Massive Wall Street bonuses are back

Same as it ever was

They're back!

On the heels of the debauched tale of excess The Wolf of Wall Street, mega-bonuses in the financial services industry are making a comeback.

In fact, a total of $26.7 billion was paid out in cash bonuses in 2013 — a jump of 15 percent over the previous year, according to a report based on personal income tax trends conducted by New York State Comptroller Thomas DiNapoli. That works out to an average of about $164,530 per Wall Streeter. (And doesn't include other forms of compensation, like stock options.)

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The numbers add up to the highest average bonus paid since before the financial crisis hit in 2008 — and this year claims the spot for the third largest Wall Street windfall on record.

Wait. Didn't the recession — and post-crisis regulations — put the kibosh on these eye-popping bonuses?

To be fair, some restrictions have indeed been put in place since the financial crisis — including new compensation rules that require banking firms to provide fewer cash bonuses and more in stocks. (The aim being that, because deferred stock vests over time and therefore prohibits employees from selling it right away, compensation would be more closely tied to the performance of the company.)

And soaring bonuses weren't a trend seen across the board. For example, when calculated as a percentage of net revenue, compensation has actually been falling at big firms like Morgan Stanley and Goldman Sachs, the New York Times reports.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Still, it looks like Wall Street's riches are here to stay. As DiNapoli noted in a statement, "The industry still had a good year in 2013, despite costly legal settlements and higher interest rates." Even with increased regulations, "Wall Street continues to demonstrate resilience."

This story was originally published on LearnVest. LearnVest is a program for your money. Read their stories and use their tools at LearnVest.com.

More from LearnVest...

-

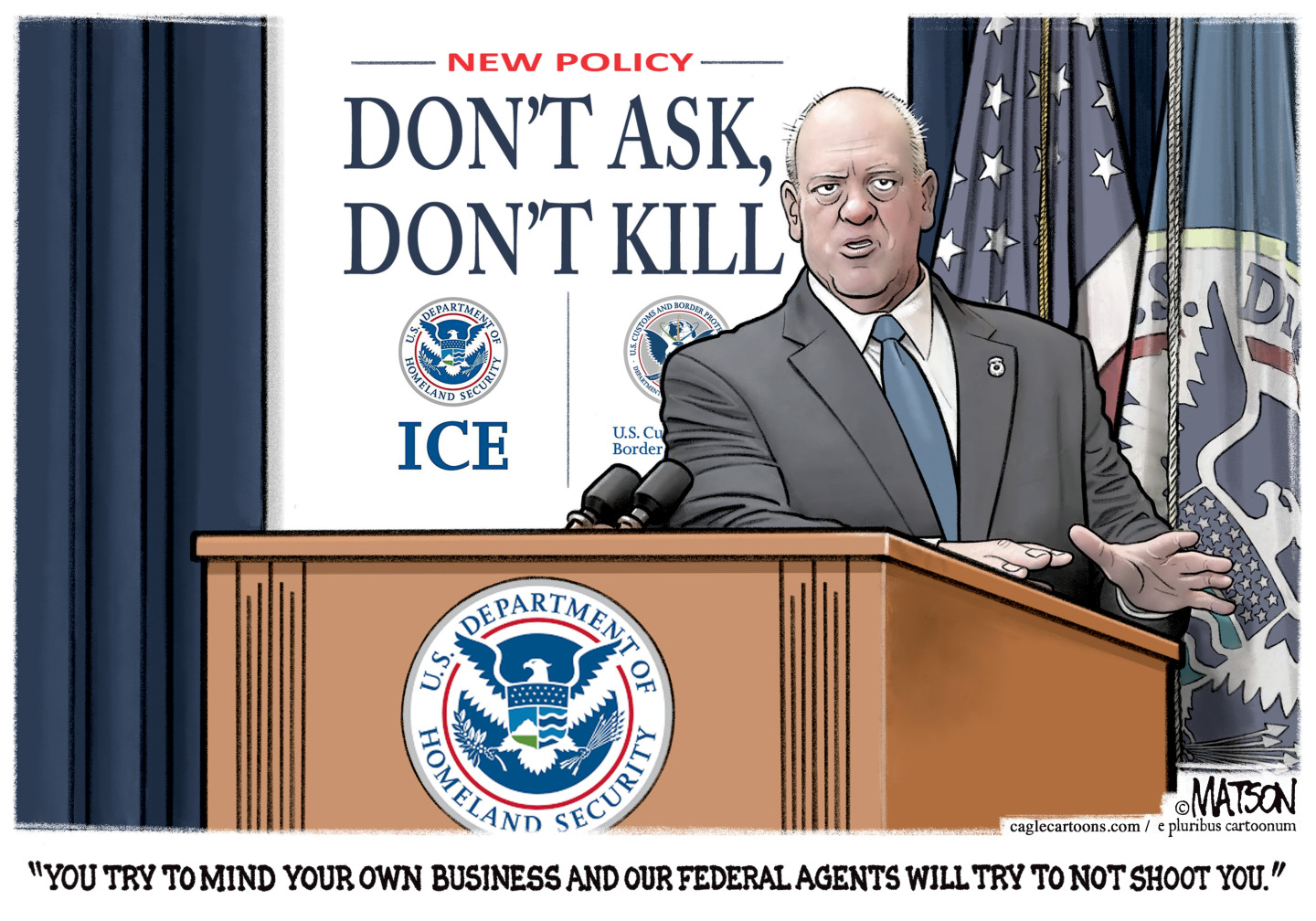

Political cartoons for February 1

Political cartoons for February 1Cartoons Sunday's political cartoons include Tom Homan's offer, the Fox News filter, and more

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

Reforming the House of Lords

Reforming the House of LordsThe Explainer Keir Starmer’s government regards reform of the House of Lords as ‘long overdue and essential’