Should employers be allowed to run credit checks on job applicants?

More and more states are passing laws against this practice

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The practice of employers running credit checks on job-seekers isn't new. But it is the target of some new blowback. Nine states — seven of them since 2010 — have passed laws restricting employers from running credit checks on job applicants before making a hiring decision, on the grounds that such checks discriminate against workers.

Credit agencies have been selling credit information to employers since the 1990s — and 47 percent of companies still use this data, often for hiring decisions surrounding low-paying jobs, says the New York Times. Why? Steven Burman, founder and president of Credit Advocates, a nonprofit in New York that helps consumers who have credit problems, acknowledges to the Times that even he uses these checks for every hire:

An employee dealing with bill collectors could be a distracted worker, he said. And how financial problems are explained could offer insights into an applicant's character: Does he take responsibility for debts, or does she blame problems on someone or something else? [New York Times]

Of course, some consumer advocates disagree with this rationale. And the evidence is mixed at best.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

One study published in 2008 in the International Journal of Selection and Assessment suggested a correlation between a person's financial history and workplace theft. But a 2011 study in the Journal of Applied Psychology found no link between a person's credit score and what it called "deviant" behavior like workplace theft. (It did, however, find a correlation between a low credit score and an agreeable personality.) [New York Times]

Another potential reason that employers use credit checks: Negligent hiring lawsuits are on the rise. "If an employee's actions hurt someone, the employer may be liable," says Privacy Rights Clearninghouse, a California-based consumer advocacy nonprofit. "The threat of liability gives employers reason to be cautious in checking an applicant's past. A bad decision can wreak havoc on a company's budget and reputation as well as ruin the career of the hiring official. Employers no longer feel secure in relying on their instinct as a basis to hire."

Regardless of the rationale behind these credit checks, this practice can be discriminatory, say Daniel Garodnick and Amy Traub in the New York Daily News. For instance, "African-American and Latino households are disproportionately likely to report poor credit, a finding some attribute to the nation's deep racial wealth gap and to predatory lending that has targeted communities of color." Garodnick and Traub continue

Credit reports were never developed for hiring in the first place; these records of an individual's borrowing history were intended for lenders to make decisions about how likely someone is to pay back a loan. But when companies selling credit information saw a new customer base for their product, they began marketing reports to employers — even though credit checks have never been proven reliable for hiring. [Daily News]

Low-income and minority Americans aren't alone in feeling the impact of this practice. Almost 25 percent of credit reports contain serious errors. Plus, thanks to the lousy economy of the last few years, more and more Americans have found themselves in a terrible cycle: Being laid off led to unpaid bills, which led to bad credit, which led to not being able to find a new job. The result is that qualified workers are barred from new jobs, say consumer advocates.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Carmel Lobello is the business editor at TheWeek.com. Previously, she was an editor at DeathandTaxesMag.com.

-

The broken water companies failing England and Wales

The broken water companies failing England and WalesExplainer With rising bills, deteriorating river health and a lack of investment, regulators face an uphill battle to stabilise the industry

-

A thrilling foodie city in northern Japan

A thrilling foodie city in northern JapanThe Week Recommends The food scene here is ‘unspoilt’ and ‘fun’

-

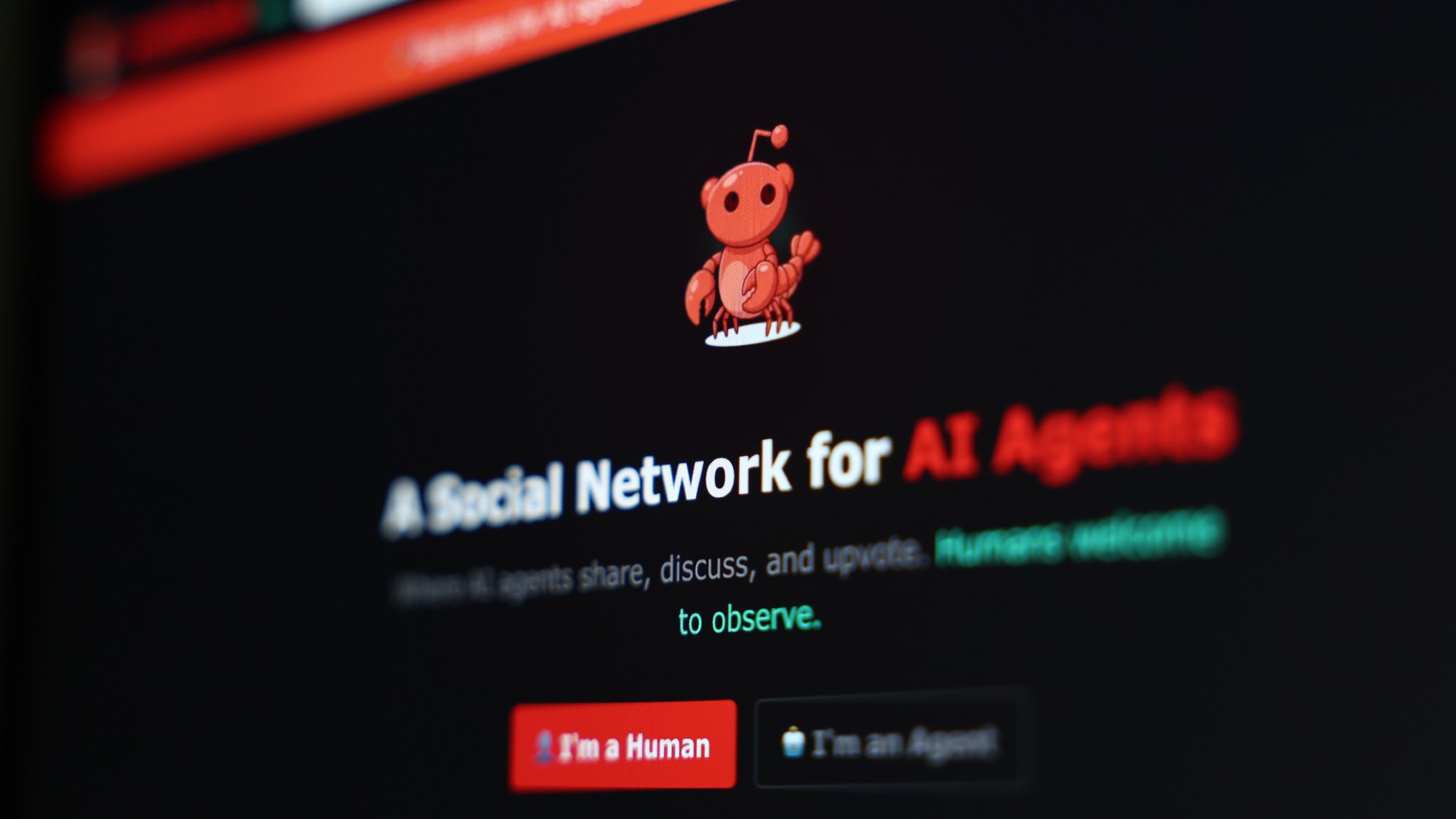

Are AI bots conspiring against us?

Are AI bots conspiring against us?Talking Point Moltbook, the AI social network where humans are banned, may be the tip of the iceberg