The real problem with Thomas Piketty's grand theory of inequality

Chris Giles is poking holes in the French economist's book — but they're the wrong holes

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

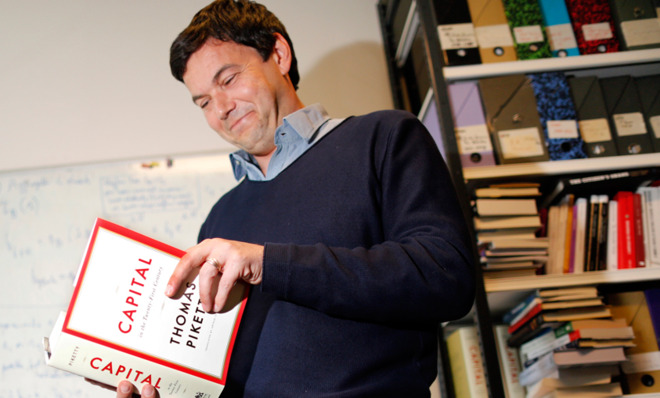

The Financial Times' Chris Giles' attack on Thomas Piketty's Capital in the 21st Century — in which he alleges that the French economist made serious methodological errors that undermine his conclusions about wealth inequality soaring to historically bad levels — has generated a fierce debate, particularly because so many liberals had celebrated Piketty's book to champion progressive economic policies. Piketty, for his part, says he was "ambushed" by Giles, and that the FT's criticism of his data is "dishonest".

What Giles pretty clearly did find is that the underlying data Piketty used for his book is rather muddy, with different studies showing varying levels of wealth inequality. The historical recordkeeping of wealth levels across various countries is rather shoddy. Giles also found that Piketty made a few minor errors and typos. He was absolutely right to bring these to light.

But all of this misses the forest for the trees. Whether you use Piketty's data on wealth inequality or Giles' "corrected" data, it is clear that in the last two centuries, wealth inequality in Europe has fallen significantly, and today is either flat (according to Giles) or slightly rising again (according to Piketty). In the U.S., wealth inequality is no worse than it was two centuries ago, although it has risen a little from where it was in the 1970s. The rise of capitalism — particularly compared to the feudal economy that existed before it in Europe — is not a story of rising inequality. It is a story of falling inequality.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

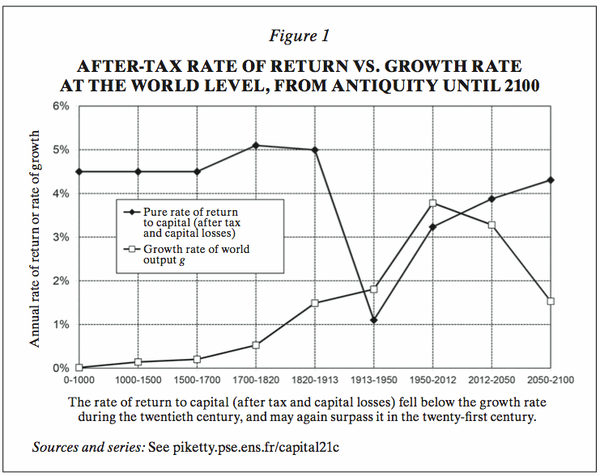

Piketty's main theory is that inequality grows or shrinks based on two key quantities: G, the level of economic growth in the entire economy, and r, the rate of return on capital in the economy. If G exceeds r, then inequality tends to shrink, as the growth in the wealth of capital holders is outpaced by growth in the economy at large. But if r exceeds G, then inequality tends to expand. Setting aside the difficulty in defining the rate of return on capital, Piketty's data hardly shows that the rise of capitalism is correlated with rising inequality:

[Thomas Piketty]

Now, Piketty claims that this falling inequality in the first half of the 20th century (when G > r), was associated with the two World Wars — where a heck of a lot of capital was destroyed, and thus the rate of return on capital was lower. I think Piketty is seriously off the mark. Piketty's data shows that even with the effects of the two World Wars, his estimate of the average return on capital (r) would still have been much higher than the average rate of growth (G) in the years 0-1000, 1000-1500, and 1500-1700. What changed was not the two World Wars — there were plenty of capital-destroying wars prior to the 20th century. What decisively changed was the rate of growth, which according to Piketty's data exploded upward after 1820. The rise of capitalism since the industrial revolution has been a story of explosive economic growth and wealth creation.

History shows that the major systemic driver of inequality is not capitalism, but low-growth feudalism — and the hereditary privilege and lack of widespread economic opportunity that feudalism ensures — that preceded it. For Piketty to look at his own data and conclude that capitalism is the driver of inequality after 1700 years of low-growth feudalism and massive inequality is, quite simply, bizarre.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

This misinterpretation of economic history throws Piketty's future projections — which foresee a 21st century with a falling rate of growth, and rising inequality — into an awful lot of doubt.

As I wrote last month when I first looked at Piketty's ideas, while there has definitely been a stagnation in growth in some countries, like Japan, in recent years, it is not right to assume that the soaring growth and wealth creation that brought down inequality in the middle of the last century will never return. In fact, growth continues apace worldwide, rising in 2013. New technological innovations like renewable energy, 3D printing, robotics and the internet of things have the potential to severely boost growth in the 21st century as innovations like fossil fuels, automobiles, the radio, computing, and rubber did in the 20th.

Consider renewable energy, for example. Solar panels — the cost of which continues to massively decrease as the technology improves, and which are already as cheap as fossil fuels in some parts of the world — have the potential to create massive economic growth over the next two decades and beyond. The total solar energy hitting Earth each year is equivalent to 12.2 trillion watt-hours. That's over 20,000 times more than the total energy that all of humanity consumes each year, and far more in one year than the total quantities of fossil fuels that have yet to be extracted. That is a source of fuel for a stunning amount of growth.

Once solar is cheaper per watt than coal, oil, and natural gas, falling energy costs will provide massive relief to people squeezed in recent years by the rising cost of fossil fuel extraction, a burden passed on to the consumer. Falling energy prices provide more disposable income to save and invest, or to spend. And because of the decentralized nature of solar energy, the benefits of cheap, plentiful energy can be realized by anyone with a solar panel, instead of being accrued by the capitalist who owns the coal mine, the power plant, or the oil well.

Now, capitalism's intrinsic virtue is wealth creation and economic growth, not low inequality. While mass wealth creation certainly helps, it is still possible for inequality to rise under a capitalist system, as we have seen in the last 40 years, especially if economic elites bend the political system back toward the feudalistic paradigm of hereditary, entrenched privilege. Arguably, the developed world has been pushed back in that direction in the last 40 years. Look at the way Western governments scrambled to bail out bankers and other economic elites during the 2008 financial crisis, while allowing high unemployment to persist for many years afterward.

In the end, Piketty's sudden and overwhelming relevance may simply be a byproduct of the fact that he has a major book on inequality at the right time, when a lot of people are rightly worrying about rising inequality. But Piketty's theory of inequality does not fit the facts of history, and his proposed solution — a global tax on wealth — is untested and would be fantastically difficult to implement, at least compared to tried-and-tested measures like government spending on job creation. Those worried about rising inequality should exercise caution before naively getting behind him.

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.

-

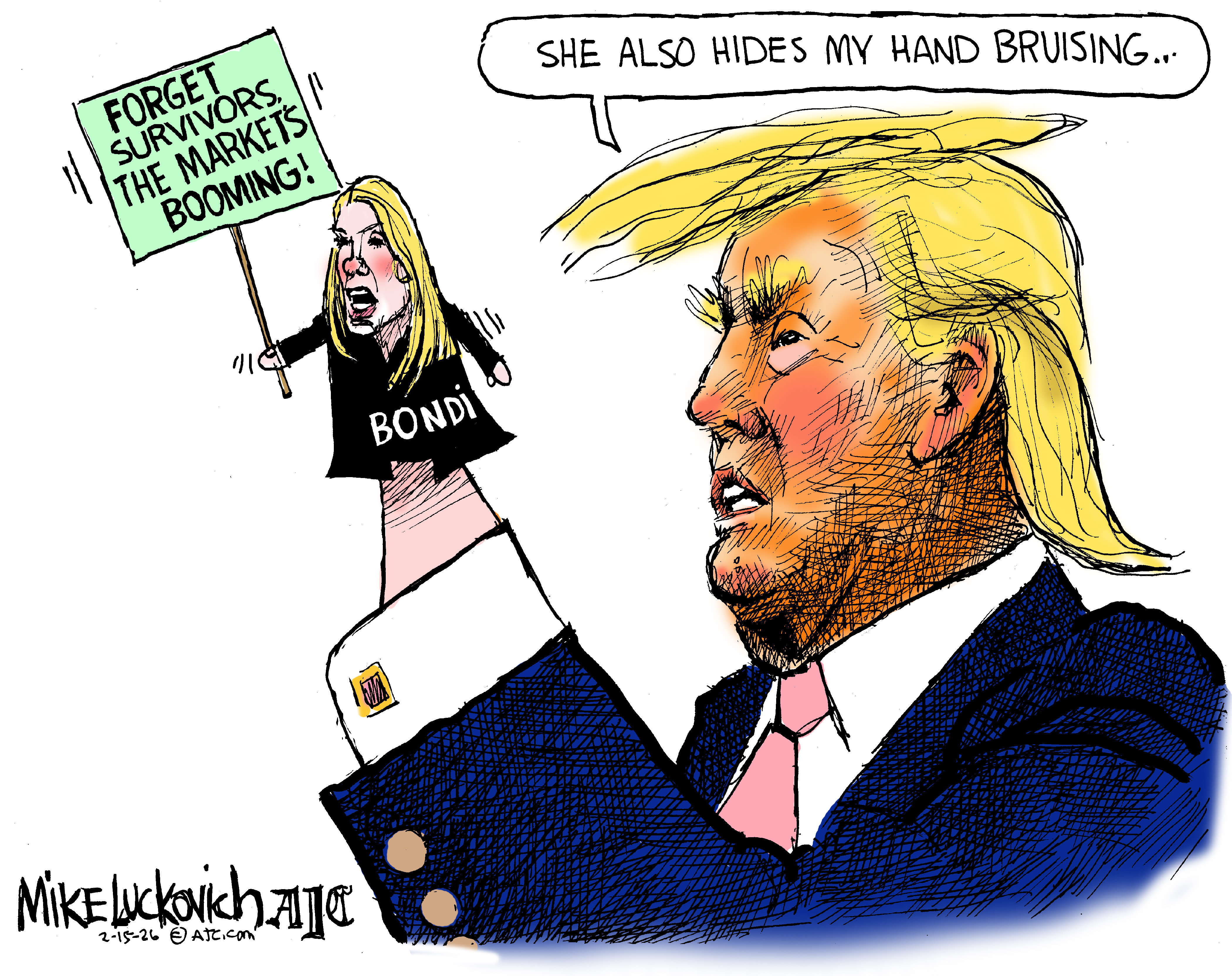

Political cartoons for February 15

Political cartoons for February 15Cartoons Sunday's political cartoons include political ventriloquism, Europe in the middle, and more

-

The broken water companies failing England and Wales

The broken water companies failing England and WalesExplainer With rising bills, deteriorating river health and a lack of investment, regulators face an uphill battle to stabilise the industry

-

A thrilling foodie city in northern Japan

A thrilling foodie city in northern JapanThe Week Recommends The food scene here is ‘unspoilt’ and ‘fun’