Investment in renewable energy is falling. But you won't believe what will happen next.

As far as long-term investments go, the renewable energy sector has a bright future

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Around the world, investment in renewable energy companies has fallen. According to a study by Bloomberg, $254 billion was invested in renewable energy worldwide last year, a drop of 12 percent from 2012, which itself was a nine percent fall from a 2011 high of $318 billion.

This is a rather strange development. As a group, solar companies were one of the best-performing investments of 2013. The renewable energy sector as a whole is booming, and solar capacity is growing at an immense rate. So why is investment falling?

There seem to be two main reasons.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

First, solar technology has been getting much, much cheaper, with prices almost halving since 2011. This means that more renewable energy is being generated with fewer dollars invested. Even if demand for renewable energy technology rises, falling prices means that the amount of investment can still fall.

Second, the figures compiled by Bloomberg don’t include investments by companies outside the renewable sector. For example, information giant Google alone invested more than $1 billion last year in developing solar capacity to run the company's data centers, and claims that it wants to go 100 percent solar in the long run. Microsoft and Walmart also made similar investments.

Still, current levels of investment are deemed by the industry to be insufficient, the goal being to increase solar capacity enough to reduce carbon emissions and fend off global warming. Climate-policy advocates and solar investors, including hedge fund billionaire Tom Steyer and former U.S. Treasury Secretary Robert Rubin, called for renewable energy financing to double by 2020 in order to reduce greenhouse gas emissions by 25 percent. They also said the world should obtain at least 30 percent of its energy from renewable sources by 2020, and that renewable energy investment should double again, to $1 trillion, by 2030.

Will we get there? It really depends on the market. If the price of renewable energy continues to fall so dramatically, eventually the market will adopt it solely based on price. If other sources of energy remain cheaper than renewables, it will be an uphill battle regardless of what policies governments enact to encourage people to switch to renewable energy.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

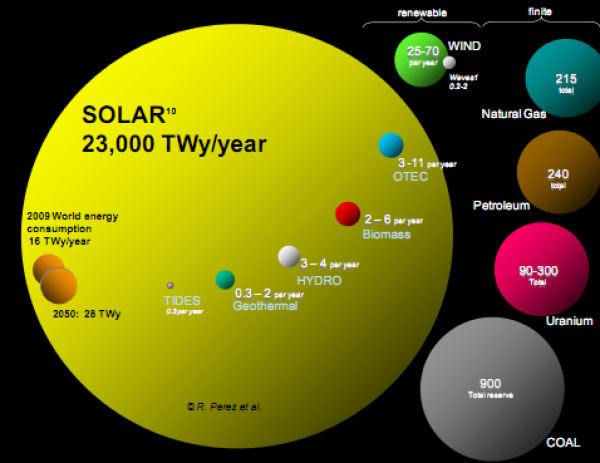

In the long run, the economics are on solar’s side, because solar is by far the most abundant energy source available to us. Fossil fuels and fissionable fuels are inherently limited, because there is only a finite amount stored in the Earth’s crust. As this diagram demonstrates (in Terrawatt-years per year), the availability of solar energy on Earth dwarfs other energy sources:

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.