The IRS's long history of scandal

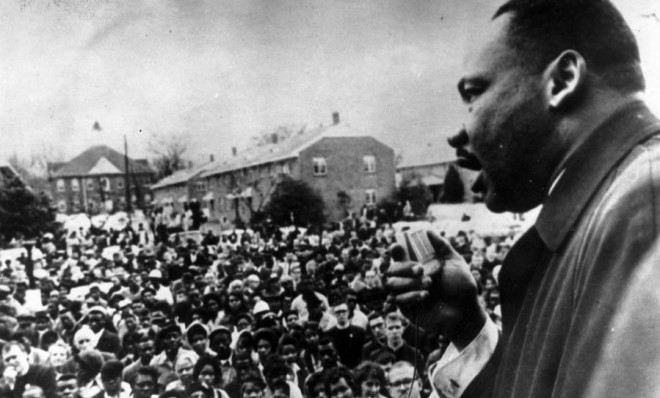

The Internal Revenue Service has admitted to selectively auditing conservative groups. This is hardly a first offense. The IRS targeted MLK, too.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Why was the IRS created?

When the U.S. was founded, it had no tax-collecting agency and little need for one for the next 80 years. The much smaller federal government of that era was funded largely by customs tariffs and state-collected excise taxes on sugar, liquor, and tobacco. But when the Civil War began, President Abraham Lincoln needed new revenues to cover the immense cost of waging the war, so in 1862 he successfully pushed Congress to create the country's first income tax, and the Bureau of Internal Revenue to collect it. Seven years after the Civil War ended, the income tax was repealed, and again the government financed its operations mostly through taxes on alcohol and tobacco. But in the Progressive Era in the early 20th century, reformers argued that such taxes unfairly penalized the poor. At the same time, hawks wanted more revenue to build up the U.S. military. In 1913, the 16th Amendment was ratified, instituting the income tax for good.

How quickly did the taxing authority expand?

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Within years of the income tax's creation, World War I drove top tax rates to 77 percent. The number of tax returns also exploded — from 778,289 in 1916 to 7.6 million in 1920 — and the agency was hard-pressed to keep up. After 1919, it also fell to the Bureau of Internal Revenue to enforce Prohibition. From the outset, overworked agents were susceptible to corruption and political influence in deciding whose returns to audit. Franklin D. Roosevelt brazenly used IRS audits as a weapon against conservative publishers William Randolph Hearst and Moses Annenberg, right-wing radio demagogue Father Charles Coughlin, and industrialist Andrew Mellon. FDR would not be alone in succumbing to that temptation. "In almost every administration since the IRS's inception," wrote David Burnham, author of A Law Unto Itself: Power, Politics and the IRS, "the information and power of the tax agency have been mobilized for explicitly political purposes."

Did that lead to scandals?

Pretty regularly. In 1951, congressional Republicans uncovered widespread corruption at the Bureau of Internal Revenue, leading to the dismissal of 66 agents for such activities as bribe-taking and extortion. President Harry S. Truman proposed a reorganization in which tax agents would be hired through the civil service, rather than political patronage. Republican Dwight Eisenhower endorsed Truman's reform plans and in 1953 changed the agency's name to the Internal Revenue Service.

Did those reforms bear fruit?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Too often they did not. Throughout the 1950s and 1960s, FBI Director J. Edgar Hoover's Counter Intelligence Project — codenamed COINTELPRO — had unlimited access to the IRS files of such suspected "subversive'' organizations as the National Association for the Advancement of Colored People and the National Council of Churches; it even ordered an IRS audit of Dr. Martin Luther King Jr. In the early 1960s, the IRS responded to President John F. Kennedy's public complaints about tax-exempt conservative groups by setting up the Ideological Organizations Audit Project, which challenged their tax status. But it was President Richard Nixon who most blatantly wielded the IRS as a political weapon.

What did Nixon do?

The White House tapes recorded Nixon urging aide John Ehrlichman in 1971 to get the IRS to dig into the tax returns of possible Democratic presidential candidates Sens. Edmund Muskie, Hubert Humphrey, and Ted Kennedy. "I can only hope that we are, frankly, doing a little persecuting," Nixon said. "There's a lot of gold in them thar hills." In 1969, the Nixon administration set up an IRS unit called the Special Service Staff, which used tax records to assemble dossiers on more than 11,000 groups and individuals. After the 1972 election, Nixon staffers gave the IRS a list of 576 supporters of Democrat George McGovern. In 1974, one of the articles of impeachment against Nixon charged him with seeking "confidential information contained in income tax returns for purposes not authorized by law."

Did Watergate end IRS abuses?

There have been plenty of questionable audits since the Nixon era, including one of Paula Jones after she refused to settle a sexual harassment suit against President Bill Clinton. (His White House denied any role.) The IRS recently admitted that its division overseeing tax-exempt organizations had singled out groups with "Tea Party'' and "patriots'' in their names for special scrutiny. In its own defense, the IRS says enforcing tax laws effectively but impartially becomes harder each year, given the cuts to its operating budget — which is down 8 percent since 2010 — and the growing complexity of the federal tax code. The tax code has been amended 4,680 times in the past 12 years alone and now runs to 74,000 pages. Such "complexity creep" only confirms "taxpayers' suspicions that the tax laws are designed to entrap them and obscure what is and is not being taxed," wrote National Taxpayer Advocate Nina E. Olson in her last annual report. "This is no way to run a tax system."

Refusing to pay taxes

"I like to pay taxes. With them, I buy civilization,'' Supreme Court Justice Oliver Wendell Holmes once said. But ever since federal income taxes were first levied, many Americans have disliked taxes so strongly that they've refused to pay them. Wichita contractor Arthur Porth unsuccessfully argued in a 1954 case that taxation amounts to "involuntary servitude," making it illegal under the 13th Amendment. More recently, a Pennsylvania small-business owner named Larken Rose concocted the so-called 861 argument, named after the section of the code that lays out the sources of taxable income. In Rose's arcane reading of that section, which he turned into a video that sold more than 15,000 copies, only income derived from "international commerce or federal possessions'' is taxable. Courts have repeatedly rejected this reading of the code, and Rose has served 15 months in jail for tax evasion. Nonetheless, actor Wesley Snipes tried a version of the 861 argument to explain why he paid no taxes on $38 million he earned from 1999 to 2004. Unmoved, a judge sentenced him to three years in prison.

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day