Australia just scrapped its debt ceiling. America should, too.

Mature countries just walk away from a fight

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Debt ceiling fights, it seems, have become a permanent fixture in American politics. Twice in the last couple of years, the United States has been days away from potentially irrevocable economic damage because Congress refused to raise the debt ceiling and let the Treasury issue more debt. The next debt ceiling fight is slated for March 2014.

But isn't there a better way to increase a borrowing limit — and one that doesn't freak out markets, investors, and, well, just about everyone every few months?

Australia has an answer: It decided to get rid of its debt ceiling altogether:

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The federal government will be able to borrow as much money as it wants after Federal Treasurer Joe Hockey cut a deal with the Greens to dispense with the debt ceiling completely...

It means the government will not have to ask the Parliament for permission whenever it wants to borrow money above a certain limit. [Sydney Morning Herald]

Some may be extremely concerned by this possibility. If the government can borrow all the money it wants, then won't that lead to the government making extremely irresponsible decisions, such as spending huge amounts of money it doesn't have building bridges to nowhere?

But it's actually a brilliant idea — and one that America and the rest of the world would do well to implement as soon as possible — because it would eliminate the uncertainty and confusion of debt ceiling fights. And there is no reason — absolutely no reason — to believe that it will lead to excessive government spending. Why? Because there already exists a natural debt ceiling called interest rates — the cost at which investors in the market will lend the government money.

The U.S. government is legally bound to pay its debts, and as the issuer of currency it has the means to do so. This means that U.S. government debt is considered by the market to be a very safe asset. And, as Frances Coppola argues, that means that it is a critically important part of the global financial system, because it is used around the world as collateral for lending and as a store of purchasing power. Right now interest rates are very low by historical standards, even after adjusting for inflation. This means that the government is not producing sufficient debt to satisfy the market demand. The main reason for that is the debt ceiling.

If the Treasury became extremely profligate and started borrowing much, much more — say, increasing borrowing from just over half a trillion dollars a year to ten trillion dollars a year — interest rates would rise significantly, making it unaffordable for the government to do so. That is the only debt ceiling we need.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The debt ceiling today is particularly badly designed. Why? Because it's denominated in an arbitrary number of dollars. Let's say you are a government with $1,000 of debt. Can you repay it? It depends what your tax base is. If the whole economy is generating $10 of activity per year, you have no chance. At a 30 percent tax rate, that would yield just $3 per year in tax. But let's say you have a $10,000 economy. Then, a 30 percent tax rate yields $3,000, meaning that $1,000 of debt would be easy to repay. So the sustainability of your debt is dependent on the size of the economy, and the size of your debt is much more meaningful if it is expressed in terms of the amount of activity taking place in the economy (GDP).

So should the current debt ceiling be replaced by a ceiling expressed as a percentage of GDP? While that is slightly less stupid than the current system, it is still not the best idea because it would be very hard to agree on what constitutes a sustainable level of debt. For example, Harvard economists Ken Rogoff and Carmen Reinhart published a well-received paper suggesting that 90 percent of GDP was the level at which government debt becomes damaging to economic growth. But their 90 percent limit has been completely debunked since. Great Britain, for example, had a debt over 250 percent of GDP in the 19th century, and successfully paid it down without defaulting.

Essentially, then, the only sensible way to determine how much the government can borrow is whether or not people are willing to lend the government more money. Australia has made a very smart move, and the U.S. should follow suit as soon as possible.

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.

-

Bad Bunny’s Super Bowl: A win for unity

Bad Bunny’s Super Bowl: A win for unityFeature The global superstar's halftime show was a celebration for everyone to enjoy

-

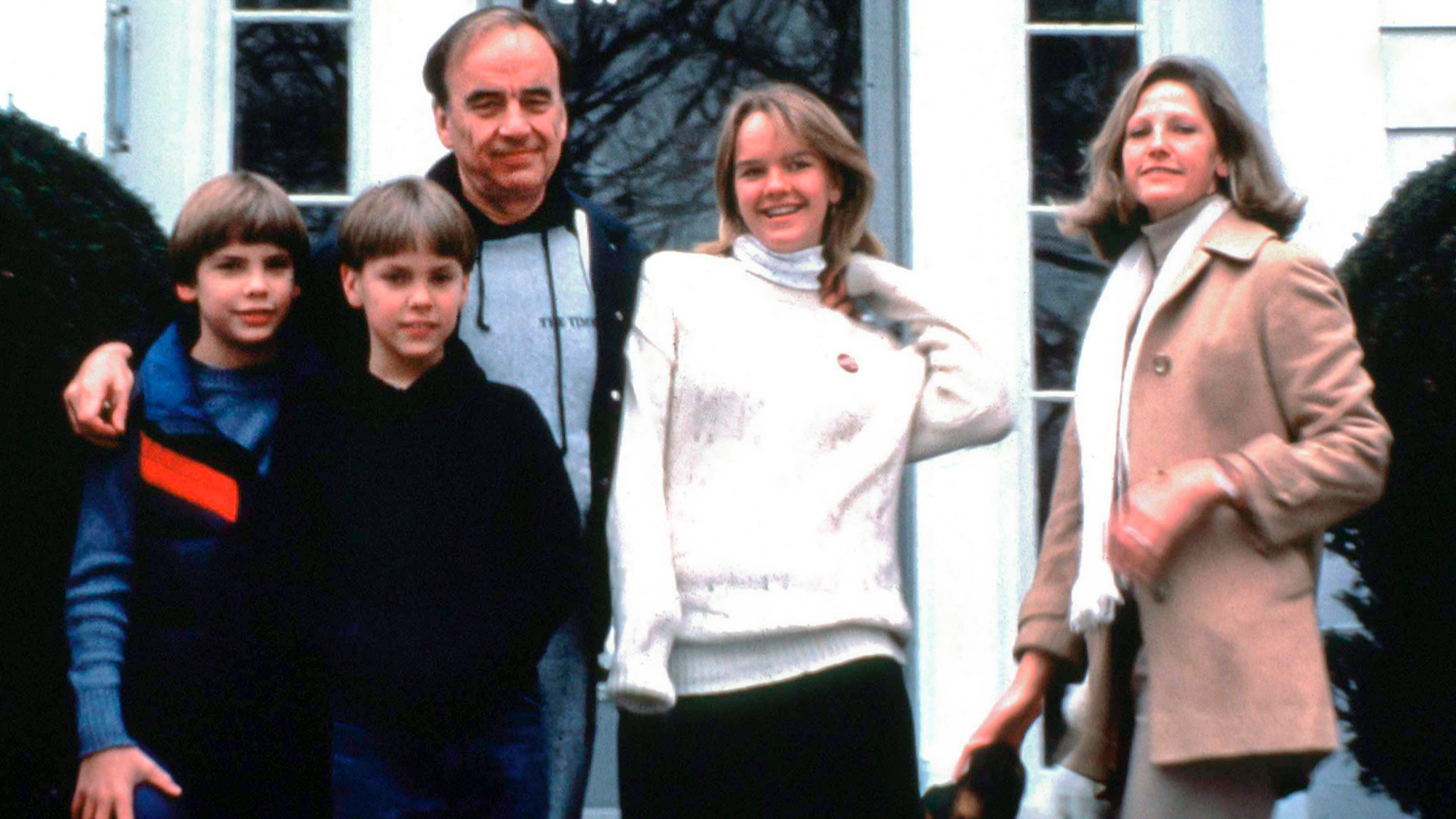

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’Feature New insights into the Murdoch family’s turmoil and a renowned journalist’s time in pre-World War II Paris

-

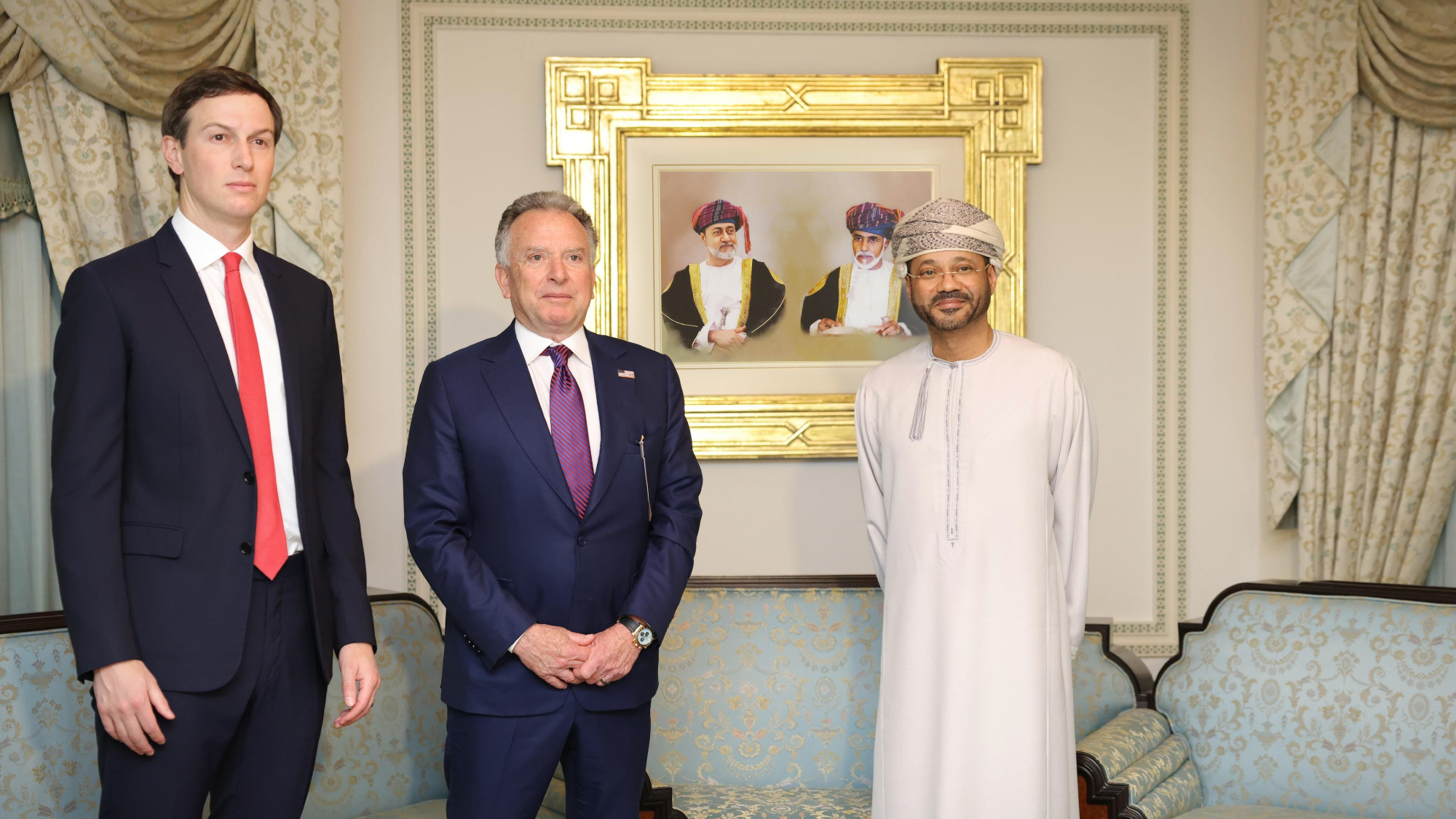

Witkoff and Kushner tackle Ukraine, Iran in Geneva

Witkoff and Kushner tackle Ukraine, Iran in GenevaSpeed Read Steve Witkoff and Jared Kushner held negotiations aimed at securing a nuclear deal with Iran and an end to Russia’s war in Ukraine