How to budget $70,000

Three real budgets, analyzed

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

If you ask most people, they'll probably say that budgeting isn't terribly titillating...unless, of course, we're talking about someone else's finances.

Let's be honest: Although you may not want to fess up to just how much of your monthly budget you blow on eating out each month, it's easy to judge the bad spending habits of others — like the next-door neighbor who just bought a second set of pricey wheels.

Yes, there's nothing like financial voyeurism, which is why we convinced three brave people, whose annual household incomes come in at around $70,000, to share the details of their monthly spending — and saving — habits.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

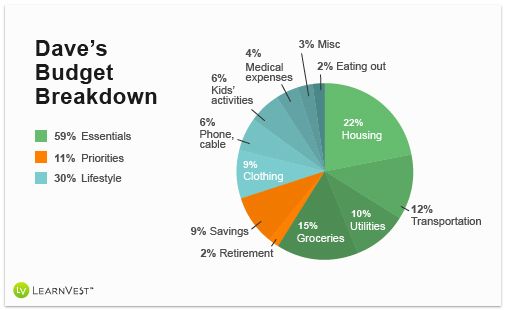

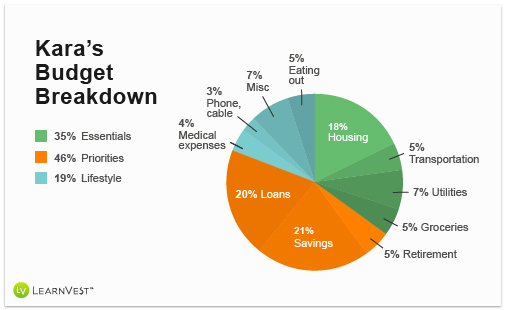

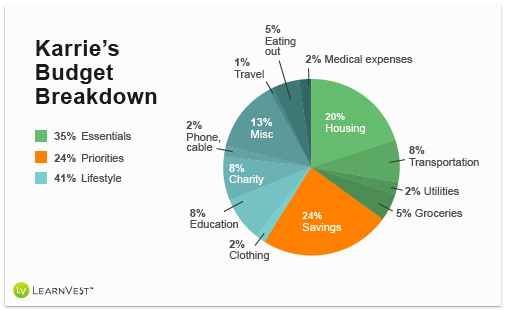

And we do mean every detail: Each intrepid participant divided his or her budget into percentages, which were then color-coded in line with the 50/20/30 rule. The rule recommends that you allocate 50 percent of your budget for essentials (housing, transportation, utilities and groceries), 20 percent toward financial priorities (retirement contributions, savings, and debt payments), and the remaining 30 percent for bonus (read: fun) lifestyle expenses.

We then asked Nancy Anderson, a CFP® with LearnVest Planning Services, to review each budget to see how they are mastering their money — and where there's room for a little financial improvement.

Dave, 42, civil engineer

I recently got a new job after being laid off earlier this year, and while I'm happy to be back at work, I had to take a pay cut in the process. My wife and I have two kids under the age of 12, so she works part-time as a teacher's aide here in Utah. To keep our costs in check, she's been great at re-examining our budget recently, and we've made cuts where we can. For example, she stopped going to Pilates, and I canceled my cable TV subscription to NFL RedZone — as much as it breaks my heart!

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com