Why America's new love affair with saving is not great economic news

The recession transformed Americans' relationship with money

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

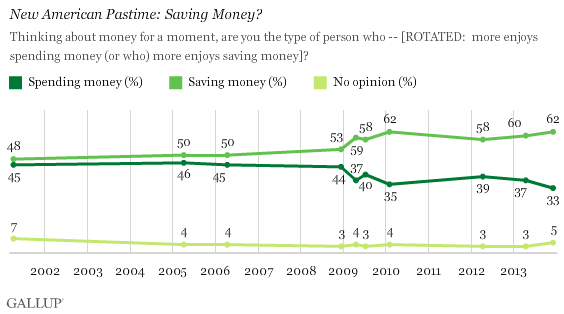

This data from Gallup shows that the 2008 recession transformed America’s relationship with money. In 2006, before the recession, 55 percent of Americans saw themselves are savers, and 45 percent saw themselves as spenders. By 2010, 62 percent saw themselves as savers, and only 35 percent saw themselves as spenders, a pattern which holds up today:

This tallies with data showing that the total level of money Americans are sitting on has soared since the recession. This is not great news.

Now, there's no doubt that everyone should have some liquid savings as insurance against the uncertainty of the future, although the historical record illustrates that investing money in productive companies tends to have a much, much higher yield than sitting on it in a savings account, certificate of deposit, or money market fund. But if lots and lots of people simultaneously decide to save more money, it can hurt the economy.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The British economist John Maynard Keynes saw rising levels of saving as a symptom of recessions and depressions. If the market loses confidence and asset prices begin to fall, people run for safety by liquidating investments and sitting on cash instead of spending it or investing it in productive businesses. While this may benefit the individuals sitting on cash by shielding them from falling asset prices and allowing them to build up a cash safety buffer, less spending in the economy simultaneously means less income in the economy. My spending is your income — any reduction in spending in the economy is a reduction in income. Keynes called this the Paradox of Thrift. This data suggests that Keynes’ view is correct.

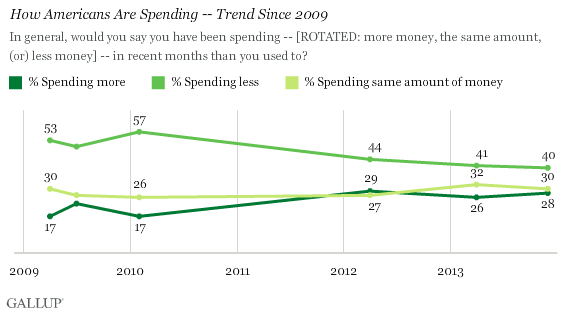

Fortunately, the actual trend in spending has begun to recover since the recession. In 2010, 57 percent of Americans said they were spending less, and just 17 percent said they were spending more. Today, 40 percent say they are spending less, and 28 percent say they are spending more:

This slight rebound in spending corresponds to the state of the economy — there has been some recovery, but we are by no means out of the woods yet.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.