital is at risk. The value of your investments can go down as well as up, so you could get back less than you invested.

For more, visit exoinvesting.com

© Exo Investing is a trading name of Finhub Technologies Ltd. which is authorised and regulated by the Financial Conduct Authority. (Financial Services Register number: 748161).

-

Where to go for the 2027 total solar eclipse

Where to go for the 2027 total solar eclipseThe Week Recommends Look to the skies in Egypt, Spain and Morocco

-

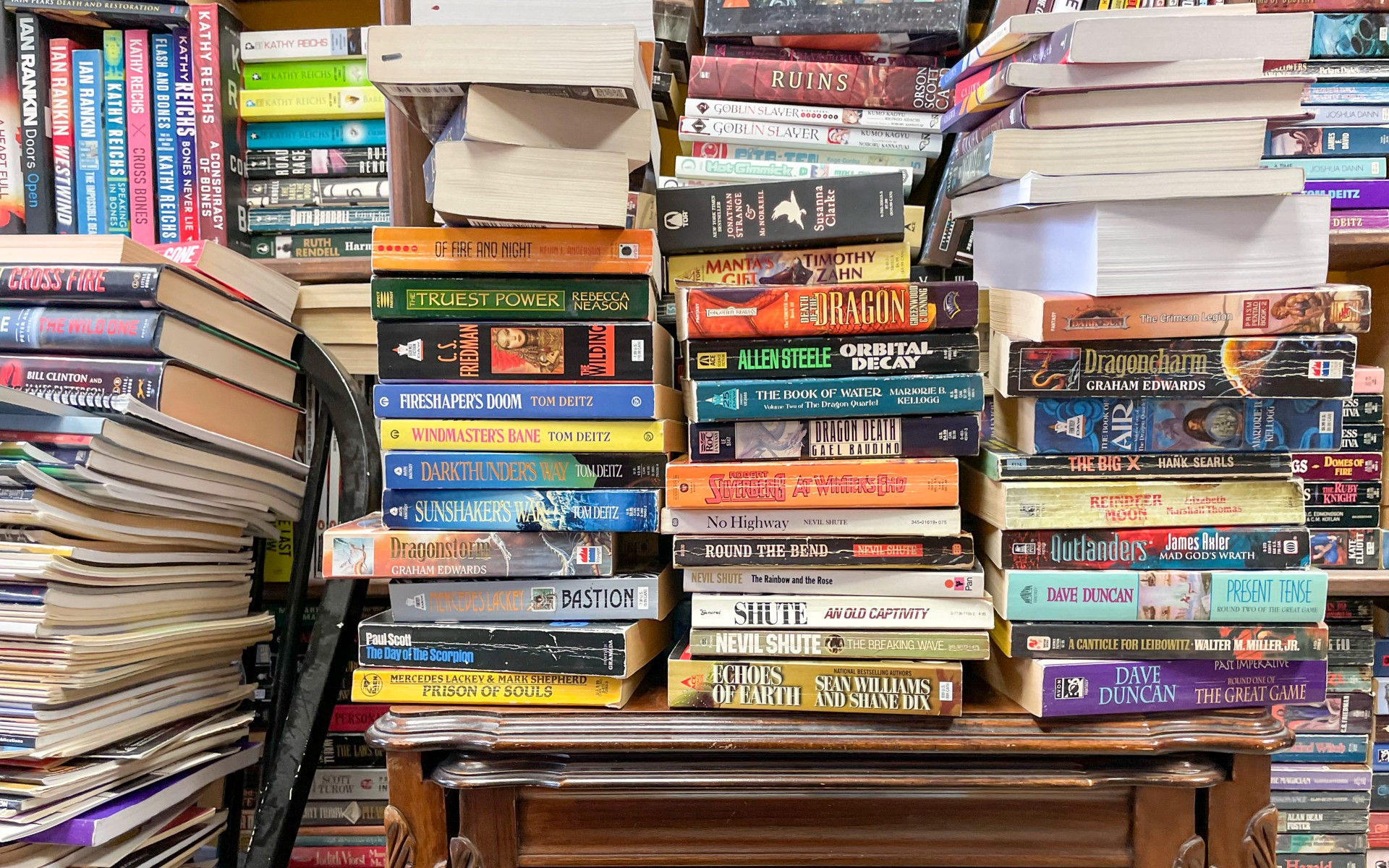

The end of mass-market paperbacks

The end of mass-market paperbacksUnder the Radar The diminutive cheap books are phasing out of existence

-

Political cartoons for February 22

Political cartoons for February 22Cartoons Sunday’s political cartoons include Black history month, bloodsuckers, and more