What the Fed haters don't get about interest rates

Interest rates aren't artificially low

Ever since the financial crisis, the U.S. Federal Reserve and other central banks around the world have kept rates far below their historical averages. U.K. interest rates remain at 0.5 percent, American interest rates are less than that, and even Spain, Ireland, and Italy can borrow for under 3 percent. Central banks lowered rates to spur economic activity, jobs, and growth — and with American unemployment down to 6.1 percent, there are signs that, at least in the U.S., it's working.

Yet, there is a growing backlash against low interest rates in influential circles.

Bankers and policymakers worry that central banks are inadvertently inflating bubbles. During her semi-annual testimony to Congress last week, Fed chair Janet Yellen fielded questions about economic bubbles from no less than four anxious senators on both sides of the aisle. She could only reply that she was keeping an eye on them.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

And bubble worries are global. The Bank for International Settlements (BIS), dubbed "the Swiss-based 'bank of central banks'" by The Telegraph's Szu Ping Chan, is telling the world that low interest rates and loose money are creating asset-price bubbles. Central bankers, critics around the world argue, should take away the proverbial punch bowl.

But here's the thing: Blaming central banks for these worries actually makes no sense.

Interest rates are an extremely powerful force. They are, in the simplest terms, the cost of money. Lower rates make investing cheaper, and thus more attractive. They also make saving less profitable. Higher rates do the opposite, increasing the desire to save and reducing the desire to invest. Higher rates force down the price of houses, bonds, and shares, while cuts make all assets more valuable. That is why the BIS fears low rates are creating worldwide asset bubbles. It is also why raising rates can quickly turn a bubble into a bust.

Ever since Alan Greenspan cut rates in 1987 in response to the stock market crash, central banks have been much more willing to cut rates than raise them. This "Greenspan Put" gave traders the impression that the central banks would bail them out with a rate cut, should asset prices fall too far. This implicit guarantee, the BIS argues, has distorted markets and forced asset prices to untenable levels.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

But when the BIS and others argue that central banks have set their policy rate too low, they make one massive, incorrect assumption: that rates are set below the natural rate at which the desires of savers and investors coincide. That just isn't the case: Even with rates barely above zero, we still have a glut of savings and a dearth of investment.

Rates are actually low today because the world's collective desire to save far outweighs its desire to invest. In part this is cyclical: With demand stagnant, firms have little reason to invest in productive capacity. Why build a new widget factory if you aren't selling all the widgets you already have in stock? In part it is due to the lack of safety net in much of the developing world. Chinese workers sensibly forgo current consumption in order to put away savings for the inevitable rainy day.

There is another, structural explanation. We all know that productivity gains have eliminated jobs. What low interest rates tell us is that productivity gains have also diminished the need for capital. Every year we can make more goods and services with fewer inputs of labor and capital.

When J.P. Morgan established U.S. Steel, he needed billions of dollars to build modern steel mills. When Mark Zuckerberg established Facebook, all he needed was a rented house and a few servers. Even steel mills today are far less expensive than they used to be. Ever since Nixon closed the Gold Window in 1971 the supply of money has exploded, constrained by nothing more that banks' willingness to lend. The money supply has shot up, while demand for it has not.

Low interest rates — no matter what the BIS, senators, and columnists at the Wall Street Journal tell you — are not pernicious. They are necessary to continue generating productive investment and jobs. That will remain the case for the foreseeable future, at least until inflation picks up significantly, and unemployment falls significantly further.

Attempt to raise them now and the economy tumbles back into recession. Rates aren't grazing zero because central banks have artificially set them low, but because most of us would rather save than invest. These days, capital is plentiful. Demand for it is not. That is why it is cheap.

Tom Streithorst has been a union member, entrepreneur, war cameraman, and journalist in London. He's currently working on a book on post-scarcity economics.

-

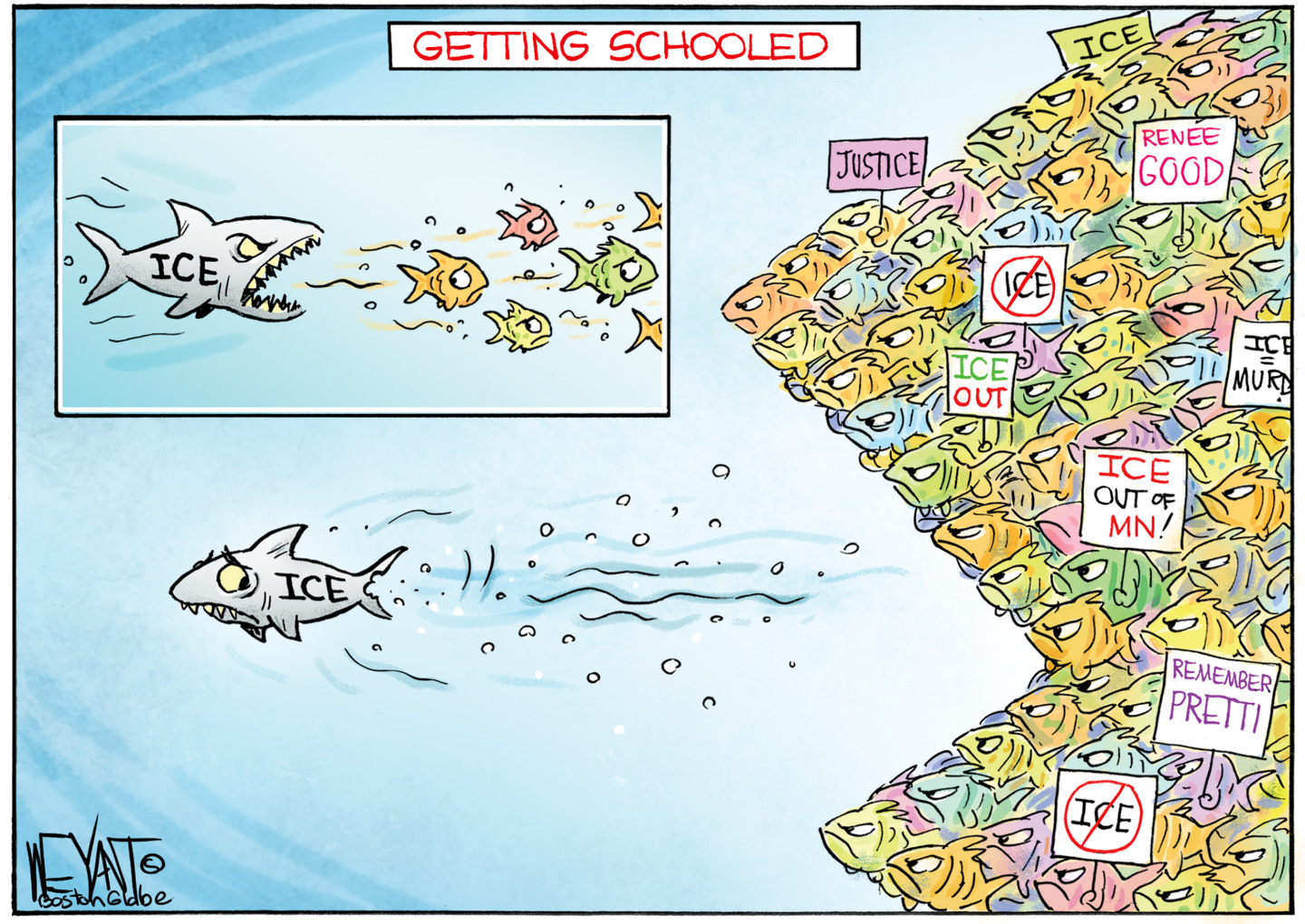

Political cartoons for February 2

Political cartoons for February 2Cartoons Monday’s political cartoons include ICE getting schooled, AI in control, and more

-

Democrats win House race, flip Texas Senate seat

Democrats win House race, flip Texas Senate seatSpeed Read Christian Menefee won the special election for an open House seat in the Houston area

-

New Epstein files dump strains denials of elites

New Epstein files dump strains denials of elitesSpeed Read Fallout from the files has mostly occurred outside the US