Yes, the economy is endangering Family Dollar — just not in the way you think

The dollar store just announced plans to shutter 370 stores, but an upbeat economy isn't the cause

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

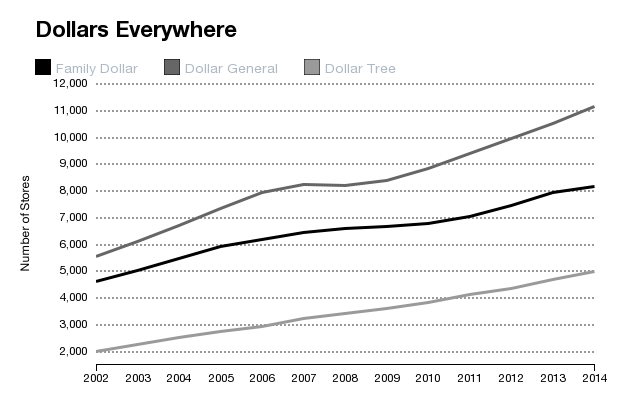

In the wake of the 2008 recession, dollar stores such as Dollar Tree, Dollar General, and Family Dollar — which sell a wide selection of different goods, from food and household goods to clothing — exploded throughout America, drawing in new customers hit by the weak recovery, or just looking for a bargain. Over the past five years, the big three dollar chains added 5,700 new stores:

But discount retailers got a shock last week when Family Dollar issued a dismal earnings report and announced plans to close 370 stores, roughly 5 percent of its locations.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The company gave a range of excuses for the disappointing results, including harsh winter weather. Yet some suggest the economy is too healthy for dollar stores to thrive, arguing that dollar stores generally do best in weaker economic times when customers need to stretch their budgets.

But while the economy is recovering as a whole, times are still very tough for a lot of people — including most of those who make up dollar stores' target audiences.

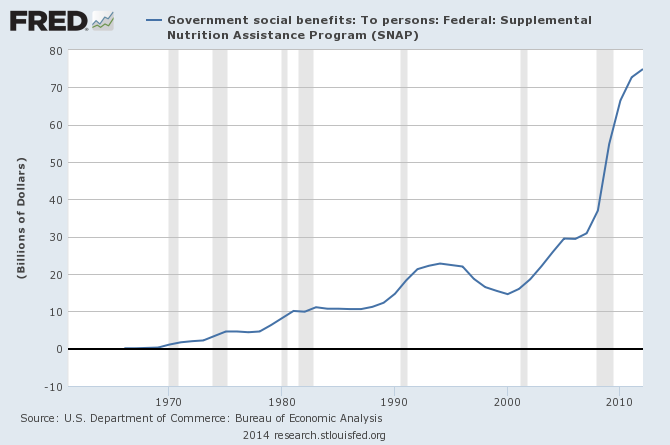

Spending on food stamps, for example, is still rising, although not nearly as fast as it was earlier in the decade:

[Federal Reserve Bank of St. Louis]

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

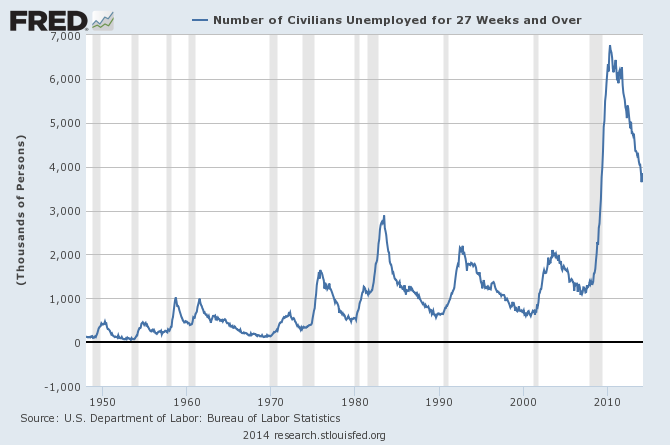

And while the numbers of long-term unemployed are decreasing, there are still more of them than at any point between World War II and the 2008 recession:

[Federal Reserve Bank of St. Louis]

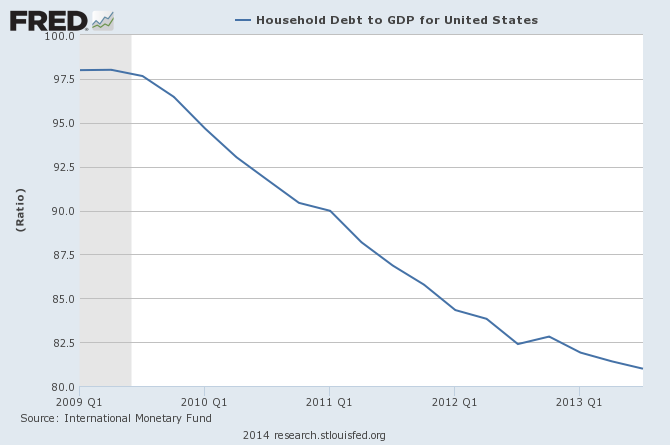

And households as a group are still in penny-pinching mode, gradually paying down debt accrued before the recession and saving at a higher rate than before the recession:

[Federal Reserve Bank of St. Louis]

These three things suggest that economic conditions are still right for dollar stores to thrive.

The real story, then, behind Family Dollar's closures is of competition between different dollar stores. As Businessweek notes, "[t]here have never been so many places to buy an 80¢ stick of deodorant or a $1.05 jar of salsa."

In other words, the lower-end marketplace has become saturated. An anemic recovery has made budget retailers a lot of money, and they've responded by plowing it back into aggressive expansion plans. And it's Family Dollar that has been the competitor squeezed.

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.