The Fed may soon end its loose monetary policy — for real this time

All the indicators are pointing toward a change. But it would be better for the Fed to overshoot its stimulus than undershoot.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

It has been a long six years since the financial crisis prompted the Federal Reserve to unleash a wave of emergency policies to prop up the economy. Now it finally looks like the central bank may soon begin raising interest rates and ending its quantitative easing program.

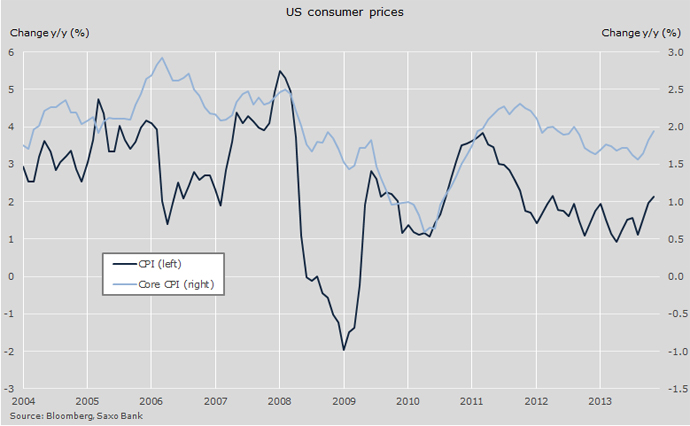

After a year of falling inflation, prices are now rising at the fastest rate since 2011, according to inflation data released this week. The core Consumer Price Index — which tracks the prices of all goods besides energy and food — is now rising at just below the Fed's target of 2 percent:

That's a pretty exciting development, because it means that the American economy is finally normalizing again after years of economic distress.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The unemployment rate is way down from the highs of 10 percent in the aftermath of the crisis. It is sitting at 6.3 percent, just 0.8 percentage points above the Fed's target rate. And underemployment — which includes workers who have given up looking for a job, and part-time workers who want a full-time job — has fallen significantly, too, to 12.2 percent, from 17.1 percent at its peak.

Stock markets have rebounded strongly, with both the Dow Jones Industrial Average and the S&P 500 making all-time highs in recent months. Housing prices have bottomed out, and are finally beginning to rise again. And credit markets, which totally froze in the wake of the financial crisis, are finally expanding again.

Rising inflation is really the icing on the cake, signaling that the U.S. may well have avoided the terrible kind of deflationary trap — in which falling prices discourage spending and investment, which only causes prices to fall more — that Japan has been stuck in since the early 1990s.

That means that, yes, the era of ultra-low interest rates and quantitative easing may well be coming to an end. The Fed, of course, has been tapering its quantitative easing programs now for six months, and is on course to finish that program by October. With such a gradual taper, the Fed has had the option (and still has the option) to step up the stimulus again if the economy falls back into recession, or if unemployment rises. But that hasn't happened, suggesting that quantitative easing will finish on schedule.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Still, the Fed must be wary of tightening too early. The last recession was especially deep, and the recovery has been especially slow. Given the huge dangers of falling back into a deflationary depression, it would be better to overshoot monetary stimulus — resulting in above-target inflation — than undershoot, a tendency that has plagued Japan, the euro zone, and Sweden. (Thanks to Shinzo Abe's Abenomics program, Japan seems to be finally emerging from its funk.)

Overshooting is not risky. The Fed has lots of strong tools that it can use to bring inflation down quickly if inflation does spike. It can perform "quantitative tightening," by selling assets it bought during the quantitative easing programs. It can rely on the old lever of raising interest rates. Or it can do both.

If inflation can stay at or near the 2 percent target, then holding interest rates at near zero at least into the first quarter of 2015 would seem prudent. This would give the economy time to confirm that it really has recovered.

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.

-

Political cartoons for February 20

Political cartoons for February 20Cartoons Friday’s political cartoons include just the ice, winter games, and more

-

Sepsis ‘breakthrough’: the world’s first targeted treatment?

Sepsis ‘breakthrough’: the world’s first targeted treatment?The Explainer New drug could reverse effects of sepsis, rather than trying to treat infection with antibiotics

-

James Van Der Beek obituary: fresh-faced Dawson’s Creek star

James Van Der Beek obituary: fresh-faced Dawson’s Creek starIn The Spotlight Van Der Beek fronted one of the most successful teen dramas of the 90s – but his Dawson fame proved a double-edged sword