How did Lululemon become a $10 billion yoga empire?

The popular apparel chain keeps posting profits, and competitors are wondering what goes into its "secret sauce"

Investors expected little from Lululemon when it began selling shares at $2 a pop in 2007. The maker of Wunder Under pants and other yoga women's wear hardly seemed like a player in the competitive world of retail sportswear. Five years later, Lululemon's stock has hit $76, and the company is valued at $10 billion — more than the clothing behemoth J.C. Penney. Last week, Lululemon posted a quarterly profit of $74 million, reported sales growth for the twelfth straight quarter, and, fittingly, opened a Boston store with a yoga class and dance party for 500 neon-clad guests. Here, a guide to Lululemon's "secret sauce":

How is Lululemon different from other retailers?

One key to its success is a "scarcity" model, in which its outlets keep only a limited supply of stock. Customers know that they have to buy an item right away if they want to get their hands on it, which "creates these fanatical shoppers," CEO Christine Day tells The Wall Street Journal. Lululemon also rarely offers sales, which means its customers buy everything at full price. Its yoga pants, for example, range from $75 to $128, while similar products can be found at the Gap at prices as low as $25.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Why do customers pony up for the more expensive stuff?

Call it the Apple model. Day's strategy is to continually refine Lululemon's core products, which results in clothes that are "aesthetically pleasing, functional — and pricier," says Marina Strauss at Canada's The Globe and Mail. Day has pledged to keep improving the features and fabrics of Lululemon's clothes, even though that will bump up costs. The investment pays off by inspiring "fierce loyalty, with bloggers breathlessly documenting every product launch," says Allison Martell at Reuters.

Are there flaws in Lululemon's strategy?

Yes. The scarcity model forces the company to "walk a very fine line," says Abram Brown at Forbes, and Lululemon "teetered off its edge" last year. While sales were strong, they could have been even better if the company had kept "enough in the stores to meet demand." Also, Lululemon's stock price, at around $75, is probably "overpriced," says Johanna Bennet at Barron's. The company's performance has been "incredible," but it can't keep up this "breakneck growth."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

So it's heading for a fall?

Not necessarily. The company is expanding its product line beyond yoga and women's wear. Overseas markets present a huge opportunity for further growth. And Lululemon has essentially established itself as the "Nike for women," which is invaluable, says Jim Cramer at The Street. People have doubted Lululemon before, and regretted it, says Bennet. "Last summer, we suggested avoiding the stock at $42.50…We were wrong — and how."

Sources: Barron's, The Boston Globe, Forbes, The Globe and Mail, Reuters, The Street, The Wall Street Journal

-

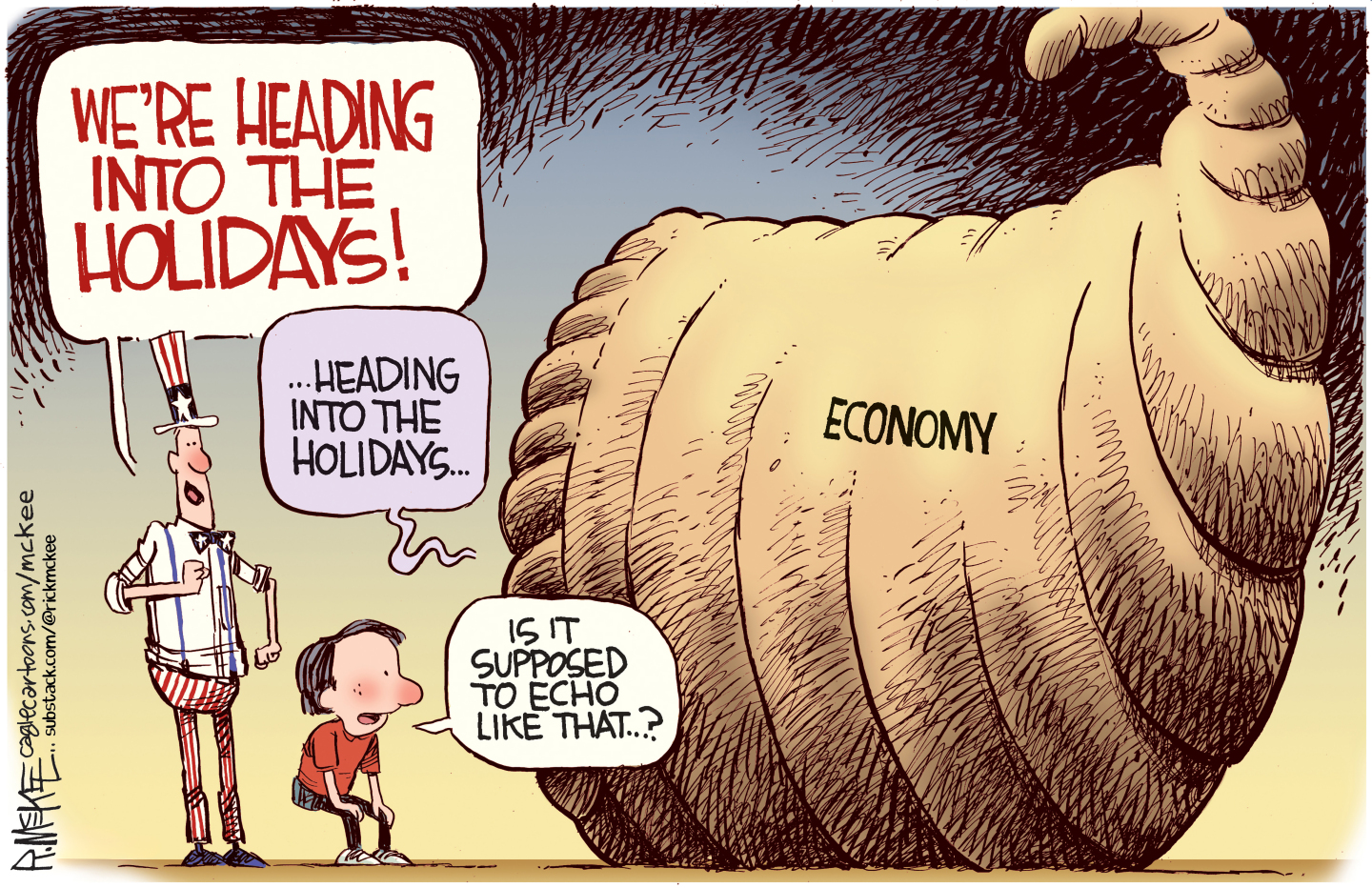

Political cartoons for November 23

Political cartoons for November 23Cartoons Sunday’s political cartoons include a Thanksgiving horn of plenty, the naughty list, and more

-

How will climate change affect the UK?

How will climate change affect the UK?The Explainer Met Office projections show the UK getting substantially warmer and wetter – with more extreme weather events

-

Crossword: November 23, 2025

Crossword: November 23, 2025The daily crossword from The Week