Making money: A primer for homebuyers

3 top pieces of financial advice — from husbanding your nest egg to fighting mystery charges

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Husbanding your nest egg

"It was beautiful while it lasted," says Kelly Greene in The Wall Street Journal. But stark financial realities have trumped the conventional wisdom that your retirement nest egg will be enough for your lifetime if you withdraw 4 percent a year after retiring. In fact, "timing is everything," especially if you have a traditional stock-bond portfolio. If you hit a bear market as soon as you retire, 4 percent a year will deplete your savings too quickly. But you can hedge against that threat by adding variable annuities, which guarantee income but also allow you to dip in for more in an emergency. The IRS's life-expectancy tables can also help you figure out how much you can safely withdraw each year. And keep your eye on the market. "If stocks are pricey when you retire," be cautious with your withdrawals. But if they're trading at bargain prices, you'll probably have a little more wiggle room.

Fighting off mystery charges

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

It pays to be vigilant against so-called "grey charges," says Farnoosh Torabi at Yahoo. If you're missing some cash at the end of each month, check your statements for automatic withdrawals you weren't aware of. Maybe it was one of those "free" trials you signed up for — many convert to a paid subscription if you don't cancel right away. If you're purchasing items online, be aware that some companies try to sneak in products — and charges — you didn't want, just as some monthly charges appear as "zombie subscriptions" well after you've canceled them. And be on the lookout for fees that slowly creep higher. "The increase may be as little as a dollar, but unchecked these small costs will add up quickly."

A primer for homebuyers

With interest rates at an all-time low, house-hunting is on the rise, says Kate Ashford at Forbes. Those new to the process should adhere to some basic rules. First, get pre-approved for a mortgage — "it will prove you're serious to your realtor and to home sellers," and will give you a realistic idea of what you can afford. Think about your down payment; putting down a nominal amount, such as 3 percent, isn't "necessarily a bad thing, but it does mean that you'll have very little equity in your home when you first move into it." And whatever you do, don't skip the home inspection. Order one before you close on the deal — it's "worth every penny."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Sergio Hernandez is business editor of The Week's print edition. He has previously worked for The Daily, ProPublica, the Village Voice, and Gawker.

-

What to know before filing your own taxes for the first time

What to know before filing your own taxes for the first timethe explainer Tackle this financial milestone with confidence

-

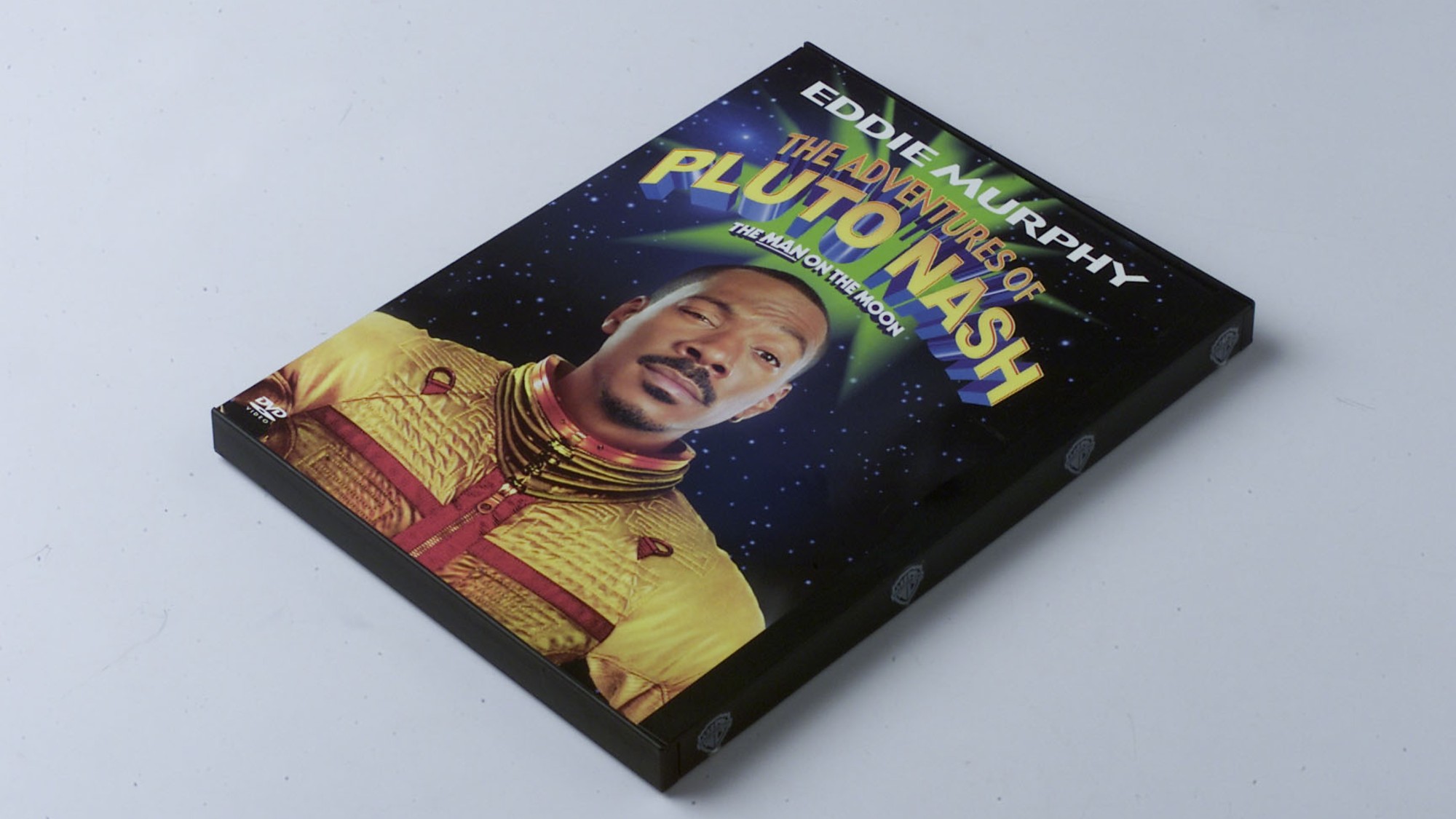

The biggest box office flops of the 21st century

The biggest box office flops of the 21st centuryin depth Unnecessary remakes and turgid, expensive CGI-fests highlight this list of these most notorious box-office losers

-

What are the best investments for beginners?

What are the best investments for beginners?The Explainer Stocks and ETFs and bonds, oh my