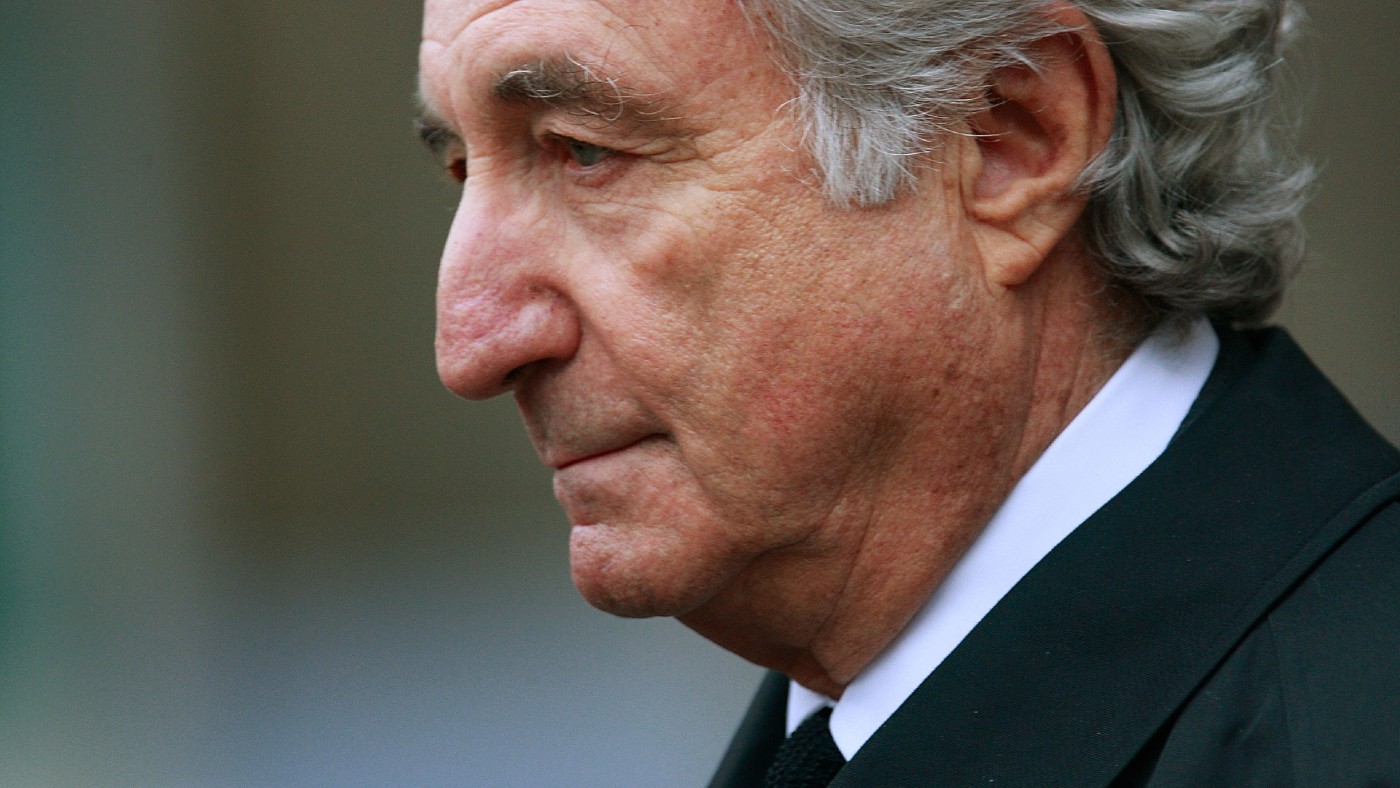

The legacy of Bernie Madoff

The Wall Street swindler orchestrated the largest financial fraud yet seen. Were lessons learned?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Bernie Madoff, “mastermind of the largest Ponzi scheme in history”, died last week, said Ben Hoyle in The Times. Madoff, 82, was serving a 150-year sentence for swindling thousands of well-heeled clients out of some $65bn in investments – having beguiled them with fictitious annual returns of 10% or more. A former chairman of the Nasdaq, he exuded authority. Among those ensnared were actors John Malkovich and Zsa Zsa Gabor, director Steven Spielberg and the Nobel Prize-winning Holocaust survivor Elie Wiesel, whose foundation lost $15m. “We thought he was God. We trusted everything in his hands,” Wiesel remarked. But Madoff fooled even the pros. Fund manager Nicola Horlick – the so-called City “superwoman” – invested £20m with Madoff, telling the FT just before his exposure in 2008: “he is very, very good at calling the US equity market”.

In reality, Madoff was simply funnelling money from new clients into the accounts of earlier investors and passing it off as “stunning returns”, said Laurence Arnold on Bloomberg. But unlike the infamous Charles Ponzi, whose 1920 scheme “soared and fell in the course of one year”, Madoff “kept his ruse going for at least 15 years, even under the gaze of regulators who visited his office to inspect his records”. The fraud eventually collapsed when plunging stock markets following the Lehman Brothers collapse prompted panicking clients to seek withdrawals. More than a decade on, efforts to recover Madoff’s “ill-gotten funds” continue on behalf of ruined victims, said The Wall Street Journal. “Legal efforts are expected to play out for years.”

Madoff was driven by wanting to beat the Wall Street “club”, said Virginia Heffernan in the LA Times – just like “the new hotshots in the market” who “were making a killing” as he “lay dying from kidney failure last week”. Seen from the perspective of Wall Street in 2021, the Madoff drama is “almost quaint”. His 10% returns would strike many of those who double and triple their money daily trading cryptocurrencies as “a pittance”. Madoff was proof of the old adage “if something is too good to be true, it usually is”, said Chris Blackhurst in The Independent. Yet virtually no one sought to question his stellar profits until the whole edifice collapsed. We’re seeing the same thing now with Greensill. Many Madoff investors were wealth managers investing “other people’s money” for fat management fees. Had it been their own, they might have conducted some due diligence. As for the regulators – nothing much has changed to bolster confidence in them. “Madoff may have gone, but the flaws he so vividly exposed remain.”

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com