U.S. economic confidence remains depressed — but there's hope

The healing power of time

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

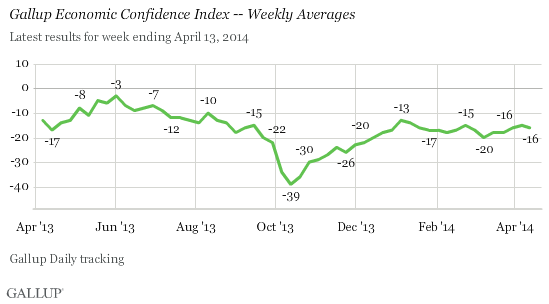

Gallup's latest economic confidence poll is out and it's still stuck in the red, down at -16 for both outlook and current conditions:

[Gallup]

That's better than the collapse down to -39 recorded during the government shutdown in October.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The harsh truth, looking backward, is that economic confidence has stayed in negative territory now for almost the entirety of the past six years:

[Gallup]

While the overall trend line looks to be moving in the right direction, why hasn't confidence hit positive territory yet? It's not high taxes — taxes under Obama are lower than they were under Reagan. It's not a result of rising government deficits or spending — deficits are falling at the fastest rate since World War II. It's not a falling stock market — we're currently in one of the biggest stock market booms of the last century, with the S&P 500 up 126 percent from the dark days of early 2009.

The causes are a mixture of still-high gas prices, high long-term unemployment, fear over the rollout of ObamaCare, stagnant real wages, political uncertainty stemming from Congressional gridlock, depressed housing prices and negative equity for millions of Americans, and a generally uneven economic recovery where tiny numbers of the very wealthy have done very well, and the middle classes have done relatively badly. The well-paid manufacturing jobs that fueled the initial growth of the middle class last century have gone abroad, and they're not coming back.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

In a larger sense, what we're seeing is an economic depression, in the most literal sense of the word; there is lasting psychological damage stemming from the massive economic slowdown and collapse in confidence in 2008.

However, the economy is growing, both in absolute size and in size per person, and unemployment remains on a downward trend. As long as that growth continues, people's perceptions of the economic situation will eventually turn positive. After all, confidence has recovered a lot over the past six years: -16 is low, but it's a lot higher than -65, -52, -39, or any of the other lows hit between 2008 and 2012.

Still, the fact that confidence still remains negative just goes to show how deep and long-lasting the economic scars of the 2008 recession have been. And its effects on the economy are clear. Business investment remains weak — people and corporations are sitting on piles of cash instead of investing. House building remains severely depressed. Ownership of stocks is at an all-time low, indicating more people than ever just aren't willing to take the risks needed to invest. The worst may be behind us, but the after-effects linger on.

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.

-

The Week Unwrapped: Do the Freemasons have too much sway in the police force?

The Week Unwrapped: Do the Freemasons have too much sway in the police force?Podcast Plus, what does the growing popularity of prediction markets mean for the future? And why are UK film and TV workers struggling?

-

Properties of the week: pretty thatched cottages

Properties of the week: pretty thatched cottagesThe Week Recommends Featuring homes in West Sussex, Dorset and Suffolk

-

The week’s best photos

The week’s best photosIn Pictures An explosive meal, a carnival of joy, and more