Japan shouldn't be buying America's bourbon industry

Sure, Suntory makes fine hooch. But if anyone outside the U.S should purchase Beam, it's Australia.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Japanese beverage company Suntory's pending purchase of Beam, the maker of most of the biggest names in bourbon, is kind of like AOL buying Time Warner back in 2000. It's David buying Goliath. It just seems wrong. Suntory is the No. 15 spirits company in the world, as measured by sales, and Beam is No. 4. Assuming the $13.6 billion all-cash deal goes through, as expected, Suntory jumps to No. 3, after Britain's Diageo and France's Pernod Ricard.

But there's more to it than size: Beam doesn't just distill Jim Beam; it also owns Maker's Mark, Knob Creek, Basil Hayden, Booker's, Baker's, Old Crow, Old Grand-Dad, and Old Overholt (the world's best deal in rye whiskey).

Beam Inc., in other words, is practically the entire top-shelf American whiskey industry.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The only U.S. whiskey producer larger is Brown-Forman, which makes Jack Daniel's — not bourbon, technically — Woodford Reserve, the storied Old Forester, and Early Times. There's a certain element of wounded national pride here: Bourbon, after all, is as American as apple pie. TIME's Eric Dodds offers five suggestions for "the patriotic bourbon drinker" who wants to ditch Beam's Japanese-owned whiskeys; among his picks are Woodford Reserve and the wonderful Buffalo Trace.

That may seem like jingoistic nonsense, and perhaps it is. Beam Inc., for example, is headquartered in Deerfield, Ill., not the rolling hills of Kentucky. And maybe it's a little hard to feel bad about a Japanese company snapping up a U.S. conglomerate that also owns Scotland's Laphroaig single-malt whisky, Canadian Club, Mexico's Sauza and Hornitos tequilas, France's Courvoisier cognac, Spain's Fundador brandy, and other assorted foreign conquests.

But the Beam family, starting with German immigrant Jacob Boehm (the family's pre-Americanized surname), has been distilling whiskey in Kentucky since at least 1795. It's still a family business, at least in spirit. One of Jacob's sons, David Beam, took over the family whiskey business and the other son, John Beam, founded the Early Times Distillery in 1860.

From the relaunch of the post-prohibition James B. Beam distillery in 1935 until 1998, the master distiller was always a Beam or Noe — Booker Noe, Jim Beam's grandson and "one of the most colorful and delightful men in the business," according to Gary Regan and Mardee Haidin Regan's Bourbon Companion, was in charge for more than 40 years, until 1998. In 2007, his son, Fred Noe, took over again, becoming the seventh generation Beam in charge of the family still.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The Beams don't own Beam Inc., but they are its public face. Here's the company's version of its story, narrated by Fred Noe:

Suntory is buying that history. And its big Japanese rival, Kirin, paved the way in 2002, buying Four Roses, a distillery in Lawrenceburg, Ky., founded in about 1886.

Now, Suntory is also a family business with a long, noble history, dating back to 1899. It has been distilling whiskey since the U.S. was in Prohibition, and its flagship Yamazaki single malts are delightful.

There are lots of great articles on why the deal makes perfect sense: Japan's aging, shrinking population means its companies have to look elsewhere for growth, says Quartz's John McDuling — in Suntory's case, some 80 percent of revenue comes from Japan; Bloomberg's Justin Bachman explains that bourbon is getting hot across Asia and Suntory will be "far more knowledgeable about selling liquor in Asia than Beam could become"; The Wall Street Journal's Alex Frangos and Aaron Back describe the deal's "perfect synergy" as Japan gains "access to the perfect Manhattan."

David A. Mann at Louisville's Business First notes that Kirin and Italy's Gruppo Campari, which bought Wild Turkey in 2009, have either left their Kentucky distilleries alone or put serious money in upgrading the facilities. Suntory will probably let Beam continue to run the Beam family of bourbons.

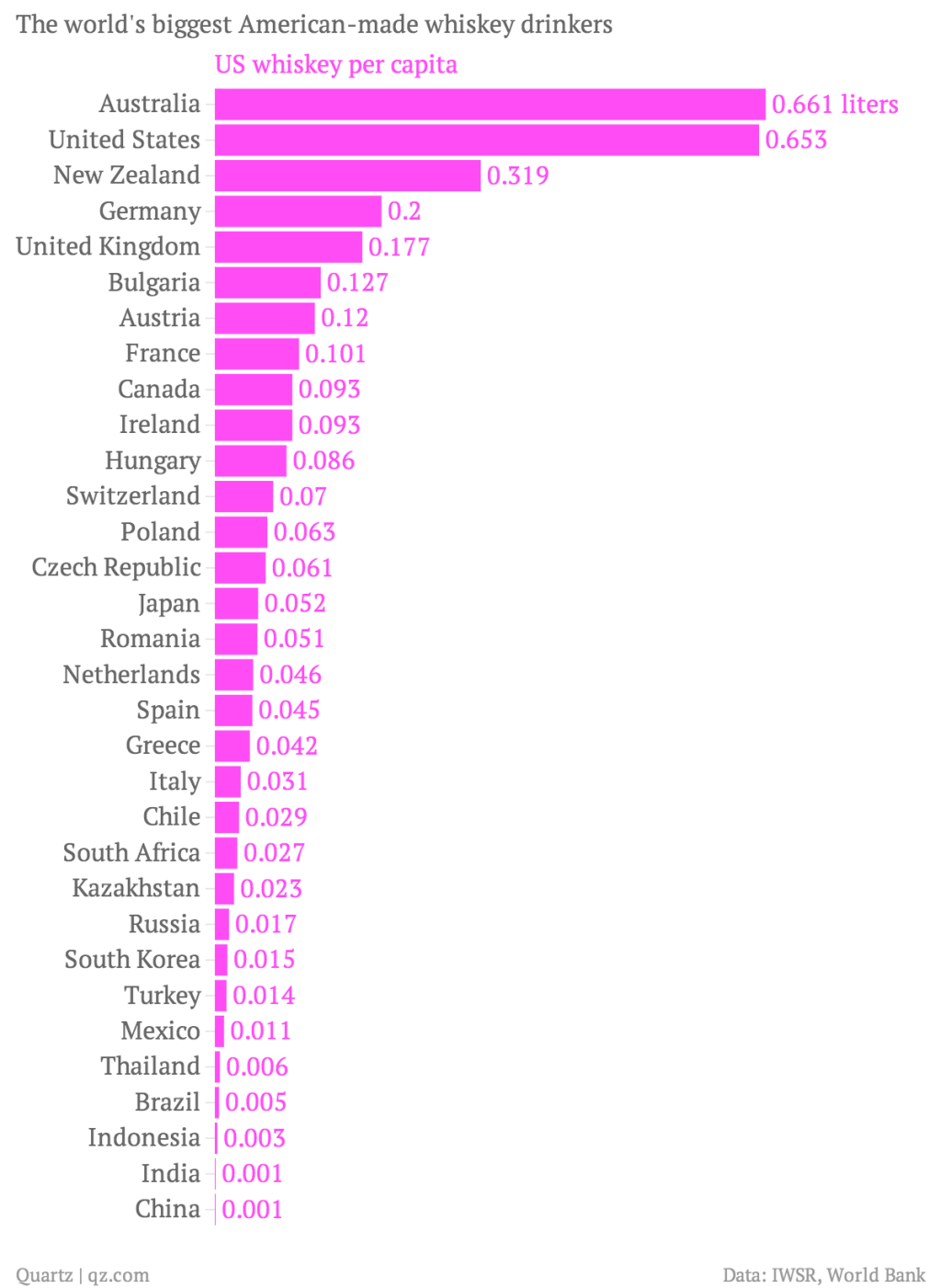

So why shouldn't Suntory buy many of America's best bourbons, all in one shot? Because Japan isn't a particularly big market for bourbon. This is about money, not love. Do you know the biggest market for U.S. whiskey? Per capita, it's apparently Australia, where Jim Beam is also the most popular individual liquor. Quartz's Roberto A. Ferdman has this remarkable chart:

I count at least 14 countries that would appreciate owning Beam more than Japan. France drinks the most whiskey per capita, period (followed by Uruguay), and in terms of raw numbers, populous India wins the whiskey race hands down. Japan never even cracks the Top 10. Bourbon deserves better.

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

The Week Unwrapped: Do the Freemasons have too much sway in the police force?

The Week Unwrapped: Do the Freemasons have too much sway in the police force?Podcast Plus, what does the growing popularity of prediction markets mean for the future? And why are UK film and TV workers struggling?

-

Properties of the week: pretty thatched cottages

Properties of the week: pretty thatched cottagesThe Week Recommends Featuring homes in West Sussex, Dorset and Suffolk

-

The week’s best photos

The week’s best photosIn Pictures An explosive meal, a carnival of joy, and more