Are we seeing an Alibaba bubble?

The Chinese internet behemoth is now more valuable than Amazon and Facebook. Some say its good luck can't last.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Alibaba has officially conquered America.

Last week, the Chinese e-commerce giant launched the largest initial public offering in history, weighing in at a huge $25 billion after it exercised an option to sell an additional 15 percent more shares. That came in response to the stock soaring by 38 percent — from $68 per share to $93.89 at market's close — during its debut on the New York Stock Exchange on Friday.

The company now has a market capitalization of more than $230 billion, meaning it is more valuable than fellow tech giants eBay, Amazon, and even Facebook.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But as with any success story on the stock market, there has been a backlash. Many commentators are arguing that the Alibaba mega-IPO is just another tech bubble.

Eamonn Fingleton of Forbes urged investors to "just say no to Jack Ma's Alibubble." He adds, "Rarely have I seen anything as blatantly overpriced as Alibaba." Although Alibaba's market share in China is dominant, he argues, that is "the worst news of all. The fact is that there is only one way such numbers can go: down."

John Ficenec of The Telegraph was equally damning: "There are plenty of areas of concern over a valuation this high. The first is the clarity of where the profits are actually coming from. Alibaba Group founder Jack Ma has been on an acquisition binge during the past two years, buying up 29 companies for a total of $16bn. It is very difficult to split out which individual company in the group is responsible for profit generation."

He adds that "growth in China is slowing," and cautions investors to "avoid this Chinese bubble."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

However, there's plenty of evidence to suggest that Alibaba is the real deal.

As I noted back in May, Alibaba's platforms sold $248 billion worth of merchandise last year, outpacing the total global sales of Amazon and eBay combined. Furthermore, in each of the last seven years, Alibaba has grown at a more rapid pace than those two companies.

The Chinese love Alibaba's services. That $248 billion in sales equated to more than 11.3 billion orders. That's almost 10 orders for every person in China. And the majority of people in China don't even have internet access yet — just 42 percent were online at the end of 2013, compared to 81 percent in the U.S. That signals a massive growth potential.

As John Naughton notes in The Guardian, not every successful tech IPO is a Pets.com. And while there are far too many tech firms today attracting wheelbarrows of money without any revenues or profits (see: Snapchat), Alibaba is not one of them. Alibaba generated revenue of 40.5 billion yuan ($6.5 billion) in the last three quarters of 2013, making a net profit of $2.9 billion.

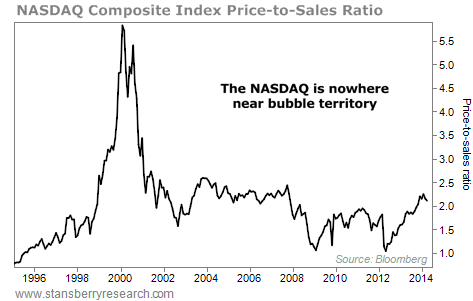

When you look at the bigger picture, tech stocks are in line with actual performance. The ratio of prices to revenues, as this graph shows, is not even close to the levels reached during the 2000 Nasdaq bubble.

(Bloomberg/ Stansberry Research)

While there are certainly some tech firms in bubble territory, the overvalued ones will be those without profits and revenues. That would not include Alibaba.

When it comes to Alibaba, you may want to believe the hype after all.

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.