The 'me, me, me generation' is so over credit cards

People aged 18 to 29 have a lot less credit card debt — and a lot less credit

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

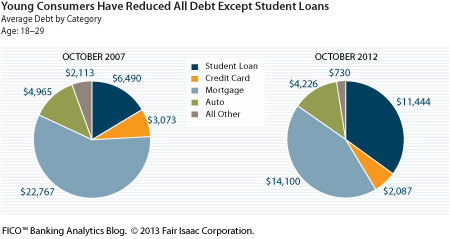

Since 2008, when the doors of ridiculously easy credit slammed shut, Americans have been steadily chipping away at their debt. A new study by FICO, the company that calculates credit scores, found that outstanding debt for the 18 to 29 age group has slid in every category, except student loans.

Most notably: Credit card debt is down by almost a third.

By most measures, this is great news: People are wrestling with less debt-related anxiety, and those in that age group can start saving for retirement earlier than their parents. The drop in credit debt also has broader economic benefits: Fewer debt payments means more money to spend and stimulate economic growth.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But FICO warns that less debt also signals a worrisome trend — that more and more young people are staying away from credit cards entirely.

It seems that the "me me me generation," as TIME called it, feeling the pressure of the weak job market and student loan debt, is shunning cards to avoid risk. As FICO notes, avoiding credit cards also prevents people from building strong credit. "One implication of a shift away from credit cards is that young people aren't as likely to build a credit report and a credit score as quickly, since credit cards have traditionally been the main way younger people establish credit," says the The New York Times.

Another factor contributing to the decrease in credit cards, says FICO, is the Credit Card Accountability Responsibility and Disclosure Act (known simply as the CARD Act), which put tighter restrictions on who can open lines of credit. In order to open a credit card, the act requires consumers to be 21 and either show proof they'll be able to pay the debt, or have a cosigner guarantee the card.

So young people who don't qualify for credit cards, either because of their age or job status, are caught in a catch-22: They can't open a card without credit, but it's hard to build credit without a card.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Hard, but not impossible. Carolyn Bigda of the Chicago Tribune recommends that beginners ask their banks about "secured cards":

With a secured credit card, you don't need a sterling credit history. But you do need to put down a cash deposit, often $250 and up, which serves as collateral for the amount you borrow. Over time, as you build your credit file, you can switch to a traditional card. Just be sure to pick a secured card that reports to all three of the main credit bureaus. (Equifax, Experian and TransUnion). Not all cards do. [Chicago Tribune]

As for all that dream-crushing student loan debt — there's a way people can use it to their advantage. While $1 trillion of student loan debt in the U.S. is an upsetting tab — one that may be hurting the economy on the whole — the loans could actually help offset anemic credit scores (so long as the debtors are able to pay). The Los Angeles Times' money guru Liz Weston explains:

If your daughter wants to build up her scores faster, she might want to consider a small installment loan. Having both installment and revolving accounts can lead to higher scores. Installment loans include auto loans, mortgages, personal loans and, yes, student loans. If she does decide to apply for a small student loan, make sure she fills out the Free Application for Federal Student Aid and takes out federal student loans only. Federal student loans have fixed interest rates, flexible repayment terms and plenty of consumer protections. Private student loans have none of those attributes. [Los Angeles Times]

The average student loan debt total of $11,444 hardly counts as a "small student loan," but paying the tab on time from the age of 22 does help establish long term credit.

Carmel Lobello is the business editor at TheWeek.com. Previously, she was an editor at DeathandTaxesMag.com.

-

Is Andrew’s arrest the end for the monarchy?

Is Andrew’s arrest the end for the monarchy?Today's Big Question The King has distanced the Royal Family from his disgraced brother but a ‘fit of revolutionary disgust’ could still wipe them out

-

Quiz of The Week: 14 – 20 February

Quiz of The Week: 14 – 20 FebruaryQuiz Have you been paying attention to The Week’s news?

-

The Week Unwrapped: Do the Freemasons have too much sway in the police force?

The Week Unwrapped: Do the Freemasons have too much sway in the police force?Podcast Plus, what does the growing popularity of prediction markets mean for the future? And why are UK film and TV workers struggling?