3 money apps that look more useful than Coin

Will a 'master credit card' really change the way we shop?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

There's plenty to gripe about when it comes to credit cards. They're deceptively expensive, easy to misuse, and they've helped a lot of people mess up their lives. But one gripe you don't often hear about plastic: How difficult it is to use.

Yet for the last few years, a handful of tech startups have introduced a string of new products aimed at simplifying the simple payment method. The latest: Coin, a sleek, digital card that houses the information for all your debit, credit, and gift cards in one place.

It works like this: You attach the Coin device to your smartphone, swipe your cards through it, and snap a photo of both sides of each card. Then voila: All those heavy, bulky credit cards that have been beefing up your wallet and wearing rectangular fossil in your back jean pocket are consolidated into one card. Now, to make a payment, you simply select which card they'd like to pay with from Coin's digital display, and swipe the Coin card instead.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

It sounds nifty, but does it really solve a problem? Reporters have been quick to point out a few hurdles the device will face before its 2014 release. For example, the current iteration of Coin stops working when your phone dies, which means if your phone dies at the bar before you've paid for drinks you're in a pickle. And, possibly more importantly, it has yet to win approval of any of the major credit card companies, says CNN's Julianne Pepitone.

So how can technology improve how we pay for things? Here, three other payment apps:

Beacon

What's an easier payment method than swiping a credit card? Doing absolutely nothing.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

That's the idea behind Beacon, a Bluetooth device PayPal debuted in September. Essentially, it's a thumb-sized piece of hardware that plugs into a wall outlet, serving as a connector between the store's sale system and customers who have downloaded the PayPal app. Using Bluetooth Low Energy (BLE), so it doesn't drain smartphone batteries like competitor Pay with Square, the technology triggers when a connected customer walks into the store. If the customer approves the check-in, their face and shopping history appears on the retailer's terminal. The customer can then collect or order goods, and pay with a simple verbal confirmation.

Saved Plus

Launched earlier this year, Saved Plus tackles a different payment challenge: Learning how to pay yourself.

The app connects your checking account to a savings account, and transfers a little money each time you make a purchase. Users select a percentage amount they'd like to save for each purchase (five to 20 percent), as well as the maximum transfer amount, and a minimum balance your checking account will need to approve the transaction. That way, you're always saving a little bit as you spend, without really thinking about it.

The app has a few bells and whistles, too. Users can set long or short-term goals attached to specific purchases, for example, while keeping an eye on monthly and yearly projections.

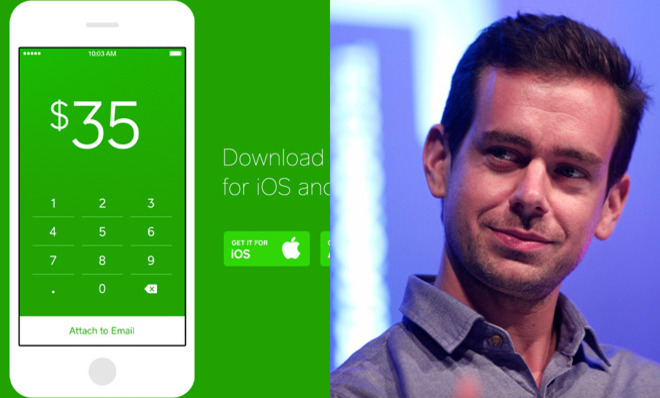

Square Cash

Developed by Twitter's founder Jack Dorsey, Square Cash lets you transfer money to a friend by sending her a quick email.

The first time you use the service, you enter your debit card information. Then, to send cash to a friend, add the friend's email, CC cash@square.com, and write the dollar amount in the subject line. If the recipient is a Cash member, the transaction is complete. If it's her first transaction, she'll have to enter her information just once.

This simplifies common transactions, like going in with your friends for a birthday present, or splitting the bill at a restaurant where waiters have 'tude about running multiple cards.

Another similar product is Venmo, which makes transfers via text message.

Carmel Lobello is the business editor at TheWeek.com. Previously, she was an editor at DeathandTaxesMag.com.

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day