Personal finance: The benefits of patience

Waiting until age 70 to claim Social Security benefits can really pay off.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Self-restraint really pays off when it comes to managing your money, said Tara Siegel Bernard in The New York Times. If you’re “nearing or on the cusp of retirement,” you might be looking forward to starting to draw your Social Security benefits. But don’t pull the trigger just yet. “If you delay collecting your benefits, which can be claimed anywhere from age 62 to 70, the money you refrain from taking each year is basically a payment for a much higher stream of lifetime income.” For many older Americans, of course, “leaving sizable sums of money on the table” can be a strain—especially if they “need the money to live on.” But if you have enough to get by in early retirement, the strategy of effectively “buying more income from Social Security” by waiting is an attractive alternative to securing it through an annuity, which will cost you more in the long run.

Too bad so many “Baby Boomers are making the wrong moves,” said Laurence Kotlikoff in PBS.org. Less than 2 percent are waiting until age 70 to claim their benefits, and I blame “economic schizophrenia.” People are over-consuming today, figuring they’ll let their “future selves fend for themselves later.” Don’t ignore your fiduciary responsibility to yourself; hunker down and make a plan. Consult a financial planner who specializes in Social Security, and make sure to use software that will give you “the right Social Security maximization strategy.

Holding off isn’t just a virtue for retirement planning, said Derek Pain in The Independent (U.K.). It’s also useful in the stock market. “Investors, particularly small players, need to exercise patience. It is easy to get panicked into selling when a share goes into reverse.” Just a little market volatility is too often enough to spook mom-and-pop investors. Sure, “it is always wise to be prepared for the possibility of a looming disaster.” But making knee-jerk decisions won’t earn you many happy returns, either.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But there’s one area where you shouldn’t drag your heels, said Dan Caplinger in Fool.com: tax planning. While “most people wait until the last minute,” procrastination can be costly. Remember that “by selling losing stocks, you can use capital losses to offset any gain as well as up to $3,000 of other types of income.” Most taxpayers imprudently wait until the end of the year to lock in their losses. “Doing so beforehand can help you avoid the rush and potentially get better prices for your shares.”

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Colbert, CBS spar over FCC and Talarico interview

Colbert, CBS spar over FCC and Talarico interviewSpeed Read The late night host said CBS pulled his interview with Democratic Texas state representative James Talarico over new FCC rules about political interviews

-

The Week contest: AI bellyaching

The Week contest: AI bellyachingPuzzles and Quizzes

-

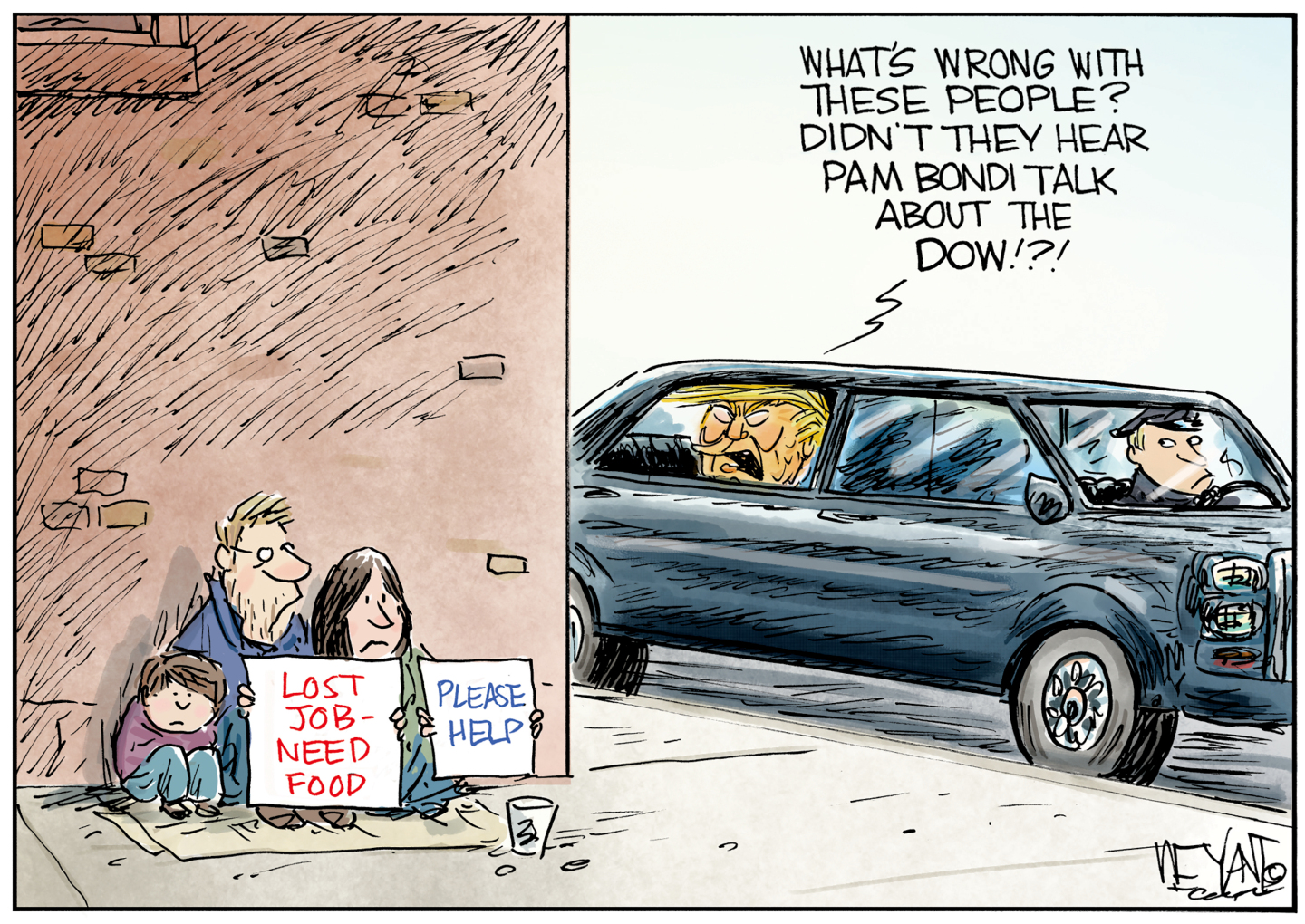

Political cartoons for February 18

Political cartoons for February 18Cartoons Wednesday’s political cartoons include the DOW, human replacement, and more