The economy's new normal

Are we in a permanent slump?

Are we in "a permanent slump?" asked Paul Krugman at The New York Times. Larry Summers thinks so. At the International Monetary Fund's annual research conference recently, the former Treasury secretary argued that the U.S. is in "'secular stagnation' — a persistent state in which a depressed economy is the norm, with episodes of full employment few and far between." Krugman agrees, on strong evidence. Our households are still deeply in debt, for example, yet "demand shows no sign of running ahead of supply." This means it's time for central bankers to give up on their recurrent dreams of "snatching away the punch bowl." The truth is that "easy money should, and probably will, be with us for a very long time." Whether because of our slowing population growth or our persistent trade deficits, we're stuck in a world where "prudence is folly" and trying to balance budgets and save more only makes "everyone worse off."

Kevin Drum at Mother Jones blames "the investment drought." Somewhere along the way, we shifted from an economy that valued real goods and services to one obsessed with paper profits. "There simply aren't enough promising real-world investments available, which means that lots of money is either sitting on the sidelines or else getting diverted into financial rocket science." Wall Street's greed isn't enough to explain this. The finance industry "would happily allocate more money to real-world investment opportunities if the demand were there. But it's not, even with essentially free money."

Summers is a pessimist, said Peter Coy at Businessweek. If he's right, "the economy is incapable of producing full employment without financial bubbles or massive stimulus, both of which tend to end badly." The problem is that once interest rates "reach the floor of zero," they can't be further reduced to stimulate the economy. Central banks can overcome that problem by amping up monetary and fiscal stimulus, "but that has some nasty side effects." They can also start paying "sharply negative interest rates on bank deposits," but that would deter depositors from keeping their money in banks to begin with. To stop that, in turn, central banks would have to devalue cash itself, "effectively imposing the same negative interest rate on paper money as on money deposited in banks" by pegging prices to electronic dollars instead of paper money.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Good luck with that, said Jared Bernstein at The New York Times. The fact is that central banks can only do so much. There is no doubt that "the head of the Federal Reserve is one of the most powerful people in the world." (Summers himself was, until recently, a top pick for that post.) But "the Fed can't create jobs. It can't invest in infrastructure. It can only try to create the conditions for other people to do so." If our economy is ever going to get back to full employment, "it needs complementary fiscal policy to stimulate the missing demand that would be taking advantage of the low-interest-rate environment." And forging such a policy falls not to the Fed, but to Congress.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Sergio Hernandez is business editor of The Week's print edition. He has previously worked for The Daily, ProPublica, the Village Voice, and Gawker.

-

Metal-based compounds may be the future of antibiotics

Metal-based compounds may be the future of antibioticsUnder the radar Robots can help develop them

-

Europe’s apples are peppered with toxic pesticides

Europe’s apples are peppered with toxic pesticidesUnder the Radar Campaign groups say existing EU regulations don’t account for risk of ‘cocktail effect’

-

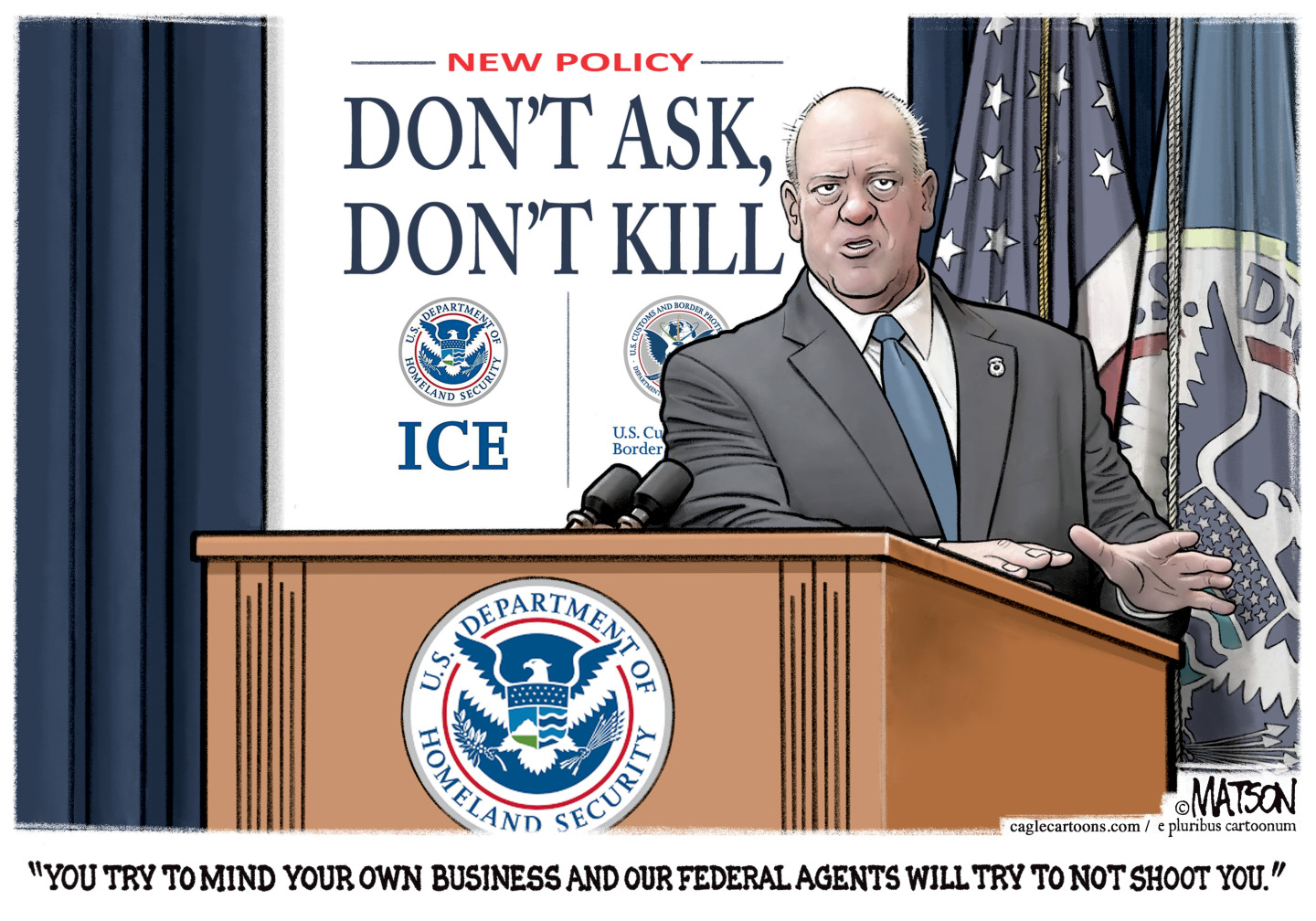

Political cartoons for February 1

Political cartoons for February 1Cartoons Sunday's political cartoons include Tom Homan's offer, the Fox News filter, and more