G7’s ‘seismic’ tax deal: what will it mean for the world’s biggest companies?

Proposed minimum global level of corporate tax will target multinationals and tech giants

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The G7 group of wealthy nations struck a deal at the weekend that would create a global minimum corporate tax rate of at least 15% and make the world’s largest multinational companies pay more tax in each country they operate in.

Finance ministers met in London to discuss the tax reforms and the UK’s Chancellor of the Exchequer Rishi Sunak hailed the agreement as “seismic” and “truly historic”.

The deal announced between the US, UK, France, Germany, Canada, Italy, Japan and the EU could see “billions of dollars flow to governments to pay off debts incurred during the Covid crisis”, the BBC reports. And according to estimates from the Organisation for Economic Co-operation and Development (OECD) as much as $81bn (£57bn) in additional tax revenues each year would be raised under the reforms.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

“A process has begun, a precedent has been set,” says the BBC’s economic editor Faisal Islam. “It may or may not end up being transformative, but this moment is historic.”

What has been agreed?

Under pillar one of the agreement, the “largest and most profitable multinationals will be required to pay tax in the countries where they operate - and not just where they have their headquarters”, the G7 said in a statement. The rules would apply to global firms with at least a 10% profit margin - and would see 20% of any profit above the 10% margin reallocated and then subjected to tax in the countries they operate.

Under pillar two, the G7 also agreed to the principle of at least 15% global minimum corporation tax operated on a country by country basis, “creating a more level playing field for UK firms and cracking down on tax avoidance”. Corporation tax in the UK is already 19% and is set to rise to 25% by 2023 in response to spending during the pandemic, the BBC reports.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

OECD estimates that pillar one would generate between $5bn (£3.5bn) and $12bn (£8.4bn), while pillar two, the global minimum rate, would collect between $42bn (£29.6bn) and $70bn (£49.4bn). However, this assumed that a global minimum rate of 12.5% would be applied under pillar two, The Guardian says.

Which companies will be affected?

The world’s biggest companies will be forced to pay more tax in countries where they do business as well as where they are headquartered. The Biden administration suggests about 100 multinationals could fall under pillar one but it is not clear how many are caught by the London agreement.

Online tech giants such as Amazon, Google and Facebook will also be caught by the agreement and the EU Tax Observatory analysis indicates it would also catch companies such as oil giants BP, Shell, Iberdrola and Repsol, mining firm Anglo American, telecoms firm BT, and banks such as HSBC, Barclays and Santander.

What about Amazon and its cloud-computing business?

Amazon could evade the new rules because its profit margin in 2020 was only 6.3%, The Guardian says. This would be an “embarrassment for European negotiators seeking to extract more from big US tech companies”.

However, finance ministers are “plotting a raid” on Amazon’s cloud-computing business (Amazon Web Services) to ensure it pays more corporate tax under the new G7 deal, the FT reports.

The company appears to fall outside the 10% profit margin threshold set by the G7, but according to a source briefed on the discussions, the OECD is “exploring a special measure to treat Amazon’s cloud-computing division as a separate entity”. This measure would ensure that Amazon pays more tax in European countries such as France, Germany, the UK and Italy.

How have the big tech companies reacted?

The world’s biggest tech companies signaled approval to the G7 tax reform, Business Insider reports. An Amazon spokesperson said “we believe an OECD-led process that creates a multilateral solution will help bring stability to the international tax system” and the G7 agreement “marks a welcome step forward in the effort to achieve this goal”.

A Google spokesperson told Reuters that “we strongly support the work being done to update international tax rules” while in an email to Business Insider Facebook’s vice president for global affairs Nick Clegg said the company “has long called for reform of the global tax rules and we welcome the important progress made at the G7”.

‘Deal does not going far enough’

The G7 agreement has been described as “historic” but campaigners have criticised the group for not going far enough. Aid charities believe it is too low and would not stop tax havens from operating, the BBC reports.

“It’s absurd for the G7 to claim it is ‘overhauling’ a broken global tax system by setting up a global minimum corporate tax rate that is similar to the soft rates charged by tax havens like Ireland, Switzerland and Singapore,” said Gabriela Bucher, executive director of Oxfam. “They are setting the bar so low that companies can just step over it.”

What about tax avoidance?

The deal is “certainly transformational”, says Ronen Palan, professor of international politics at the City University of London. “The only thing I am not sure about is, transformation from what to what?”.

Writing on The Conversation, he added: “Is it going to transform a system of taxation that was designed early in the 20th century and is simply not fit for purpose in the 21st? Or is it going to transform the techniques of tax avoidance, and give rise to a whole new suite of tax avoidance schemes? My gut feeling is the latter.”

What happens next?

The “headline-grabbing” tax deal should be signed off at this week’s G7 meeting in Cornwall, the FT reports. And French economy minister Bruno Le Maire says it paves the way for a global accord at the G20 in Venice in July.

Much detail still needs to be ironed out but any final agreement could have “major repercussions for low-tax countries and tax havens”, Euronews says.

Singapore, a low-tax jurisdiction where several multinationals have regional headquarters, will change its tax system as needed “when a global consensus is reached”, Reuters reports. After the G7 agreed to back a minimum global corporate tax rate of at least 15%, experts said it could lead to a gradual phasing out of concessionary tax rates in Singapore - which has a rate of 17% but “provides incentives and schemes which reduce the effective rate”.

Finance Minister Lawrence Wong said in a Facebook post that the new rules “should not inadvertently weaken the incentives for businesses to invest and innovate. Otherwise, countries will all be worse off, fighting over our share of a shrinking revenue pie”.

Mike Starling is the former digital features editor at The Week. He started his career in 2001 in Gloucestershire as a sports reporter and sub-editor and has held various roles as a writer and editor at news, travel and B2B publications. He has spoken at a number of sports business conferences and also worked as a consultant creating sports travel content for tourism boards. International experience includes spells living and working in Dubai, UAE; Brisbane, Australia; and Beirut, Lebanon.

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

Bad Bunny’s Super Bowl: A win for unity

Bad Bunny’s Super Bowl: A win for unityFeature The global superstar's halftime show was a celebration for everyone to enjoy

-

How Britain’s inflation became the ‘worst in the G7’

How Britain’s inflation became the ‘worst in the G7’Talking Point UK feels pain of double-digit price rises for the first time since 1982

-

What is hepeating?

What is hepeating?In the Spotlight ‘Many women’ recognise this harmful workplace behaviour and various studies show evidence of it

-

The return of the World Economic Forum in Davos

The return of the World Economic Forum in DavosIn the Spotlight Does the annual gathering of the global business elite have any relevance, when globalisation is in swift retreat?

-

Cryptocurrencies: luna’s death spiral

Cryptocurrencies: luna’s death spiralIn the Spotlight A vicious crash has shaken confidence in the entire crypto ecosystem

-

Elon Musk’s Twitter takeover: trouble for Tesla?

Elon Musk’s Twitter takeover: trouble for Tesla?In the Spotlight It’s hard to find a solid business case for the billionaire’s buyout of the social media platform

-

Will Britain fall into a recession this summer?

Will Britain fall into a recession this summer?Today's Big Question Spiralling cost of living comes after the Russian invasion of Ukraine

-

Disney vs. conservatives: the latest chapter of the war on ‘woke’

Disney vs. conservatives: the latest chapter of the war on ‘woke’In the Spotlight No doubt company is becoming increasingly political, in a way that rankles with many people

-

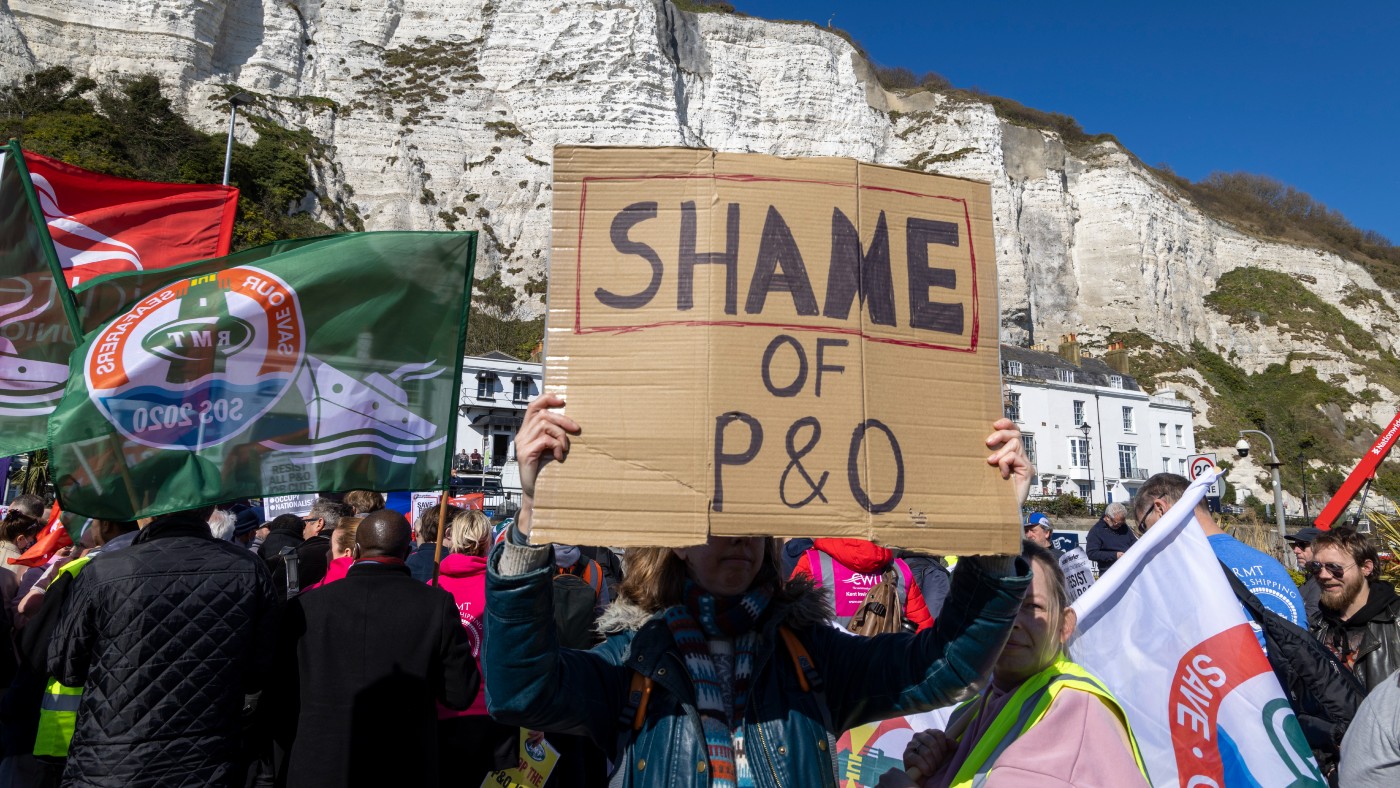

‘Rocking the boat’: the disgrace of P&O Ferries

‘Rocking the boat’: the disgrace of P&O FerriesIn the Spotlight Stern action is needed to counter companies who believe breaking the law is justifiable