Don't be fooled by the jobs report

The economy is still terrible

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

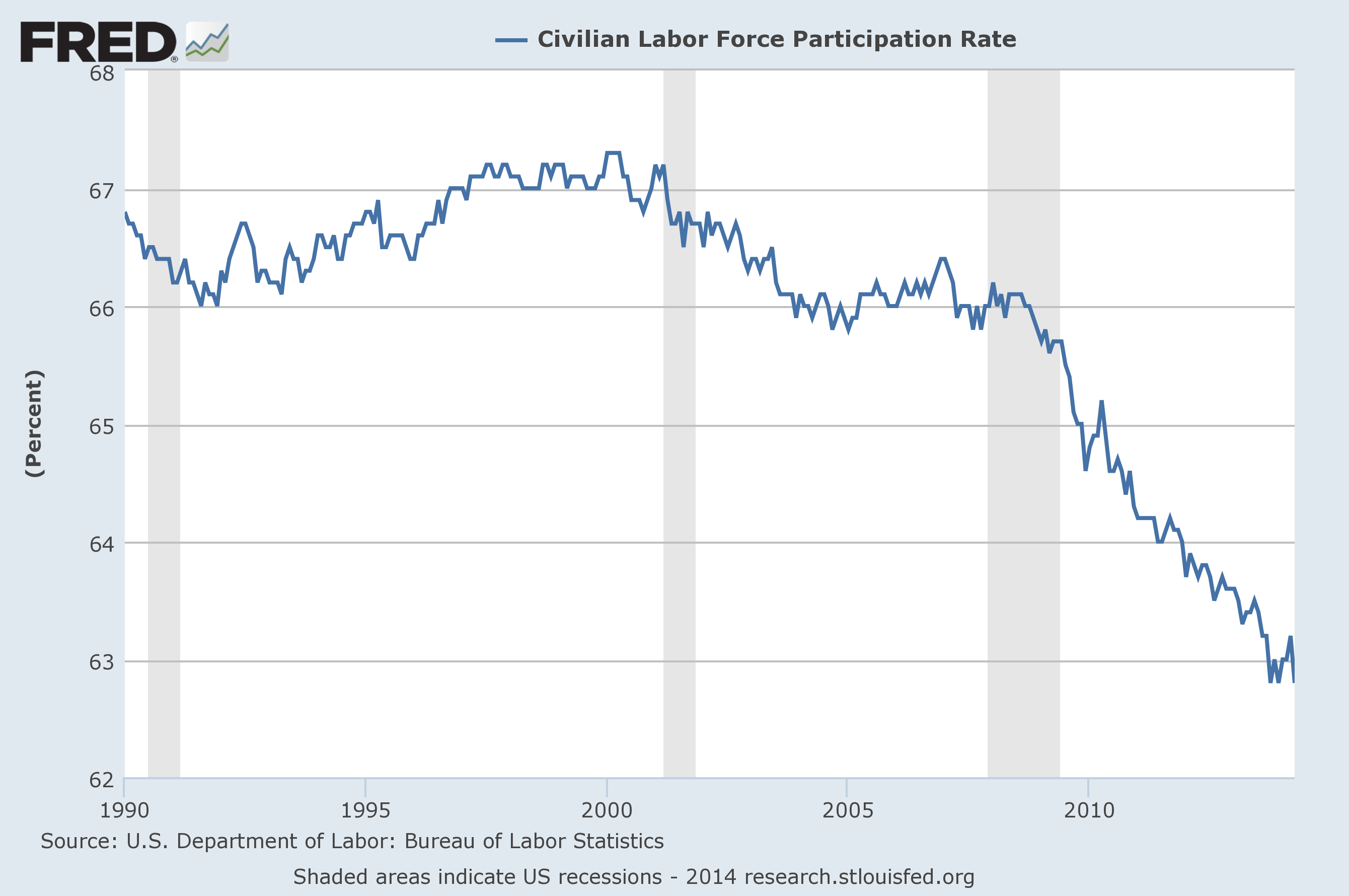

It's jobs day! And the headline result is relatively okay, I guess: 288k jobs created, the unemployment rate down to 6.3 percent. The jobs number is good, but as Jared Bernstein points out, the decline in the unemployment rate is completely due to nearly a million fewer people in the labor force. (For deeper analysis, see Bill McBride and Heidi Shierholz.)

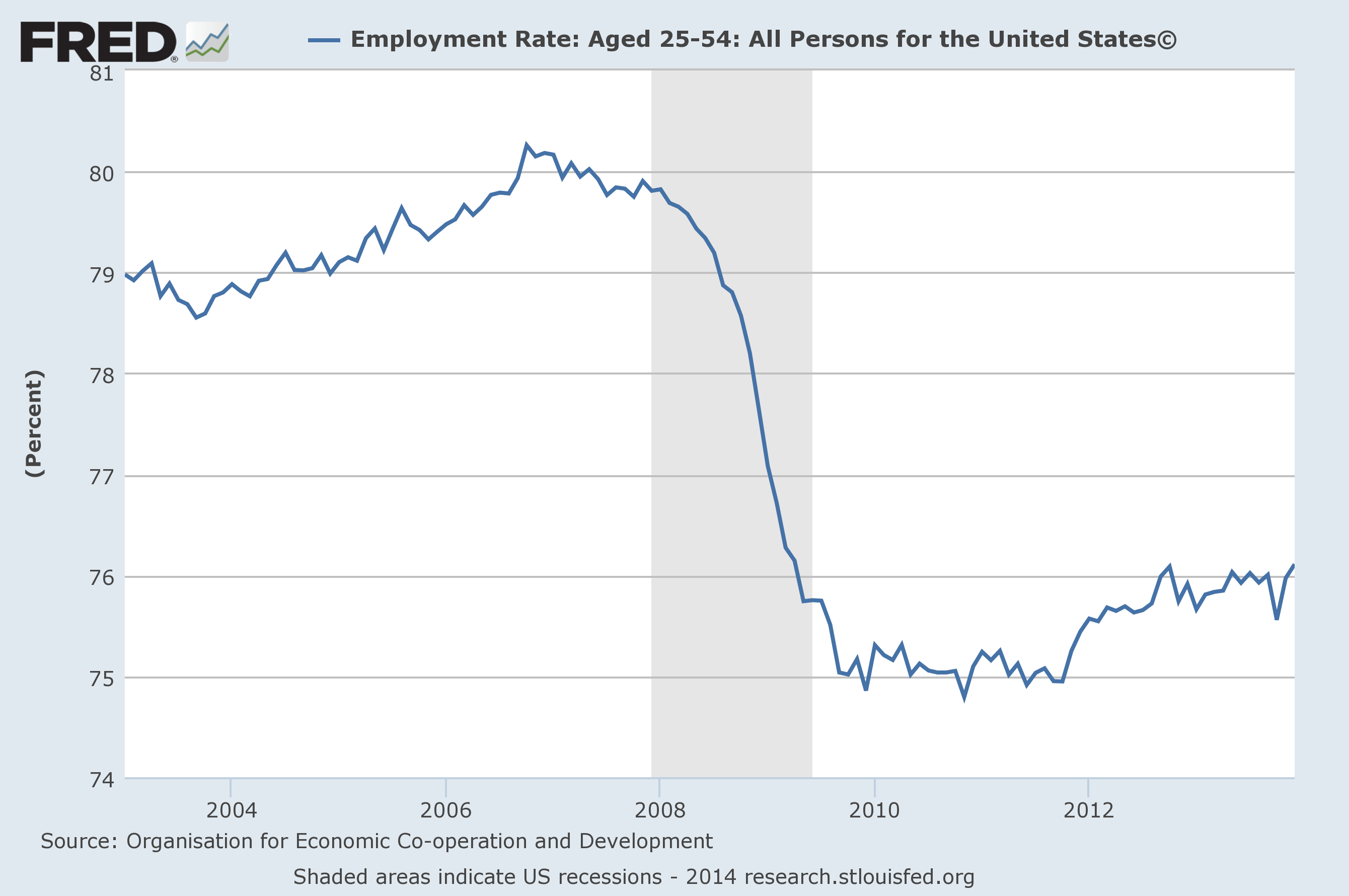

But when you look at the broader context, this is the same story since the "recovery" started: A very weak economy with pathetic growth, persistently high unemployment, and colossal amounts of potential output abandoned for no reason. We have made almost no dent at all in the most important economic chart. Here's the employment rate among people 25-54, the cream of the US workforce:

That five percentage point crash, on which we've made very little progress, represents millions of jobs lost, millions of careers delayed or not started, and millions of people just flat dropping out of the workforce. Check out the labor force participation rate, which is at a new low:

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

What these graphs paint is the picture of a political elite which has effectively abandoned the idea that providing material security for its citizens is the most important policy goal that exists. We know how to stimulate the economy to raise these numbers, we simply aren't doing it. And it isn't just workers alone we're talking about — every lost job represents goods and services not bought, houses not built, and families not started. That's what being under capacity means in human terms: We've simply abandoned incomprehensibly huge amounts of wealth, as Dean Baker points out:

...even by the I.M.F.'s measures the wealthy countries are losing well over $2 trillion a year due to economies operating below potential GDP. The cumulative losses to the rich countries from the Great Recession are virtually certain to exceed $20 trillion and could well top $30 trillion. [CEPR]

And that's leaving out the decent probability that sometime in the next four to five years, there will be another recession. While our current economic expansion hasn't been widely felt, it is already near the length of the postwar average. Will the stock market, which is starting to look a little frothy these days, end it? Will the Fed deliberately cause one out of a frankly monstrous desire to keep a lid on nonexistent inflation, as Bill McBride predicts?

No one can say for sure. But one thing I'd be willing to bet on is that the policy response will be inadequate and hesitant, if not worse. If Republicans are in charge, I would not be surprised if they go all-in on Mellonite liquidationism and cause a full-blown depression. We're now more than halfway through our first lost decade, and if that time has taught me anything, it's that we simply can't trust the political system to provide full employment. It's time to start thinking and mobilizing.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

Political cartoons for February 16

Political cartoons for February 16Cartoons Monday’s political cartoons include President's Day, a valentine from the Epstein files, and more

-

Regent Hong Kong: a tranquil haven with a prime waterfront spot

Regent Hong Kong: a tranquil haven with a prime waterfront spotThe Week Recommends The trendy hotel recently underwent an extensive two-year revamp

-

The problem with diagnosing profound autism

The problem with diagnosing profound autismThe Explainer Experts are reconsidering the idea of autism as a spectrum, which could impact diagnoses and policy making for the condition