5 ways of looking at Congress' push to end tax-free internet shopping

The Senate is on track to pass the Marketplace Fairness Act this week. The House might follow suit. Should you be upset?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The Senate clearly isn't trying to win a popularity contest. The sclerotic upper chamber of Congress, unable or unwilling to pass popular legislation like expanded background checks on firearm purchases, is poised to pass a bill this week that could end tax-free internet purchases.

On Monday afternoon, the Senate voted 74 to 20 to start debate on the Marketplace Fairness Act, which allows states to require Amazon, Overstock, and other online retailers to collect sales taxes on behalf of state and local governments. There are some caveats: 1) Businesses with less that $1 million in annual online sales are exempt, and 2) States have to meet e-tailers halfway, buying special software and streamlining their tax systems to make it easier to collect sales taxes. The Washington Post's Brad Plumer has a good primer on the bill.

Technically, internet sales are already taxed — you're supposed to keep track of what you buy online and pay the sales tax on your annual tax returns — but come on. A 1992 Supreme Court decision left in place a system where online retailers only have to collect state sales tax if they have a warehouse or other physical presence in the state. Congress can change that, but hasn't.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Now that "the odds look decent" Congress will act, says The Washington Post's Plumer, what to think? Here, five ways of looking at the end of tax-free internet shopping:

1. Taxing online purchases is only fair to state and local businesses

Some of the biggest supporters of the proposed law are brick-and-mortar retailers, from giants like Walmart to small mom-and-pop stores. Pretty much anyone can understand why that is. "Sales taxes typically range from 5 to 10 percent, so local businesses start out at a 5 to 10 percent price disadvantage compared to internet retailers that don't collect taxes," says Michael Mazerov at the Center on Budget and Policy Priorities (CBPP).

On top of that, "over time, shoppers learned that they could browse products in the aisles of a Best Buy, only to click 'purchase' on their smartphones for a tax-free deal from an internet retailer," says Jia Lynn Yang at The Washington Post. The end result of this competitive disadvantage is that local retailers either don't hire as many workers, or they go out of business. Compare Amazon's thriving profitability with Borders' demise, for example.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

State and local governments are also big proponents of the bill, for equally obvious reasons. According to a 2009 study from the University of Tennessee, cash-strapped governments are losing out on $11 billion in annual revenue from tax-free online sales.

2. The bill is a stealth tax hike

A big portion of the pushback against the bill is coming from conservatives who argue that requiring people in one state to pay sales tax to another is essentially a tax hike. "The Senate may act to raise taxes," says Ed Morrissey at Hot Air, "and barely anyone knows about the effort." That's because the "pro-tax senators are trying to rush through an online tax hike with as little consideration as possible," says The Wall Street Journal in an editorial.

Anti-tax activist Grover Norquist is also (predictably) against the bill, arguing not only that it's a new tax on consumers but also that it's tantamount to "taxation without representation." An online retailer in Topeka or Salt Lake City will now be forced to be less competitive because it has to charge New Yorkers more, "and workers in businesses in Kansas or Utah cannot vote against the New York legislature or New York City council that raises the sales tax."

3. Sales tax on online purchases helps the poor

In general, sales taxes are regressive, meaning they affect low-income people more than wealthier families. "Tax-free internet shopping compounds the problem," says the CBPP's Michael Mazerov. "Many low-income families would love to shop online to avoid sales tax but can't because they don't own a computer or can't afford high-speed internet access." To make matters worse, says Laura Clawson at Daily Kos, many poor people "don't have the credit cards or bank accounts required to order goods online."

In that sense, the bill is progressive, easing slightly the tax burden of the poor. And if state and local governments can recoup some of this tax revenue currently benefiting online retailers, that also helps low-income taxpayers.

4. But it could hurt smaller online retailers and states without sales tax

Amazon is backing this bill for a couple of reasons. For one thing, it's already building warehouses in most states, meaning it already has to collect sales taxes in much of the U.S. Amazon also "coincidentally now sells its own tax compliance service to other merchants," says The Wall Street Journal's editorial. But it's also true that Amazon, Walmart, and other large retailers will be better able than their smaller competitors to enact the new tax-collection regime.

"In response, some online retailers asked that the threshold for collecting sales tax be pushed higher," says The Washington Post's Plumer. EBay, for example, wants all retailers with less than $10 million in out-of-state sales exempt.

Senators from states with no sales tax, like Oregon and New Hampshire, are also rallying against the bill. Under the legislation, "a Granite State web merchant would be forced to collect and remit sales taxes to all the governments that do" have sales taxes, a burden not imposed on its New Hampshire brick-and-mortar rivals, says The Wall Street Journal. All in all, "big business and big government are uniting to pursue their mutual interest in sticking it to the little guy."

5. Applying the tax law equally is the right thing to do

Conservatives make some good points, but "in the end, though, the question is one of equal application of the law," says Hot Air's Morrissey. Is it really "just to keep the exemption on tax collection almost 20 years after the commercialization of the internet, which shows no sign of abating at all?"

Yes, it appears that "the Senate is indeed poised to pass something useful," says Kevin Drum at Mother Jones. "How about that." One reason this bill is making it through the upper chamber, despite Norquist's objection, is that the lead sponsor is Wyoming Sen. Mike Enzi, "the fourth most conservative senator in the country and a guy with a 90 percent rating from Norquist's own lobbying group, Americans for Tax Reform." The next step is the tricky one: On we shall go to "the House of Representatives, where we'll find out if Norquist's grip is tighter than it is in the Senate."

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’the week recommends The pasta you know and love. But ever so much better.

-

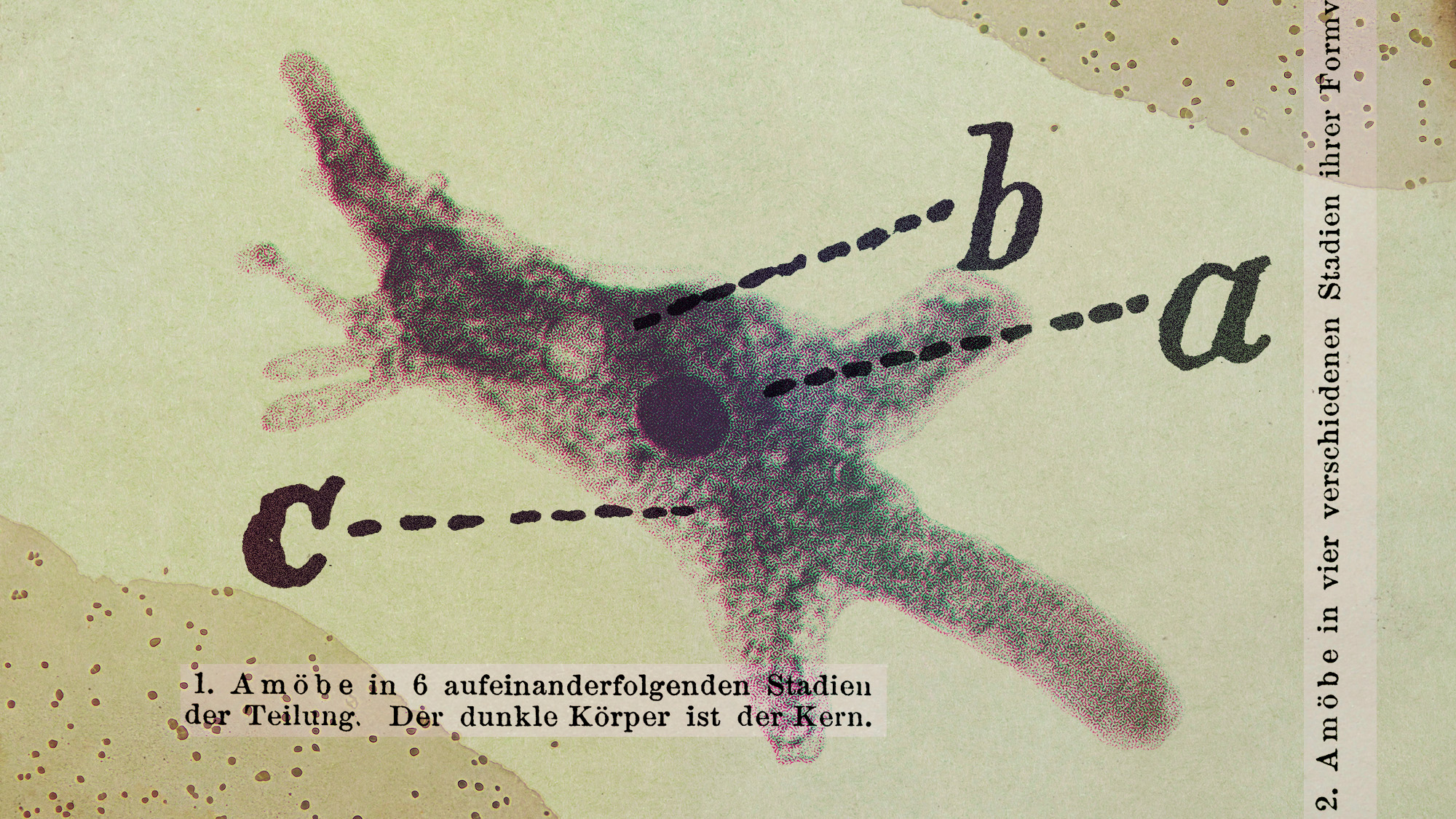

Scientists are worried about amoebas

Scientists are worried about amoebasUnder the radar Small and very mighty

-

Buddhist monks’ US walk for peace

Buddhist monks’ US walk for peaceUnder the Radar Crowds have turned out on the roads from California to Washington and ‘millions are finding hope in their journey’