The news at a glance

Jitters over Cyprus bailout plan; A hitch in American-US Airways merger; AT&T hacker sentenced to three years; A record fine for insider trading; Feds probe Microsoft over bribery claims

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Markets: Jitters over Cyprus bailout plan

Global markets stumbled this week after the European Union announced a controversial plan to tax bank accounts in Cyprus to help pay for a bailout, said Ryan Vlastelica in Reuters.com. The Cypriot parliament’s subsequent rejection of the plan could “put the bailout in jeopardy and raise the risk of default.” In the U.S., the S&P 500 dipped and market benchmarks remained fragile over the plan to seize up to 10 percent of bank deposits to help fund a $20 billion bailout package for the tiny Mediterranean state. But “strong U.S. housing data” limited the downturn, as did the European Central Bank’s standing commitment to preserving the euro.

What particularly worries investors is the prospect that Cyprus’s tax on bank accounts could spread to other euro zone nations, said Steve Rothwell in the Associated Press. Without a bailout, the debt-ridden island nation faces bankruptcy, but market watchers worried that seizing deposits “could set off panicked withdrawals from banks in other European countries,” creating a devastating ripple effect throughout the region and beyond. “The underlying tone of the market is set to stay jittery,” said Jane Foley, an analyst at Rabobank International, “with investors unnerved about the potential loss of trust between banks and small depositors.”

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Airlines: A hitch in American-US Airways merger

A federal supervisor of American Airlines’ bankruptcy case has raised a red flag over a multimillion-dollar severance package for the airline’s chairman and CEO, said Terry Maxon in The Dallas Morning News. Tom Horton, the carrier’s current CEO, is expected to collect almost $20 million in cash and stock when American merges with US Airways, even though he will be the non-executive chairman of the new company. U.S. Trustee Tracy Hope Davis, whose office is part of the Justice Department, filed an objection to the deal, questioning whether the severance package is “permissible” under federal bankruptcy laws.

Tech: AT&T hacker sentenced to three years

A security researcher was sentenced this week to 41 months in prison for exposing a security fault that left AT&T’s iPad users vulnerable, said Charles Arthur in The Guardian. Andrew “Weev” Auernheimer was found guilty in November of identity fraud and conspiracy after he revealed the email addresses of 114,000 iPad owners, including CEOs, military officials, celebrities, and top politicians. Auernheimer insisted he broke no laws and hadn’t used the information for personal gain. “I’m going to jail for doing arithmetic,” said Auernheimer.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Hedge funds: A record fine for insider trading

SAC Capital Advisors will pay an unprecedented $616 million to settle insider-trading charges with the Securities and Exchange Commission, said Peter Lattman in The New York Times. The $15 billion hedge fund was accused of selling off nearly $1 billion in shares of two pharmaceutical companies after receiving secret information about problems with an Alzheimer’s drug. The settlement, still subject to a judge’s approval, doesn’t affect the ongoing trial of an SAC trader or prevent future charges being brought against the fund’s owner, Steven A. Cohen.

Crime: Feds probe Microsoft over bribery claims

Federal regulators are investigating Microsoft’s ties to business partners that allegedly bribed foreign officials, said Christopher M. Matthews in The Wall Street Journal. The Justice Department and the Securities and Exchange Commission are examining whether Microsoft or its resellers offered kickbacks to Chinese, Italian, and Romanian officials in exchange for government software contracts. The software giant’s general counsel said the company would “cooperate fully in any government inquiries.”

-

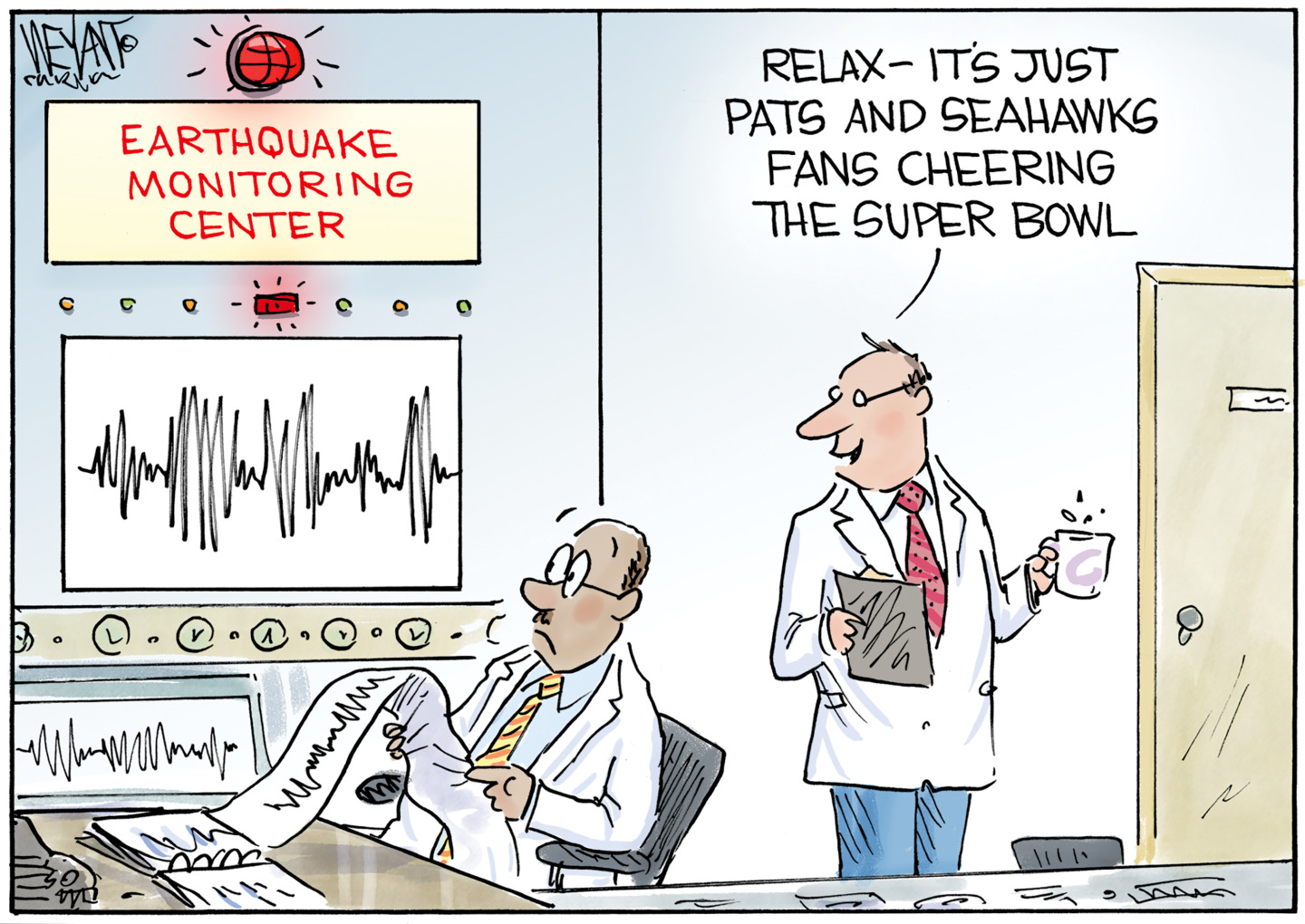

Political cartoons for February 7

Political cartoons for February 7Cartoons Saturday’s political cartoons include an earthquake warning, Washington Post Mortem, and more

-

5 cinematic cartoons about Bezos betting big on 'Melania'

5 cinematic cartoons about Bezos betting big on 'Melania'Cartoons Artists take on a girlboss, a fetching newspaper, and more

-

The fall of the generals: China’s military purge

The fall of the generals: China’s military purgeIn the Spotlight Xi Jinping’s extraordinary removal of senior general proves that no-one is safe from anti-corruption drive that has investigated millions

-

The news at a glance...International

feature International

-

The bottom line

feature Youthful startup founders; High salaries for anesthesiologists; The myth of too much homework; More mothers stay a home; Audiences are down, but box office revenue rises

-

The week at a glance...Americas

feature Americas

-

The news at a glance...United States

feature United States

-

The news at a glance

feature Comcast defends planned TWC merger; Toyota recalls 6.39 million vehicles; Takeda faces $6 billion in damages; American updates loyalty program; Regulators hike leverage ratio

-

The bottom line

feature The rising cost of graduate degrees; NSA surveillance affects tech profits; A glass ceiling for female chefs?; Bonding to a brand name; Generous Wall Street bonuses

-

The news at a glance

feature GM chief faces Congress; FBI targets high-frequency trading; Yellen confirms continued low rates; BofA settles mortgage claims for $9.3B; Apple and Samsung duke it out

-

The week at a glance...International

feature International