Is this the first sign of rising inflation?

U.S. wages surged last month — but that's probably no reason to get carried away...

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

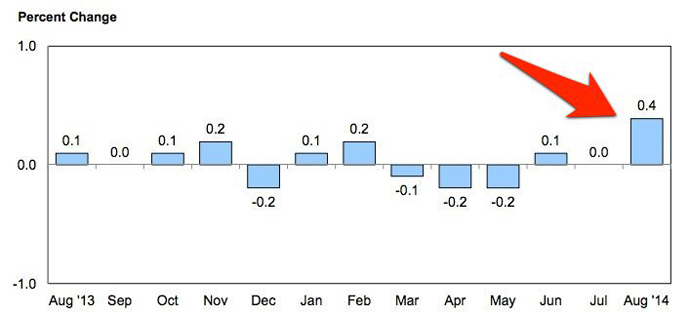

As Business Insider's Joe Weisenthal points out, August was a stellar month for wage growth. Month-on-month wage growth rocketed to 0.4 percent after being flat in July. It was by far the best showing in a year:

Why is this such a big deal? Well, wages are one of the key factors that the Federal Reserve is watching alongside the unemployment and underemployment rates as signifiers of labor market slack. Rising wages are a sign that employers are bidding up the price of labor, indicating that the supply of job seekers can't keep up with growing demand for their services. That's a healthy sign for the labor market.

With the unemployment rate falling to 6.1 percent — just 0.6 percent away from the 5.5 percent level that the Fed defines as full-employment — and the underemployed decreasing dramatically from the 17.2 percent peak it hit after the financial crisis to 12 percent, the only missing piece was wage growth. Now we have that too.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But there's a potential dark side to rising wages as well: the price/wage spiral where businesses hike prices to pay higher wages while employees demand higher wages to compensate for rising prices. In general, if wages rise too quickly, it's a signal to the Fed that the economy could be in danger of overheating, and that interest rate hikes may be necessary to prevent excessive inflation. So, is that what's happening here?

Not so fast. Even though wages climbed strongly, inflation actually fell last month due to falling energy prices and relatively stagnant prices in other consumer goods, like clothes and food. That's hardly what you'd expect to see if inflation was about to surge.

Plus one swallow does not make a summer. Fed chair Janet Yellen said yesterday that the labor market continues to make "gradual progress" towards the Fed's objectives. But she emphasized that it still hasn't recovered. Stronger wage growth is one more sign of gradual progress. She concluded by saying it would be a "considerable time" before the Fed began to hike rates. In other words, the Fed is still not buying talk of inflation quickly rising anytime soon. In fact, Yellen has been explicit about wage growth being something she would welcome after years of stagnant real wages.

Of course, that could all change if strong wage growth continues, and if strong wage growth starts to lead to rising inflation. As former Fed chair Ben Bernanke once put it, the Fed can hike rates in 15 minutes if need be. But that's a lot of "ifs."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

So rising wages should be taken as sign that the recovery is gradually strengthening. Inflation eventually beginning to pick up is part of that process. But we are by no means there yet.

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown