Great Recession hangover: What happened to America's lost wealth?

The St. Louis Federal Reserve says U.S. households have recovered only 45 percent of the wealth they lost in 2008

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

In March, the Federal Reserve had some pretty good news for America: Collectively, we had recovered almost all of the $16 trillion in household wealth we lost during the Great Recession. On Thursday, the Federal Reserve Bank of St. Louis offered a less optimistic prognosis of our national wealth recovery:

"Average household wealth in real terms, contrary to recent headlines, has not fully recovered," says the St. Louis Fed in announcing the report, "After the Fall," by Ray Boshara and William Emmons at the St. Louis Fed's new Center for Household Financial Stability. "Indeed, it is only about halfway back to prerecession levels." To be precise, we are collectively 45 percent back to peak wealth levels.

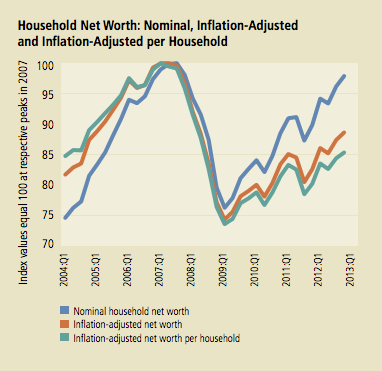

How do you get from 91 percent of household wealth recovered to 45 percent in two and a half months? Basically, Boshara and Emmons took the data from the March report and adjusted it for inflation and population growth. Here's the difference illustrated in a chart from the St. Louis Fed's report:

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

So in terms of raw numbers, we've regained $14.7 trillion of the $16 trillion in wealth that evaporated between 2007 and 2009. But we've lost a big chunk of that wealth to the 3.8 million extra households that have sprung up since then and the average 2 percent annual inflation for the past five years, says Eamon Murphy at DailyFinance. "More people dividing up wealth with even slightly less purchasing power leads to a significantly dimmer economic picture."

At the same time, "the recovery has been far from egalitarian," says Murphy. Of all the recovered wealth, 62 percent — or $9.1 trillion — is from rising share prices in the booming stock markets. "Stock wealth is unevenly held, with the vast majority of stocks owned by a relatively small number of wealthy families," say Boshara and Emmons. "Thus, most families have recovered much less than the average amount."

Also, "in a cruel twist," says Paul Tosto at Minnesota Public Radio, "Americans have been bailing out of the stock market the past few years while things have been hot." Only about half of U.S. adults now own stock, the lowest level since 1998, according to Gallup.

Plenty of families have seen no recovery at all, or are even still losing wealth, Emmons tells The Washington Post. And the households still struggling the most are demographically some combination of young, black, Hispanic, and with lower levels of education. Where did their wealth go?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The short answer: Housing, says DailyFinance's Murphy. "Home values, not stocks, are the lion's share of wealth for middle- and lower-income households, and home prices are still down about 30 percent," even with recent signs of life in the housing market. "Those who had higher-than-average concentrations of their wealth in housing — younger, less-educated, African-American, and Hispanic families — took the biggest hit in percentage terms."

Unfortunately, the future doesn't look too rosy for the non-rich, says Douglas McIntyre at 24/7 Wall Street. "The recession is not nearly over for millions of American, and it will not be from a long time."

For many Americans, the problem will only get worse because of several factors, which could cause these citizens to suffer financially for several more years, if not longer. Among these, the housing crisis has not ended in many regions. Additionally, companies have adopted a habit of replacing highly paid workers with lower paid ones, as well as part-time ones to whom they do not provide benefits. And GDP expansion has been slowed by federal austerity. That falling tide brings down all ships, which in turn undermines consumer spending — which is often tagged as two thirds of the national economy. An economy without a recovery is obviously not one that will drive up household income or wealth. [24/7 Wall St.]

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.