Personal finance tips: How to save on your cable bill, and more

Three top pieces of financial advice — from how to get a better read on debit cards to the upside of investing abroad

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Save on your cable bill

Quit overpaying for cable, said Charles Passy at MarketWatch.com. Believe it or not, cable bills "can be easily bargained down with a relatively quick call to a customer service rep." If you're digging for a discount, many providers "will offer you a deal — typically, a lower bundled price or free extras (like a movie channel) — that's good for half a year." Their hope is that you'll forget when the six months are up, but you can always call back to try to renew the deal. And pay attention to the competition. "You're more likely to make an effective case if you can quote a promotion you've been offered by a competing company." And "if at first you don't succeed," call back. "A different customer-service rep may be authorized to offer a different deal."

A better bead on debit cards

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Finding the best deal among prepaid debit cards can be a hassle, said Ann Carrns at The New York Times. It's often "difficult to determine just what fees the cards charge and what terms they offer." Each company seems to have a different fee structure, charging for everything from registering for the card in the first place to reloading it and even calling customer service. In a bid to bring more transparency to prepaid cards, the Pew Charitable Trusts is promoting "a simple, uniform disclosure box that card issuers can use to help consumers compare card fees and terms." So far one bank — JPMorgan Chase — has pledged to adopt the new format for its Liquid prepaid card beginning this spring, and Pew hopes others will follow suit.

The upside of investing abroad

Are U.S. stocks really "safer" than those in foreign countries? asked Brett Arends at The Wall Street Journal. Though stock markets in emerging countries "have been in turmoil lately," broadening your portfolio might not be a bad idea. No market provides "the best return in all periods," so the best place to park your money can vary over time. A smart strategy is keeping a "balanced global portfolio and then adjusting it roughly annually." One expert suggests splitting up your investments equally across several low-cost funds tracking five major indexes: the S&P 500, London's FTSE 100 index, Europe's Euro Stoxx 50, Japan's Nikkei 225, and the MSCI Emerging Markets index. If rebalanced periodically, this portfolio "beats a traditional portfolio by a significant margin over time," says investment manager Joachim Klement.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Sergio Hernandez is business editor of The Week's print edition. He has previously worked for The Daily, ProPublica, the Village Voice, and Gawker.

-

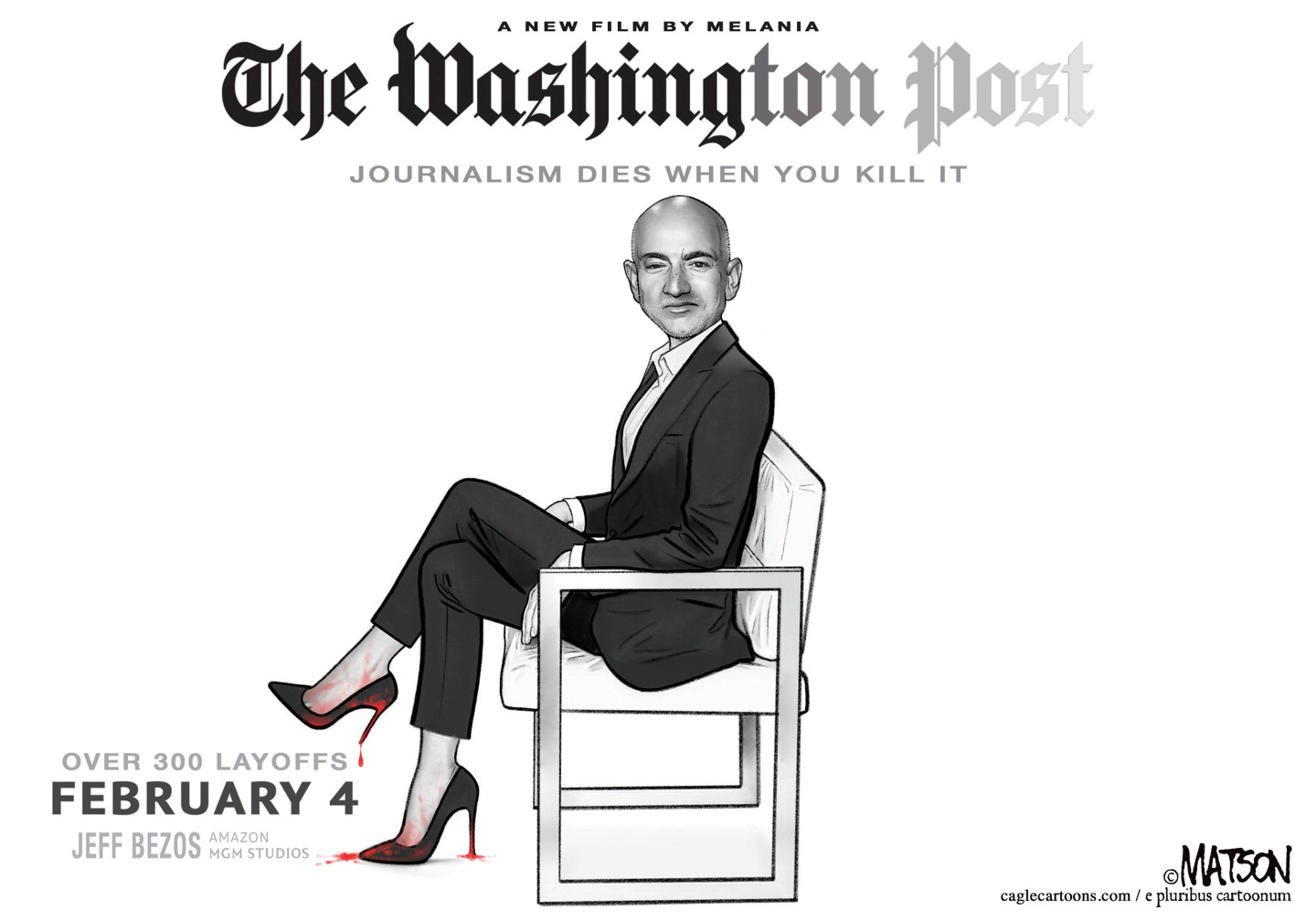

5 cinematic cartoons about Bezos betting big on 'Melania'

5 cinematic cartoons about Bezos betting big on 'Melania'Cartoons Artists take on a girlboss, a fetching newspaper, and more

-

The fall of the generals: China’s military purge

The fall of the generals: China’s military purgeIn the Spotlight Xi Jinping’s extraordinary removal of senior general proves that no-one is safe from anti-corruption drive that has investigated millions

-

Why the Gorton and Denton by-election is a ‘Frankenstein’s monster’

Why the Gorton and Denton by-election is a ‘Frankenstein’s monster’Talking Point Reform and the Greens have the Labour seat in their sights, but the constituency’s complex demographics make messaging tricky