The one word that will convince conservatives that inflation is actually low

"COLA"

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

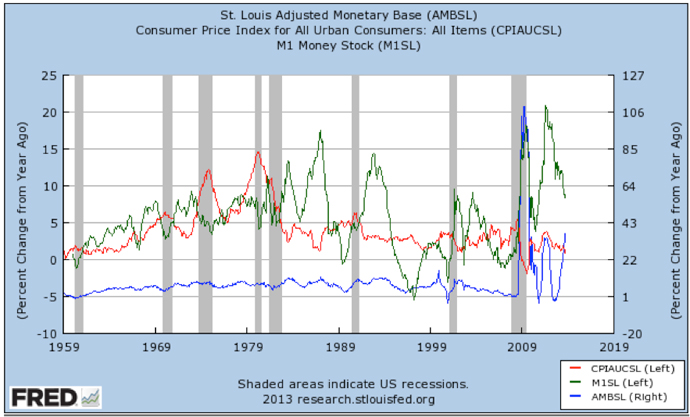

In the wake of the 2008 financial crisis, the Federal Reserve engaged in a nearly unprecedented expansion of the monetary base. In response, many conservatives and libertarians predicted massive inflation. That hasn't happened. Since 2009, inflation has remained below the 2 percent average of recent decades.

And while many have recognized this reality, others on the Right have concluded that if inflation hasn't shown up in the official numbers it's because it is being hidden. Some have sought refuge in the website ShadowStats, which purports to provide "unskewed" inflation numbers and has shown inflation at around 8 percent (in reality Shadowstats simply adds around 6 percent to the official inflation rate). In 2010, many pointed to a rapid rise in the price of commodities like oil as evidence of inflation (ignoring the fact that the prices of the same commodities had fallen even more during the early months of the crisis). For a while the price of gold was taken as the key indicator (the price of gold has fallen more than $400 an ounce this year). And lately some have started to see increases in stock prices as proof of inflation (even though the P/E ratio for the S&P 500 is not out of line with historical averages). Government manipulation of the consumer price index is also belied by the existence of privately run price indexes, such as the Billion Prices Project, which also show low inflation.

The big irony here is that in claiming that the CPI understates inflation, conservatives are effectively arguing for higher taxes and more government spending. That's because a version of the CPI is used to calculate cost-of-living adjustments (COLAs) for government programs like Social Security. If government numbers showed an inflation rate of 8 percent or more, this would result in billions more being spent on Social Security payments, as well as an increase in the amount of wages subject to the payroll tax.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Likewise, if inflation has been a lot higher than the government is admitting, then real spending hasn't risen by nearly as much as the official numbers indicate. All the talk about Obama's big spending ways, therefore, would have to be scaled back, if not abandoned.

Given these sorts of considerations, it's not so surprising that the typical line among conservative economists used to be that the CPI overstated inflation, not that it understated it. In the 1990s the Boskin Commission, appointed by the United States Senate, concluded that the CPI was overstating the inflation rate by as much as 1.3 percent annually due to methodological problems with how the index accounted for improvements in the type and quality of goods available in the economy. Even overstating inflation, by that relatively small amount, the commission found, would add nearly $700 billion to the national debt over the course of 10 years.

Of course, the fact that fans of smaller government might not like all the implications of a higher inflation rate doesn't mean that the view isn't true. But there is a consistency issue here. Unless you are prepared to accept that government spending growth has been moderate and ought to have been higher (given current law), then you can't consistently maintain the official numbers are lower than what they should be. It's better to accept what the market itself is telling us: Inflation is low, and is likely to remain so for the foreseeable future.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Josiah Neeley is a Policy Analyst for the Armstrong Center for Energy and the Environment at the Texas Public Policy Foundation.

-

How Democrats are turning DOJ lemons into partisan lemonade

How Democrats are turning DOJ lemons into partisan lemonadeTODAY’S BIG QUESTION As the Trump administration continues to try — and fail — at indicting its political enemies, Democratic lawmakers have begun seizing the moment for themselves

-

ICE’s new targets post-Minnesota retreat

ICE’s new targets post-Minnesota retreatIn the Spotlight Several cities are reportedly on ICE’s list for immigration crackdowns

-

‘Those rights don’t exist to protect criminals’

‘Those rights don’t exist to protect criminals’Instant Opinion Opinion, comment and editorials of the day