How 7 major tech companies have performed under new CEOs

Replacing a CEO is not always the easiest step for the board, but it's often rewarding — at least for most of the major tech companies in our review

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Change may be natural, and inevitable, and many other inspiring things — but a change at the top is always a white-knuckle ordeal for a major corporation and its shareholders.

In the past two years (or so), no fewer than seven major tech firms have undergone the trial of adjusting to a new chief executive.

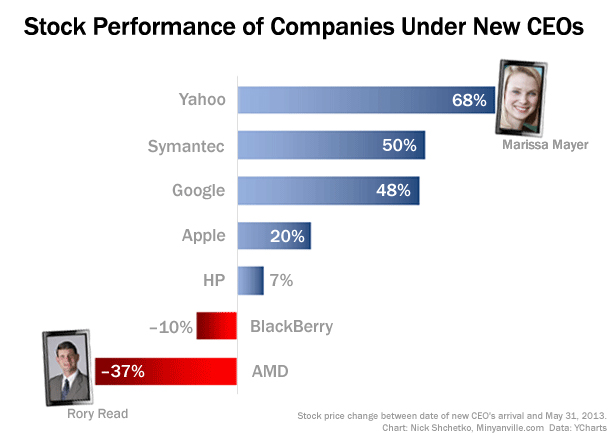

Apple (NASDAQ:AAPL), Google (NASDAQ:GOOG), Yahoo (NASDAQ:YHOO), Hewlett-Packard (NYSE:HPQ), AMD (NYSE:AMD), Symantec (NASDAQ:SYMC), and BlackBerry (NASDAQ:BBRY) have each seen their CEOs replaced for various reasons. Some of these companies began to get traction almost immediately under a new boss — Yahoo's less-than-a-year-on-duty CEO managed to increase the company's stock price by 68 percent — others are still struggling, still pushing for a turnaround.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

How well did all these newcomer CEOs perform? Given that stock price is a quick-and-dirty but by no means comprehensive performance metric (and also affected by a number of factors other than CEO leadership), we looked at the financials and market standing of the seven major technology companies that made it through the top management reshuffle in the last two years.

Apple

Since the moment Tim Cook took command at Apple on August 24, 2011 (or, as some suggest, October 5, 2011 — the day former CEO Steve Jobs died) the company has lived through bright and harsh times. Apple stock reached its all-time high of $702.1 last September only to then decline 36 percent as of the end of May. Shares are still up 20 percent compared to the day Cook stepped in as a CEO, however.

Investors seem to have mixed feelings about Apple. The company delivers outstanding financial results and is sitting on $145 billion in cash, enough to afford actually buying any of the other companies on this list (with the exception of Google). However, Wall Street bears point to disappointing signs in the company's latest reports.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

In the first calendar quarter of 2013 — on the heels of a record-breaking end of 2012, when Apple recognized an impressive $13.1 billion in profit on $54.5 billion in revenue — the company reported its first year-to-year quarterly drop in profit in a decade. Apple was also criticized for not debuting any groundbreaking new products since the early 2010 introduction of the iPad.

The company continues to lose market share in segments it had previously dominated. In tablets, which are expected to outsell desktop computers this year, Apple saw its market share decline from 58.1 percent in the first calendar quarter of 2012 to 39.6 percent in the same period this year.

On the smartphone side of the business, the company has been feeling heavy pressure from the Android cohort, led by Samsung (KRX:005930). In the first calendar quarter of 2013, Apple's smartphone market share declined to 18.2 percent, compared to 22.5 percent a year earlier. Samsung, on the other hand, has grown its presence from 27.6 percent to 30.8 percent, cementing its lead as the largest smartphone maker in the world.

For Apple, though, "winning has never been about having the most," said Cook at the recent D11 conference.

Google's stock price has surged an impressive 48 percent since Larry Page took the company he co-founded back from Eric Schmidt on April 4, 2011. (Yes, that's a little more than two years ago; nevertheless, we decided to include the company in our review).

After realigning some businesses, the new-again CEO closed several services that were not profitable and lead Google to some big acquisitions — including the $12.5 billion buy of Motorola. Now the internet giant comfortably controls the majority of search and mobile advertising markets and its Android platform now dominates the global smartphone segment.

Revenue has been growing year-over-year since Page stepped in, with the company reporting an increase in revenue of 31 percent, and a spike of 14 percent in income on a year-over-year basis in the first quarter of 2013. Revenue was growing quarter-to-quarter too, except for the last quarter, when it declined by 3 percent.

Google's cash pile has grown to $50 billion as of the end of the first quarter of 2013.

Some analysts point out that the first-in-its-history quarter-to-quarter revenue decline might raise some red flags about Google's overall performance, even though growth is still solid. Still, most analysts have "Buy" (majority) or "Hold" recommendations posted for GOOG, with the mean being somewhere around "Overweight."

The future definitely looks bright for Google as the company proactively seeks to expand to new and bigger markets with projects like Google Glass and self-driving cars, while also nurturing its key areas of internet services (search, maps) and the world-leading Android platform. The company is rumored to be preparing to launch retail stores, too.

Hewlett-Packard

When former eBay (NASDAQ:EBAY) exec Meg Whitman took the reins at Hewlett-Packard on September 22, 2011, the giant hardware maker was in a dire situation. The stock had plummeted 44 percent in one year, revenue had stagnated at around $30 billion, and profits had been declining slowly but steadily. The HP board had also just ousted previous CEO Leo Apotheker after his 11-month tenure, because of poor performance.

Now, after nearly two years under Whitman's leadership, the company is still struggling to make powerful returns, yet the CEO recently claimed, "You can feel the turnaround taking place at HP." She had also stressed that investors should be patient, saying, "This is a multi-year journey. We have a long way to go."

HP's stock price has grown by a humble 7 percent with Whitman at the helm, and on the financial side, results have been disappointing. Revenue has declined for three consecutive quarters, ranging between 5.6 percent to 10 percent year-to-year.

Profits have been down, too, by 16 percent and 31 percent year-over-year for the most recent two quarters respectively. At least the numbers are not as massively negative as they were last year, when the company suffered from a mammoth $8.8 billion write-off tied to the troublesome Autonomy acquisition, aggressive layoffs — 27,000 out of 350,000 positions, with more than 12,000 jobs cut already — and other restructuring efforts.

Its lack of success within the rapidly growing tablet and mobile markets, combined with an industry-wide decline in PC sales, might hurt HP in the long run, protracting the turnaround.

Yahoo

The internet giant lived through turbulent times since the departure of CEO Carol Bartz in September 2011. In early 2012, Scott Thompson, former PayPal boss, took charge, reorganizing the company and laying off about 15 percent of the staff. He left Yahoo in May — a false claim to a degree he didn't hold was famously discovered in his bio — and was replaced by Google veteran Marissa Mayer in summer.

Since July 17, 2012, her first day on the job, Mayer has managed to refresh the company's profile, update a number of products, and buy 12 businesses, including some high-profile companies like Tumblr.

Mayer agreed to lead Yahoo's turnaround after spending 13 years with Google, and in less than in a year, she has managed to signal to investors some clear signs of rebirth. The company's stock has risen by an impressive 68 percent, hitting $26.3 per share as of May 31.

In the first quarter of 2013, Yahoo's earnings per share grew 52 percent year-to-year, and net income was up 36 percent (though revenues declined 6.6 percent).

Mayer stepped into a company with deep pockets for spending thanks to Yahoo's decision to sell part of its holdings in the Alibaba Group just before she was hired. That deal, which saw Yahoo part with a 20 percent stake of the Chinese Internet company, brought Yahoo nearly $2.8 billion net after-tax gain to supplement its reserves.

On the flip side, Yahoo has continued to lose its search market share, which declined year-over-year by one and a half percentage points, sinking to 12 percent, in April, according to ComScore. Yahoo search is still powered by Microsoft (NASDAQ:MSFT), something Mayer hopes to change.

Display and search advertising, which fuels 81 percent of Yahoo's total revenue, remains a tough competitive market for the company. EMarketer expects Yahoo to lose 0.3 percentage points of its current 6.5 percent share of net U.S. search ad revenues this year, while Google is expected to grow its presence to 73.7 percent from 72.8 percent. Still eMarketer estimates that Yahoo's display ad revenue will grow 1.5 percent to $1.37 billion this year and search ads will reach $1.23 billion, up 7 percent.

BlackBerry

After a long and painful decline, BlackBerry (at the time still called Research in Motion) faced a management reshuffle in early 2012.

The Canadian company's co-CEOs and co-founders stepped down on January 22, 2012, and handed the company to Thorsten Heins, who had first joined in December 2007. Heins had served as the senior vice president for the Handheld Business Unit, then as COO, Product Engineering prior to becoming president and CEO.

As the new chief, Heins faced a challenging task of essentially restarting the once venerable smartphone-maker, at the time struggling with a lack of innovative new products and eroding market share.

With the launch of the new BlackBerry 10 smartphones, which followed massive layoffs (nearly 30 percent of the workforce), Heins has managed to return BlackBerry to quarter-to-quarter profitability in less than a year. In the third fiscal quarter of 2013 (ended December 1, 2013), the company recognized $9 million in profit on $2.7 billion in revenue after three consecutive quarters of losses.

Total revenue has continued to decline, however, and in the last quarter dropped 36 percent year-over-year, from $4.2 billion in 2012 to $2.7 billion in 2013. BlackBerry's share price saw a 10 percent drop between January 23, 2012 and May 31, 2013, and analysts seem to be bearish about the stock's future, with the mean recommendation being "Underweight."

Symantec

Steve Bennett, a long-time GE (NYSE:GE) veteran, took over as head of security and storage software provider Symantec where he was a chairman on July 25, 2012. Previous CEO Enrique Salem was ousted because of performance concerns.

In less than a year, Symantec's stock value rose by an impressive 50 percent, with the stock price hitting $22.39 as of the end of May. Under Bennett, the company stock has far outperformed S&P 500 (INDEXSP:.INX) by growth: 70 percent to 22 percent.

The company's financials are neither impressive nor disappointing. Profits continue to stagnate, fluctuating around $200 million for four consecutive quarters, with revenues somewhat steady in the $1.6 to 1.8 billion corridor.

Analysts are almost equally divided between "Buy" and "Hold" for the stock. They expect growth in Symantec's backup, storage and server management business (which accounts for 29 percent of revenues), but a slowdown in PC sales will continue to negatively impact sales of the company's antivirus software (35 percent of revenue). Recently the company announced its projected revenue and earnings for the next quarter would come in below analysts' estimations.

Advanced Micro Devices

Former Lenovo (OCTMKTS:LNVGY) executive and IBM (NYSE:IBM) veteran Rory Read stepped in on August 25, 2011 to save AMD, the second largest supplier of x86 processors, which are used in most desktop devices and in servers.

He joined the AMD ranks after the company had been operating for nearly nearly three quarters without a CEO. Previous CEO Dirk Meyer abruptly stepped down in January 2011, and CFO Thomas Seifert took over as an interim CEO.

Read has had little success so far in turning around the semiconductor giant: The company's share price has dropped 37 percent since he took the post, and profits have been reported in only two out of seven quarters. Revenue figures have dropped for six consecutive quarters, representing a 36 percent loss over the period.

In the last calendar quarter of 2012, the company reported a $473 million loss on revenue of $1.155 billion, down 32 percent from the same quarter in 2011. During the most recent quarter, the picture improved: The firm reported a $146 million loss on $1.088 billion in sales.

In a battle against Intel (NASDAQ:INTC), its bigger competitor, AMD is striving to compete in a shrinking PC market and in the growing mobile devices field, where the company (and x86 chips in general) do not hold significant ground.

There is some light on the horizon: AMD's products now power all the major next generation video game consoles on the market — Nintendo's (TYO:7974) Wii U, Microsoft's Xbox One and Sony's (NYSE:SNE) Playstation 4.

More from Minyanville...

* Grocery wars: Can Amazon keep the milk fresh and even make some money?

* Tech news: Gumdrop Cases bets on iPad 5 release next week

* Despite new porn ban, these four Google Glass apps will strain moral fibers

-

Palantir's growing influence in the British state

Palantir's growing influence in the British stateThe Explainer Despite winning a £240m MoD contract, the tech company’s links to Peter Mandelson and the UK’s over-reliance on US tech have caused widespread concern

-

Quiz of The Week: 7 – 13 February

Quiz of The Week: 7 – 13 FebruaryQuiz Have you been paying attention to The Week’s news?

-

Nordic combined: the Winter Olympics sport that bars women

Nordic combined: the Winter Olympics sport that bars womenIn The Spotlight Female athletes excluded from participation in demanding double-discipline events at Milano-Cortina